Economy

Home away from home investment

Updated: 2011-07-27 09:13

By Zhou Yan (China Daily)

The majority of those investing in Asian countries such as Malaysia are mostly from China's upper middle class. They're certainly not lacking in funds, but aren't in the same league as the nation's "super rich" who prefer villas in Western countries or in Singapore. The upper middle classes can easily afford quality properties outside China, which cost about one-fifth of the price of a similar dwelling in Shanghai, said Super City's Xia.

To be specific, those unable to afford a luxury house in China's first-tier cities are likely to buy a similar property in Malaysia instead, with high standards and services.

|

And the numbers looking abroad are likely to increase: after relentless growth, China's property sector will soon probably lose its luster as the darling of housing investors.

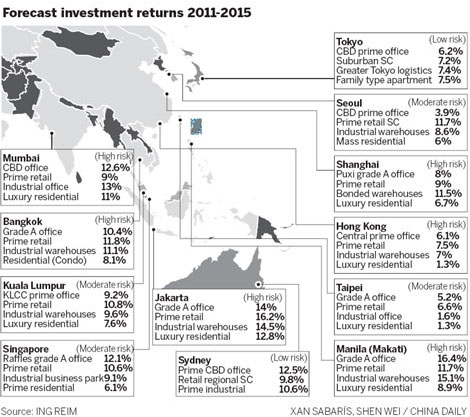

According to estimates from the Dutch property investment manager ING Real Estate Investment Management (REIM), part of the ING Group, investment returns for prime real estate in Shanghai, for example, between 2011 and 2015 are projected to stand at 10.5 percent, almost neck and neck with Kuala Lumpur's 10.8 percent.

ING REIM has forecast that the prospective return ratio for luxury residential properties in Shanghai will reach 6.7 percent over the same period, compared with 7.6 percent in Kuala Lumpur.

However, ING REIM has also said that Shanghai, together with Hong Kong and Mumbai, has become a "high risk" area for such investments, while Kuala Lumpur and Singapore are rated as "moderate risk".

More than just returns

According to Xia, Super City's first project in Malaysia in 2008 has reported price growth of 50 percent to date. Meanwhile, its first tranche of apartments with views of the sea in Penang - Malaysia's fourth island on the west coast of the Malay Peninsula - is likely to see prices rise by up to 20 percent.

House prices in Malaysia are more affordable than those in China: the cost of an average Grade 1 apartment in the heart of Kuala Lumpur is around 20,000 yuan for each square meter (sq m). However, prices are much lower in the country's smaller cities and towns, according to Kumar Tharmalingam, chief executive officer at Malaysia Property Incorporated, a government initiative that caters for overseas investors interested in the country's real estate market.

By contrast, the average transaction price for commercial residential properties along Beijing's Fourth Ring Road stood at about 25,000 yuan a sq m in the first week in May, despite recording month-on-month declines.

However, property investment is not just about generating high yields, but also a choice for securing a good standard of living during retirement, Qiu said. Malaysia introduced its "My Second Home" program in 2002 to allow foreigners who fulfill certain criteria to stay in the country for as long as they desire on a multiple-entry social visit pass.

Compared with the real estate market in industrialized countries, close proximity, the ease of gaining permanent residential status, and business and cultural connections make Southeast Asia a better choice, according to ANZ's Liu. "Currency appreciation and capital gains are now looking better than those in the US."

Indeed, property sales in Southeast Asia, including Thailand, Malaysia and Singapore, have seen "multiple" growth since Super City's first business venture in the region in 2007 as Chinese people become increasingly better off, according to Xia. "So far, most clients are from China's coastal cities such as Shanghai."

In 2010, China was home to 535,000 net-worth individuals, each with investable assets of $1 million or more. That number is roughly 58,000 higher than in 2009, placing the country fourth in the "rich list" after the United States, Japan, and Germany, according to the 15th World Wealth Report compiled by Merrill Lynch Global Wealth Management and Capgemini SA.

Further cash outflows to overseas property markets cannot be prevented, especially when set against a backdrop of limited domestic investment opportunities for cash-rich Chinese, according to some industry experts.

A lot of that capital will stay in the Asian region, though. In January 2010, China and the Association of Southeast Asian Nations (ASEAN) inaugurated a free-trade area, the biggest zone of its type among developing countries and boasting a combined population of 1.9 billion.

"China's private capital outflow has just started. We expect this trend to accelerate in the coming years as the country's capital controls are progressively liberalized. Trade ties will be a good indicator as to where Chinese capital will go. Given the Free-Trade Agreement between China and ASEAN, we expect more Chinese capital to flow to ASEAN," said ANZ's Liu.

|

Specials

Turning up the heat

Traditional Chinese medicine using moxa, or mugwort herb, is once again becoming fashionable

Ciao, Yao

Yao Ming announced his retirement from basketball, staging an emotional end to a glorious career.

Financial sector short of talent

Lack of skilled professionals in Shanghai inhibiting the city's development as a financial hub