Brokerages taking stock after profits drop sharply

Updated: 2011-11-15 07:55

By Li Xiang (China Daily)

|

|||||||||

Third-quarter plunge signals continuing investor concern

BEIJING - A sharp decline in third-quarter profits, due to sluggish markets, has forced brokers to take stock as a third of listed securities companies reported losses for the year.

The country's 17 listed securities companies have been facing difficult times amid shrinking trade volume in both the Shanghai and Shenzhen stock markets. Investors are deeply concerned over protracted European debt woes and uncertainties surrounding domestic monetary policy.

Both net profits, and the return on net assets, of all 17 companies fell in the third quarter from a year earlier. Six companies actually reported losses. The average net profit decline stood at 42 percent in the first three quarters.

Only Shanxi Securities Co Ltd posted a slight rise in turnover while the other 16 companies all reported declines.

CITIC Securities Co Ltd, the country's largest brokerage by market value, saw the sharpest turnover decline, 40 percent, followed by GF Securities Co Ltd and Pacific Securities Co Ltd.

Analysts said that the weak stock market and intense competition over commission rates among the brokerages were the main reasons for the downturn.

The Shanghai Composite Index has declined about 17 percent this year, one of the worst performers among major global markets. This decline was driven by concerns over Europe and the US.

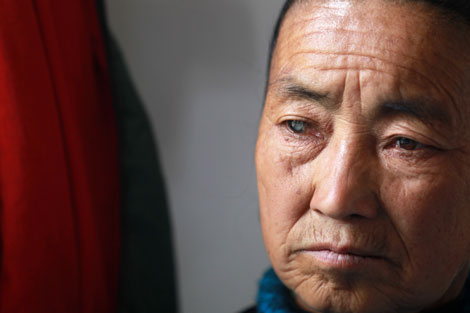

"The market has dropped so much that investors only care about who offers the most attractive commission," said a securities broker, who declined to be named, in Shanghai.

Commissions plunged about 63 percent to 10 billion yuan ($1.56 billion) in the first three quarters, according to media estimates. Analysts noted that the harsh climate is likely to continue for the rest of the year.

The securities regulator is considering expanding the over-the-counter (OTC) market and easing rules on brokerages engaging in private equity investment.

Analysts believe that this could provide a profit boost for brokerage firms.

"The expansion of the OTC market will create new profits for firms and improve their performance," Zhao Xu, an analyst at Northeast Securities Co Ltd, said.

Zhao added that it is essential for Chinese brokerages to diversify and broaden their revenue streams. There is still too much dependence on commissions as a source of income, he said.

The industry has begun to show signs of recovery with the A-share market turning a profit in October. Sixteen firms that released October data managed to make 730 million yuan in profits, a rebound from September's low.

"But if the regulator delays expansion many firms will face a tough winter," said Zhang Qi, an analyst at Haitong Securities.

China Daily

(China Daily 11/15/2011 page1)