Pushing reform forward

Updated: 2012-10-09 16:31

(bjreview.com.cn)

|

||||||||

Urgent reforms

After three decades of reform, especially after China entered the WTO in 2001, the Chinese economy has become increasingly market-oriented, and yet a socialist market economy has been established. However, some problems in the country's economic development have arisen. Hua Sheng, president of Beijing Yanjing Overseas Chinese University, thinks the most urgent problem China must tackle is reforming its household registration system, or hukou.

|

A migrant worker walks on the platform at Yinchuan Railway Station, Ningxia Hui autonomous region. Experts say reforming the dual household registration system is needed for further economic growth. [Photo / bjreview.com.cn] |

The current system, he argues, is restricting economic development. China's rapid industrialization has brought with it a rise in its urban population, with the proportion reaching 51.27 percent in 2011. However, those who migrate from rural areas to the cities cannot simply transfer their household registration. An increasing number of farmers have moved to the cities but still maintain their rural hukou. Such a system creates drawbacks and social instability.

Related reading: Wealth gap in rural China nears warning level

Wealth distribution was another major topic discussed at the conference. Scholars were in agreement that the government should accelerate reforms addressing income distribution.

Luo Yong, a professor at Peking University, appealed to boost "equal rights reform": Under present legal frameworks and with the goal of realizing equal public services, the government should incorporate all the benefits of state-owned assets into China's social security fund and then equally distribute to each one.

Wang Xiaolu, Deputy Director of the National Economic Research Institute at the China Reform Foundation, says the government must adopt a plan for fairer wealth distribution.

Wang suggested the following to the government:

First, alleviate the tax burden of small and micro enterprises. Small businesses are a huge source of jobs, especially for migrant workers. Reducing taxes, or even offering a tax exemption, would improve employment and raise incomes for low-wage earners.

Second, increase the standard of pension insurance and social security aid to low-income families and improve the living conditions of farmers. Given the minimum wage level in poverty-stricken counties, social security aid to low-income families in rural areas is not enough. If aid is increased by 30-40 percent, an additional 400 billion yuan ($63.09 billion) would be needed, a bearable amount for the government.

Third, the social security system should cover all migrant workers. Because these workers are away from home, it is difficult to tap into their social security benefits. First- and second-tier cities - with the exception of Beijing, Shanghai and Guangzhou - should adopt a more liberal hukou policy for migrant workers.

Fourth, public resources should be utilized in a transparent manner and should be made public. That includes transparency in government budgets.

A more liberal economy?

There remain opposing voices to a more open China. Because some Western countries have erected protectionist trade barriers, China should tighten any plans to further liberalize its economy, they say. Still, others say China should not only release its grip at home but also play an active role in formulating the rules of the global economy.

Related reading: Reforms to pave way for healthier growth

Shi Zhan, an associate professor at China Foreign Affairs University, says globalization begins in the West and expands to the rest of the world. China plays a pivotal role in this process. As China reaps the benefits of globalization, it is also being forced to expand reform and liberalize its economy.

Liu Mingzhi, a researcher at the PBC School of Finance of Tsinghua University, thinks now is the time for China's financial industry to hit the international market. The global financial crisis in 2008 triggered a readjustment of the international financial order, which is now focused on developing emerging markets. As the influence of emerging markets in global affairs increases, the international monetary system will be forced to be more pluralistic. The Chinese financial industry should more actively participate in this readjustment to develop a fairer international order.

- Cypriot court remands in custody man suspected of hijacking EgyptAir flight

- Govt eyes luxury tourists amid concerns over safety

- Sleep tight and don't let sharks bite at Paris aquarium

- Aung San Suu Kyi appointed as Myanmar's new foreign minister

- Hollande promises to tighten Euro 2016 security

- US officials applaud China for nuclear cooperation

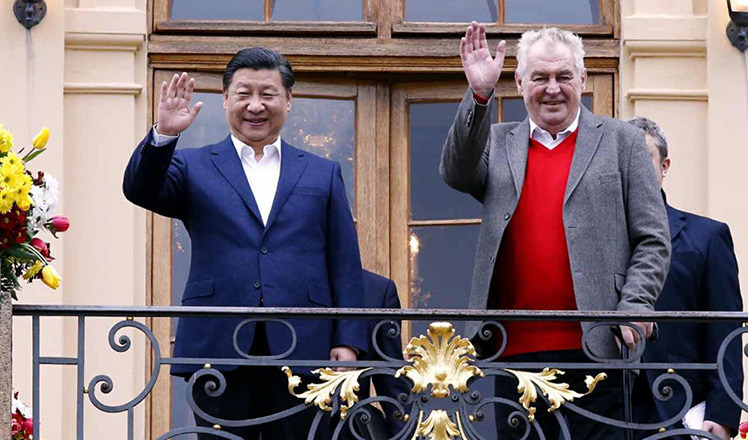

President Xi presented with 'key to Prague'

President Xi presented with 'key to Prague'

China move into the final stage of Asia qualifiers after 15 years

China move into the final stage of Asia qualifiers after 15 years

Grief, anger engulf Taiwan as suspected killer of girl arrested

Grief, anger engulf Taiwan as suspected killer of girl arrested

Stolen Buddha statue head arrives in Hebei museum

Stolen Buddha statue head arrives in Hebei museum

Top 10 best-selling beers in the world

Top 10 best-selling beers in the world

Czech President Milos Zeman hosts Xi at private residence

Czech President Milos Zeman hosts Xi at private residence

The snow-white world of a tombstone carver

The snow-white world of a tombstone carver

Conjoined twins' operation bittersweet for family

Conjoined twins' operation bittersweet for family

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

Accentuate the positive in Sino-US relations

Dangerous games on peninsula will have no winner

National Art Museum showing 400 puppets in new exhibition

US Weekly

|

|