Nation faces shift to sustainable growth

Updated: 2013-06-25 03:04

By Chen Jia in Beijing and Fu Jing in Brussels (China Daily)

|

||||||||

"Liquidity tightening can be very damaging to a highly leveraged economy," said Zhang Zhiwei, chief economist in China with Nomura Securities. It can lead to rising financing costs and a slowdown in fixed-asset investment, which is seen as the strongest driving force of China's economy.

"While we expect GDP growth to slow only moderately to 7.4 percent in the third quarter and 7.2 percent in the fourth, we now attach a 30 percent probability to a scenario in which growth falls below 7 percent in either of the two quarters," Zhang said.

Chang Jian, a senior economist with Barclays Bank, said unexpectedly weak industrial production and an "export collapse" in May were among the factors that could suggest a slowdown.

Downside risks were seen to grow when investment and output of the industrial sector, which accounts for about 40 percent of China's GDP, gave negative signals in May and June.

HSBC Holdings Plc released its preliminary June Purchasing Managers' Index last Thursday. The index declined to 48.3 from 49.2 in May, the lowest level in nine months and indicative of a contraction in the manufacturing sector.

Industrial output growth weakened to 9.2 percent year-on-year last month, compared with 9.3 percent in April.

Exports in May increased only 1 percent from a year earlier, the slowest pace in 10 months, said the General Administration of Customs.

Chang said that as the medium-term outlook for China's potential growth has dropped to 7-8 percent, the new leaders are increasingly aware of this, and may tolerate a growth rate of as low as 7 percent.

She and other economists believe that China should take the unavoidable pain of a period of structural economic transition, with challenges from a deflating of global demand and domestic investment bubbles.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

H7N9 bird flu less deadly than H5N1

Snowden exposes more US hacking, then flies

China shares extend losses

Xi vows bigger stride in space exploration

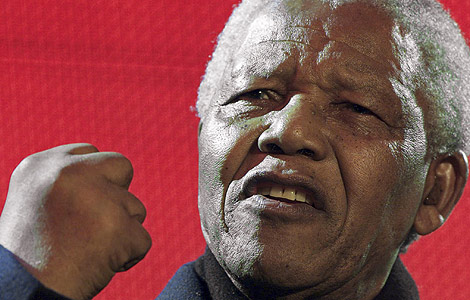

Mandela's condition critical

Suspect in shooting spree detained

Mountaineers killed in Pakistan

Foreign firms eye new 'opening-up'

US Weekly

|

|