New home prices defy curbs

Updated: 2013-07-02 03:44

By Zheng Yangpeng (China Daily)

|

||||||||

Soaring sales and improved cash flow boosted developers' confidence in the market, which is the reason behind their increasing willingness to enlarge their land banks by paying higher prices.

In addition, brisk sales in first- and second-tier cities have consumed developers' inventory quickly, and developers are eager to beef up their land banks in these cities, He said.

This is clearly seen in Beijing's property market. In the past few months, Beijing developers' inventory has declined fast from the peak of 11 million sq m to about 8 million sq m, which is forecast to be sold in seven to eight months, compared with more than 10 months in other first- and second-tier cities.

"From the inventory perspective, the upward pressure on Beijing's housing prices is even more acute than in Shanghai and Shenzhen," He said.

A separate report by the academy said in Beijing the toughest restrictions have only been effective on slashing housing turnover. Both in April 2010 and February 2011, when the Beijing government rolled out tough measures to curb home buying, turnover fell more than 60 percent.

But those declines failed to dampen prices. As turnover recovered, prices stopped stalling and began rebounding gradually.

The fundamental solution, the report said, is to increase the land supply, either by streamlining developers' procedures for acquiring land or boosting the supply of government-subsidized affordable houses.

But nationally there are also downside factors, market observers said, including the growing new housing construction speed and the central government's continuous tightening of credit supply in the coming months.

Joey Chestnut wins 7th contest with 69 dogs

Joey Chestnut wins 7th contest with 69 dogs

Lisicki, Bartoli to vie for new Wimbledon crown

Lisicki, Bartoli to vie for new Wimbledon crown

Muscle Beach Independence Day

Muscle Beach Independence Day

Tough workout for Li Na in war of words

Tough workout for Li Na in war of words

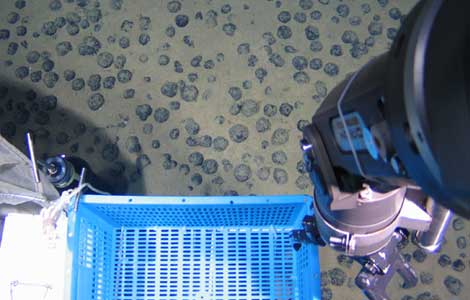

Submersible taps mineral deposits in S China Sea

Submersible taps mineral deposits in S China Sea

Ecuador finds spy mic for Assange meeting

Ecuador finds spy mic for Assange meeting

US martial artists arrive at Shaolin Temple

US martial artists arrive at Shaolin Temple

July 4 in Prescott: Balance of grief, patriotism

July 4 in Prescott: Balance of grief, patriotism

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Baby formula price probe to shake or reshape industry?

Passenger detained over bomb hoax in NE China

High rent to bite foreign firms in China

Egypt's prosecution imposes travel ban on Morsi

Russia more impatient over Snowden's stay

Mandela still 'critical but stable'

Figures show shifts in US, China economies

Chinese electrician killed in Cambodia

US Weekly

|

|