Stocks warm to reform plan

Updated: 2013-11-19 00:18

By XING ZHIGANG and YANG ZIMAN (China Daily)

|

||||||||

Insurance, brokerage services lead strong market rally on policy hopes

The Shanghai and Shenzhen stock markets rallied strongly on Monday, driven by the promise of broad reforms announced on Friday by the top leadership.

The Shanghai Composite Index rose by 2.87 percent to 2,197.22 points, led by financial services companies.

Shareholders believe the reform program will trigger a new wave of restructuring in State-owned enterprises, generating new opportunities for financial services.

In a sectoral breakdown, the insurance industry rose by more than 9 percent and brokerage services by more than 6 percent.

China Life Insurance and Citic Securities, China’s largest brokerage by market value, both registered the daily growth limit of 10 percent.

In Hong Kong, Citic Securities saw 13 percent growth in its H shares.

A 60-point resolution from the four-day Third Plenum of the Communist Party of China’s 18th Central Committee, which ended on Nov 12, also promised to introduce more competition into the financial market in China, including steps to liberalize interest and exchange rates.

The resolution was released on Friday evening, when Chinese stocks had shown early signs of gaining after information leaks on the reform plan.

Other industries, including maternal and child products, food security, medical care and environmental protection, also saw strong growth, with no sector reporting a fall.

Decisions made at the Third Plenum cover a wide range of reform measures regarding the stock market, finance, family planning, border area development, ecology and jobs. One of the most significant changes is to update the system for registering initial public offerings.

IPOs on the mainland market have been suspended for about a year, with more than 700 companies on the waiting list.

Under the new system, applicants need only submit basic, truthful information as required by the law. The current system requires regulators to also evaluate such things as IPO prices, quantity and profit prospects.

Sun Lijian, a professor at Fudan University in Shanghai, said the new IPO system will make it easier for companies to get listed as the threshold has been lowered.

The present system, with its numerous examination procedures, involves great cost in terms of time and money. Small private companies, in particular, will benefit from the new system, Sun said.

Companies with higher returns will be able to distinguish themselves more easily after being listed, with shareholders choosing from a wider range of firms, Sun said.

Despite the positive impact, Sun said the government should draft detailed follow-up measures, such as a stringent system to punish or eject violators, if necessary.

Pi Haizhou, an independent investor, echoed Sun’s thoughts on the value of a withdrawal system in the stock market.

Currently, the China Securities Regulatory Commission does not shoulder any responsibility if a company it approved violates laws or market rules.

That would no longer be the case with a withdrawal system that forces rule-breakers to face the consequence of being delisted, Pi said.

Other sectors have taken heart from Beijing’s call for reform.

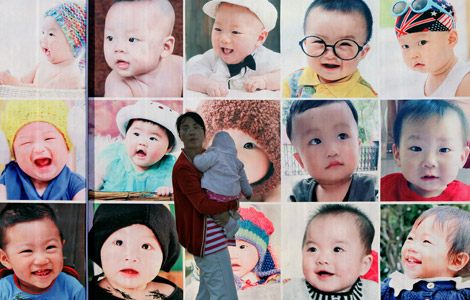

The loosening of the family-planning policy buoyed shares in firms making milk powder, children’s medicine, toys and educational products.

Milk product manufacturer China Mengniu Dairy’s stock price was up by 4.78 percent at the closing bell.

Food-testing companies also benefited from decisions to tighten supervision of food and medicine. Focused Photonies, a Hangzhou-based environmental and security testing device company, saw its shares rise by 2.68 percent.

The Party resolution also moved toward a more market-based price plan for water, oil, natural gas, power, transportation and telecommunication.

The government will intervene in price-setting only in major public undertakings, but with higher transparency and scrutiny from the public.

In Hong Kong, the Hang Seng Index rose by 2.73 percent to close at 23,660.06, a nine-month high.

NASA launches robotic explorer to Mars

NASA launches robotic explorer to Mars

Survivors of Midwest tornado sift through wreckage

Survivors of Midwest tornado sift through wreckage

Chinese manufacturers feel their way in African market

Chinese manufacturers feel their way in African market

Change in energy mix encouraging

Change in energy mix encouraging

Floral farewell to Garden Expo

Floral farewell to Garden Expo

Nation braces for more babies

Nation braces for more babies

Xi Jinping meets former US president Clinton

Xi Jinping meets former US president Clinton

5 dead as tornadoes ravage US Midwest

5 dead as tornadoes ravage US Midwest

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Officials take to global stage as influence grows

Alipay streamlines travel

NASA launches robotic explorer to Mars

China in midst of refinery boom

China eyes green plan for 2030

Survivors of US tornado sift through wreckage

Xi thanks Clinton for furthering ties

Property prices rise in October

US Weekly

|

|