Nation forecast to be Asia's largest shopping economy

Updated: 2013-12-03 09:27

By Hu Yuanyuan in Beijing and Wu Yiyao in Shanghai (China Daily)

|

||||||||

China is forecast to be Asia's largest retail economy this year, according to a report by real estate services firm Cushman & Wakefield.

"Retail growth in China has remained vigorous, while signs of moderation have surfaced as the economy undergoes a restructuring process," said Annie Lei, national director of China consulting at Cushman & Wakefield.

First-tier cities - Beijing, Shanghai, Shenzhen and Guangzhou - have the most affluent and brand-conscious consumers.

Those cities' retail sectors are growing 9 to 16 percent annually. In major second-tier cities, such as Chengdu, Wuhan, Nanjing, Shenyang and Chongqing, retail sales growth is higher, ranging from 13 to 17 percent.

"Overall, we expect a steady rise in income levels to nurture an aspiring middle-class population and, barring any economic surprises, this should underpin balanced retail growth for the next decade," said Lei.

While growth in China's retail demand is unprecedented, the surge in supply is stronger.

"Around seven out of 10 cities in China have the potential risks of oversupply in shopping malls, especially in second-tier cities such as Chengdu in Sichuan province and Shenyang in Liaoning province," said James Hawkey, managing director of retail services for Cushman & Wakefield in the Asia-Pacific region.

"Oversupply stands to affect weaker projects in the market in the coming two to three years, and we expect suburban locations and inexperienced developers to be most vulnerable, with high vacancy and project failure in extreme cases," said Hawkey.

Oversupply will have little impact on prime rents, which will continue to exhibit strong growth as retailers compete for key locations to define their brand in China and generate the strongest sales.

"The potential will stem from China's fourth-tier cities, such as Sichuan's Nanchong and Deyang," Hawkey added.

Experts and market insiders said that China's retail sector has been rediscovering "real demand" after a recent crackdown on gift purchases among government officials.

An economic recovery, meanwhile, has pushed the retail sector back to a "profit-driven track", Cushman & Wakefield said.

A significant impact on some luxury brands, especially those focused on watches, accessories and expensive liquor, has been observed, said Chen Qing, manager of a high-end retailer in Shanghai.

A joint study by Italian luxury goods association Altagamma and consultants Bain & Co forecast luxury sales growth in China to fall to 6 to 8 percent in 2013, down from an estimated 20 percent in 2012.

While sales growth may slow, China's love affair with luxury is expected to last for some time.

"It has been a pain for retailers in the short term, but it is also a process of 'bursting the bubbles' to see clearly who are our real consumers and what should be our real focus," said Chen.

In 2013, China's retail market has been shifting from sales-driven to profit-driven, which reflects a market recovery from 2012, according to Wang Jia, analyst with Orient Securities Co Ltd.

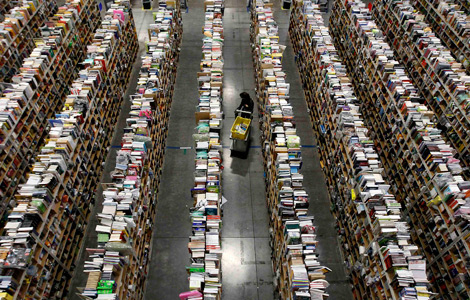

Amazon.com sees delivery drones in the future

Amazon.com sees delivery drones in the future

Simulated archaeology takes you back in time

Simulated archaeology takes you back in time

Pictures of Year 2013 by Reuters

Pictures of Year 2013 by Reuters

Thai PM calls for talks, protest leader defiant

Thai PM calls for talks, protest leader defiant

'Cyber Monday' sales set to hit record

'Cyber Monday' sales set to hit record

Tapping the power of youth volunteers

Tapping the power of youth volunteers

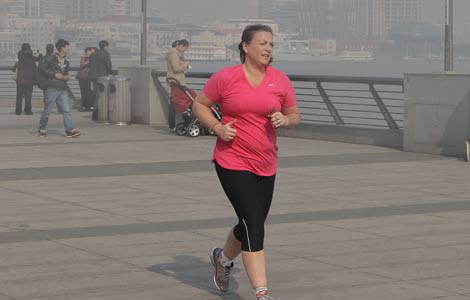

Shanghai braces for second day of severe pollution

Shanghai braces for second day of severe pollution

Private hospitals face challenges

Private hospitals face challenges

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US calls for release of American jailed in Cuba

Staggered flu shot plan best for China: study

Online shopping changing retail world

House hunting the world in Chinese

China-UK collaboration is about time: President Xi

Biden under pressure to calm tensions

FTZ OKs offshore accounts

'Go Global' pushing up China M&A

US Weekly

|

|