Vale expects iron ore price to recover

Updated: 2014-11-01 03:50

By ZHANG FAN in Rio de Janeiro(China Daily USA)

|

||||||||

|

|

Headquarter of Vale in Rio de Janeiro. [Photo by Zhang Fan/China Daily USA] |

Vale SA, the world's largest producer of iron ore, expects to increase the price for the steelmaking ingredient in the Chinese market and see it reach $100 per ton in the near future, though the Brazilian miner acknowledged that the demand for iron ore from China is "not as active".

"We believe the prices will go back to a level close to $100 but this really depends on the cost curve of the ore curve,"said Vale's JoseCarlos Martins, head of Ferrous & Strategy.

Martins made his comment at press conference in Rio de Janeiro on Oct 30 when Vale announced its third-quarter earnings. The company posted a surprising $1.44 billion loss, causing its shares to tumble to a 5-1/2-year low. Analysts surveys had estimatednet profit $1.49 billion.

Vale cited low iron ore prices and a weak local currency for the loss. A year earlier, Vale had a net profit of $3.5 billion.

The Wall Street Journal reported that a sharp depreciation in the local currency caused the company to suffer nearly $3 billion in losses related to foreign exchange and derivatives, reflecting an 11 percent depreciation of the Brazilian real between the end of June and the end of September.

"Since Vale's debt is mostly denominated in dollars, the weaker real increased the value of its debt as expressed in reais, creating a 'mainly noncash'effect, according to the newspaper.

Iron ore production reached 85.7 metric tons, "the highest output in Vale's history", according to CFO Luciano Siani. Sales to China -- is now the world's largest iron ore customer -- were $2.79 billion, or 30.3 percent of total revenues in the quarter, followed by Brazil, with 18.9 percent, Japan, 9.8 percent and Germany, 5.6 percent.

Vale and Brazil had several years of rapid growth because China's demand for commodities boomed. But Chinese growth has slowed, putting pressuring on commodity prices and hurting Vale and the Brazilian economy.

Now Vale is seeking to increase production and cut costs as new production from Australian rivals Rio Tinto Ltd and BHP Billiton Ltd has hit the market.

Low demand from steel makers has pushed iron ore prices to near five-year-lows. The spot price now is $79 per ton.

Martins said the price was staying low because higher-cost producers were not exiting the market as quickly as expected.

"We are seeing greater resistance, particularly in China, to the elimination of capacity," he said.

"What we have to do now is to be patient," he said of Vale. "Many producers are leaving the market everywhere… we still have to say that what will happen still depends on China and the world economy."

Though the price of iron ore has declined to new lows, Vale insists that it will expand current production from 300 million tons to 450 million tons in 2018.

Vale CEO Murilo Ferreira said increased production can lower costs and improve the quality of the product, which "could substitute other productions outside Vale or even inside Vale that have higher cost and lower quality".

China may be a main target for the increased production. The Sydney Morning Herald reported that Vale said it was "confident" that large amounts of Chinese iron ore production would soon be "forced out of the market" and provide support for a higher price.

Liu Zhiqiang, an analyst of iron ore from SCI International, said Chinese iron ore dealers have already acted. "Some traders have suspended their operations or reduced the scale, some even turned their focus to other area such as soybeans and oil," Liu said.

Data from China Mining Association shows that China has imported iron ore of 8,469.49 metric tons this September, a 13 percent increase compared with the previous month.

The Chinese economy grew by 7.3 percent in the third quarter of 2014. To support the slumping property market and stimulate the economy, the Chinese government has taken steps to encourage housing sales, which is expected to support China's domestic steel demand.

Vale said it is especially seeking to lower costs for transporting iron ore from Brazil to China. It used to be $18 to $22 per ton, much higher than its Australian competitor's $7.50 to $10 each ton.

In September, Vale signed long-term contracts with China COSCO, China's largest shipper, and China Merchants Energy Shipping Corp. Vale will transfer four of its 400,000-metric ton vessels to COSCO and charter them for 25 years. COSCO will also build 10 vessels of similar size to ship Vale's iron ore.

fanzhang@chinadailyusa.com

Traditional dresses add color to APEC

Traditional dresses add color to APEC

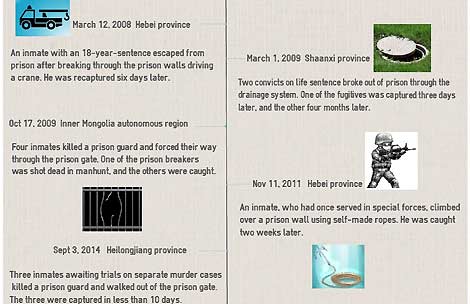

A brief look at prison breaks in China

A brief look at prison breaks in China

Chinese airline opens 1st Shanghai-Kathmandu route

Chinese airline opens 1st Shanghai-Kathmandu route

It's a hot, hot walk

It's a hot, hot walk

Moments from 2014 Shanghai Marathon

Moments from 2014 Shanghai Marathon

Solo venture to Shanghai, Hangzhou and Suzhou

Solo venture to Shanghai, Hangzhou and Suzhou

Ontario officials seek business in China

Ontario officials seek business in China

Tibetan culture to display splendor in Canada

Tibetan culture to display splendor in Canada

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Xi stresses CPC's absolute leadership over army

Foreign TV shows online will need permission

Mass Ebola outbreak 'is unlikely'

S. Korea's plastic surgery paradise lost

China, US to meet on WMD nonproliferation

Danone bolsters China presence with $550m deal

Fugitive caught near prison

Can private space survive 2 explosions in 4 days?

US Weekly

|

|