Fosun to buy Meadowbrook Insurance for about $433m

Updated: 2014-12-31 13:30

(Agencies)

|

||||||||

|

|

|

View of the headquarters building of Fosun Group in Shanghai, Feb 20, 2014. [Photo/IC] |

Chinese conglomerate Fosun International Ltd will buy Meadowbrook Insurance Group for about $433 million to enter the US property and casualty insurance market.

The cash deal of $8.65 per share represents a 24 percent premium over Meadowbrook stock's closing price on Dec 29, the companies said on Tuesday.

Shares of Meadowbrook, a specialty commercial insurance underwriter and insurance administration services company, were up 14 percent at $8.15 in extended trading.

"This transaction allows Fosun to establish a presence in the important US P&C market," Chairman Guo Guangchang, also one of China's richest men, said.

Guo, who Forbes estimates has a net worth of about $4.3 billion, is also involved in a takeover bid for French holiday operator Club Mediterranee SA with Italian tycoon Andrea Bonom.

Fosun, which has a market capitalization of about $9.10 billion, is into insurance, industrial operations, investment and asset management.

The transaction, which has been approved by the boards of both the companies, is expected to close in the second half of 2015.

Meadowbrook will continue to maintain its headquarters in Southfield, Michigan and will operate under the Meadowbrook brand name.

KPMG and Willis Capital Markets & Advisory are the financial advisers to Fosun and Meadowbrook respectively.

DLA Piper LLP is the legal advisor to Fosun while Sidley Austin LLP advised Meadowbrook on the deal.

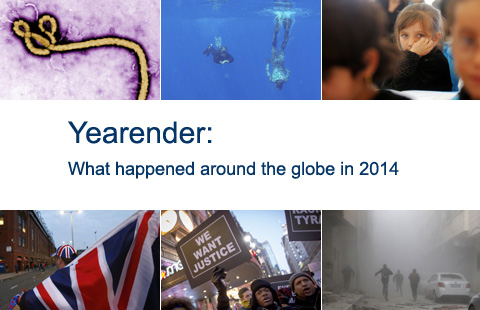

- New Year's Eve celebration in Times Square

- Death toll from tropical storm rises to 35 in Philippines

- Female fighters in the battle against IS

- China launches frigate for Bangladesh navy

- Divers set to search for AirAsia wreckage after debris, bodies found

- Nurse becomes first Ebola victim diagnosed in Britain

Let the celebration begin

Let the celebration begin

New Year's Eve celebration in Times Square

New Year's Eve celebration in Times Square

2014 Top news events in China

2014 Top news events in China

Ten breakthroughs of China's military diplomacy in 2014

Ten breakthroughs of China's military diplomacy in 2014

Creative colored drawings embrace New Year

Creative colored drawings embrace New Year

Chongqing collective wedding applies for Guinness records

Chongqing collective wedding applies for Guinness records

China Daily Pictures of the Year 2014

China Daily Pictures of the Year 2014

New Year's Eve 2015: Celebrations around the world

New Year's Eve 2015: Celebrations around the world

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

35 killed, 43 injured in Shanghai stampede

US sorghum exports to China hit 19-year high

China's Fosun moves into US insurance market

Shares of CNR, CSR surge after merger

Fosun to buy Meadowbrook Insurance for about $433m

Doyers Street: Hallowed ground in New York's Chinatown

US denies reports about proposed prisoner swap with Iran

Remote Canadian polar bear town arouses interest from China

US Weekly

|

|