Bagging rights

Updated: 2015-03-20 09:17

By Luo Weiteng(HK Edition)

|

||||||||

Moves in play

He Bin, the Beijing-based Greater China managing director of Italian luxury leatherware maker Tardini, believes long-established luxury brands also serve as characters in the M&A story, where uncertainties tend to run deep.

"It is just a matter of time for many time-honored European luxury brands suffering from the dearth of a successor of choice to hunt for buyers," He said. "M&A opportunities are emerging but the price problem stands as a major obstacle."

Having discussed M&A deals on behalf of his friends with Italian fashion house Missoni, known for its colorful knitwear designs, and Krizia, one of Italy's first ready-to-wear brands, He has been witness to a great deal of haggling between mainland buyers and European brands over an acceptable price.

At the negotiating table with the financially struggling Krizia, the brand owner insisted that the inherent value of Krizia is embodied in the intriguing design story over the past half a century, whereas brand popularity in the mainland market bears much more weight with mainland buyers.

"On the surface, the talk is locked in disagreement over price. But fundamentally, it is a wide divergence on how to weigh up the price and brand values amid different understanding of the brand that leads to a deadlock," said He.

And if the brand founders are still alive, outrageous prices could be demanded, making it extremely difficult for facilitating a takeover deal, He added.

He failed to help his friend tie up a takeover deal with Krizia. The stricken brand was finally bought out by Shenzhen-based Marisfrolg with $35 million earlier last year.

The marriage between Marisfrolg and Krizia makes for one of the few M&A success stories for mainland buyers because the two designer brands, with their similar design styles, could easily converse in a common language, said He.

However, for the vast majority of mainland buyers, who have no idea how to run these high-end brands, especially the premium international labels, the M&A game is safely played by taking stakes in brands rather than directly acquiring the business, said He.

A case in point is Shanghai conglomerate Fosun Group, which in recent years has acquired stakes in a string of overseas luxury labels like Greek jeweler Folli Follie Group, top-grade US womenswear brand St. John and Italian luxury menswear brand Caruso. But so far, Asian buyers are still marginal players in the cross-border luxury M&A business, said Tang Xiaotang, founder of mainland fashion news website Nofashion.cn.

Tang believes the M&A game is dominated by US- and European-based private equity fund and luxury conglomerates.

Taking it slow

"It has much to do with the capability of running the brands well rather than whether you can bid a higher price," said Tang.

"Many sellers want to hand over their brands to buyers with strong operational capabilities."

Large conglomerates like LVMH and Swatch Group, well-familiar with the rules of the game and always ready to swoop in and pick up firms in trouble, have the firepower for more deals, Tang pointed out.

LVMH posted 4.09 billion euros ($4.57 million) of cash on its balance sheet at the end of 2014, while Richemont had 2.4 billion euros of disposable cash at the end of March last year.

All that money has to be gainfully employed. And some of it has been.

In 2013, LVMH bought a 52 percent stake in footwear label Nicholas Kirkwood and a 46 percent holding in fashion house J.W. Anderson, while Swatch bought US jeweler Harry Winston for $1 billion.

Last year, French luxe group Kering purchased haute Swiss watchmaker Ulysse Nardin for an estimated $860 million.

Tang also notes rising interest from private equity funds and investors, who find ways to slip into the high-end sector.

Statistics from consultancy firm Pambianco, which focuses on the fashion, luxury and design sectors, show private equity firms accounted for 60 percent of M&A deals in the luxury industry in 2013.

Last September, US-based Lee Equity Partners infused capital into fashion brand Jason Wu, most famous for designing for US first lady Michelle Obama on several occasions, including her two presidential inauguration ball gowns.

The deal follows a busy year for private equity seeking fresh investment opportunities in this industry.

In 2013, US buyout group KKR acquired a 65 percent stake in a deal valuing the French label Sandro and Maje at 650 million euros, including net debt. US private equity firm TA Associates made a majority investment in Dutch LLC, parent company of fashion brands like JOIE, while Towerbrook Capital Partners, also a US private equity firm, paid about $835 million for premium American denim brand True Religion Apparel.

As luxury retailers remain stylish for large conglomerates and private equity firms, He Bin pointed out that new opportunities often come from up-and-coming startup brands.

"For Asian investors faced with the cultural difference between East and West yet not tired of snapping up high-end brands, the safe domain in the M&A game is to play it as a pure financial investment, as Japanese-led consortiums have done over the past decade," said He.

The M&A game may help mainland manufacturers expand downstream for diversification amid rising labor costs, as well as help low- to mid-end mainland retailers widen their product range with a higher-end price positioning, added Hui at DBS.

But it would take a considerable amount of time for the hefty investments to show returns. "Acquired brand names do need time to get in the know and strike up an affinity with wealthy consumers in Asian markets," said He.

Contact the writer at sophia@chinadailyhk.com

- Australia announces it will join China-proposed bank

- Germanwings pilot planned big gesture, says ex-girlfriend

- 'Behind-the-scenes' visit at Paris Zoological Park

- Migrants risk lives crossing into Europe

- US denies visa to young man for transplant

- Germanwings' co-pilot 100 percent fit to fly: Lufthansa CEO

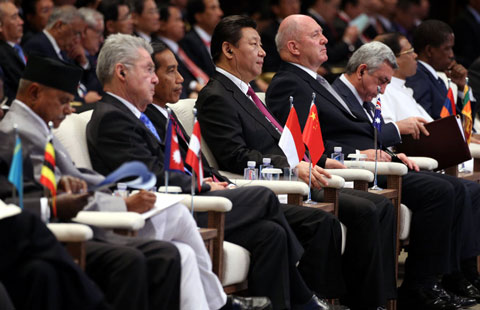

World leaders open Boao Forum for Asia 2015

World leaders open Boao Forum for Asia 2015

Buildings covered by fog in China's Qingdao

Buildings covered by fog in China's Qingdao

Across America over the week (from March 20 to 27)

Across America over the week (from March 20 to 27)

Walking tall

Walking tall

Press photo competition winners announced

Press photo competition winners announced

Strange but true: Gator takes a stroll on Florida golf course

Strange but true: Gator takes a stroll on Florida golf course

Top 9 hot-selling foreign products for Chinese babies

Top 9 hot-selling foreign products for Chinese babies

French photographer captures Beijing in the '80s

French photographer captures Beijing in the '80s

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Asian countries to seek win-win co-op: Xi

'Made in China' to 'Made in USA'

More countries to join China-backed investment bank

Grassland city looks to cloud computing

Scenic Hohhot wants to be smart based on emerging industries

Motive examined after

'deliberate crash'

Chinese CEO compares Apple Inc to Hitler

China's investment opportunities lauded

US Weekly

|

|