China's economic rebalancing benefits region

Updated: 2016-05-10 08:14

By W. RAPHAEL LAM/ALFRED SCHIPKE(China Daily)

|

||||||||

|

|

Aresidents shows China's yuan and US dollar banknotes in Qionghai, South China's Hainan province, Jan 7, 2016. [Photo/Xinhua] |

Asian economies are sailing in choppy waters, facing severe headwinds from an uncertain and challenging global environment, but the region also has strong points in favor.

The global recovery has been uneven and weaker than expected. On top of that, global trade has been sluggish and financial conditions have been volatile. The rise of China as a global economic superpower has created challenges of its own, as China's necessary rebalancing from manufacturing toward services and investment to a consumption-driven economy-critical for both China's and global growth over the medium term-remains bumpy.

As elsewhere, many Asian economies face risks associated with natural disasters and geopolitical and domestic political uncertainty. But all is not doom and gloom, as Asia has considerable strengths and remains the major engine of the global economy: it continues to provide nearly two-thirds of global growth. In addition, the region has policy buffers such as current account surpluses and high reserve levels, and has used macro-prudential policies well to help bolster financial stability. It is likely to benefit from further economic integration and regional and multilateral trade agreements such as the Trans-Pacific Partnership.

Asia's growth is moderating slightly, in line with the rest of the global economy. According to the most recent International Monetary Fund's World Economic Outlook, activity in the region moderated in the second half of 2015, and is expected to continue decelerating in the near term. GDP growth for the region is forecast at 5.3 percent in both 2016 and 2017, largely unchanged from 2015. In addition to weaker global growth and sluggish trade, the moderation in regional growth also reflects the ongoing necessary rebalancing in China.

But while external demand is relatively weak, domestic demand, particularly consumption, is expected to remain resilient across most of the region. The relative strength of domestic demand is due to generally low unemployment, lower commodity prices (which is a boon for oil and commodity importers), economic stimulus in some countries, and ongoing secular trends, including steadily rising disposable income.

The moderation in Asia's growth masks important differences within the region. In China, GDP growth is expected to continue to moderate to 6.5 percent this year and 6.2 percent in 2017. This reflects ongoing rebalancing and other structural reforms, which are expected to continue to boost consumption and the services sector, while investment and manufacturing remains relatively weak until excess capacity is reduced.

India, on the other hand, is expected to remain the fastest-growing large economy in the world, with GDP expanding by 7.5 percent in 2016-17, underpinned by strong private consumption and helped by lower oil prices. In Japan, GDP growth is projected to remain at 0.5 percent in 2016, slowing to -0.1 percent in 2017 as the widely anticipated consumption tax rate hike (from 8 to 10 percent) kicks in. And Indonesia, which is exposed to commodities, is expected to benefit from a large infrastructure push.

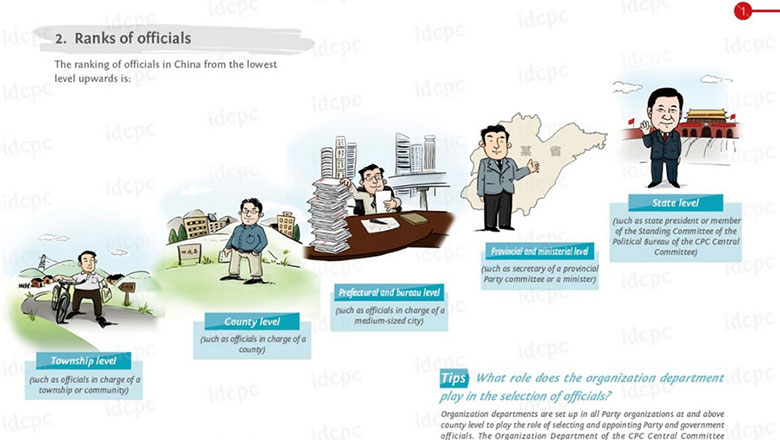

CPC creates cartoon to show how officials are selected

CPC creates cartoon to show how officials are selected

Top 5 expected highlights at CES Asia 2016

Top 5 expected highlights at CES Asia 2016

Business jet market hits air pocket

Business jet market hits air pocket

Canada getting on top of Alberta wildfire, Fort McMurray off limits

Canada getting on top of Alberta wildfire, Fort McMurray off limits

Young golfers enjoy the rub of the green

Young golfers enjoy the rub of the green

71st anniversary of victory over Nazi Germany marked

71st anniversary of victory over Nazi Germany marked

Post-90s girl organizes others’ messy wardrobes

Post-90s girl organizes others’ messy wardrobes

Landslide hit hydropower station in SE China

Landslide hit hydropower station in SE China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|