Congress to extend EB-5 visa program

Updated: 2015-12-17 12:38

By Paul Welitzkin in New York and Lia Zhu in San Francisco(China Daily USA)

|

|||||||||

Congress is poised to extend the EB-5 visa program until Sept 30, 2016, without any changes as part of a $1.14 trillion spending bill scheduled for consideration by the US House of Representatives on Friday.

EB-5 is an alternative way for immigrant investors to obtain a US visa. It was created in 1990 to help stimulate the US economy through job creation and foreign investment. With a minimum of $1 million - or $500,000 in low employment or rural areas - an EB-5 investor must create at least 10 full-time jobs through the project they are working toward completing. In return, the investor is eligible for permanent US residency.

Stephen Yale-Loehr, a law professor at Cornell University in Ithaca, New York, told China Daily in an e-mail Wednesday that the extension does not include any major changes.

"Congress was on the verge of enacting major changes to the EB-5 program, but deleted the EB-5 reform package from the omnibus spending bill at the last minute," he said.

The extension does not apply to the part of the EB5 program by which investors directly fund their own business projects in the US. However, it does apply to the regional-center program. There are more than 800 approved EB-5 regional centers in the US. About 90 percent of EB-5 investments are made through the centers, according to Yale-Loehr. The regional center part of EB-5 has funded such projects as the Hudson Yards real estate development in New York City and a ski resort in Vermont.

"The extension is a good news for Chinese applicants to the EB-5 program as the minimum threshold is still $500,000 for the next nine months," said Rei Teng, attorney at law with a San Jose, California-based law firm called "Immigration Law Group".

"But we expect the threshold to be raised next year to at least $800,000, considering factors like inflation. After all the current threshold was imposed over 10 years ago," said Teng, whose company has 90 percent of their clients from China.

"But the bigger challenge for Chinese investors than higher qualifying threshold is to provide source of funding, or tax returns," she said. "More strict rules are expected next year on that respect."

She also warned the perspective investors to be alert to possible fraud before the US authorities tighten controls over regional centers.

Contact the writers at paulwelitzkin@chinadailyusa.com

(China Daily USA 12/17/2015 page2)

- Pandas prefer choosing their own sex partners, researchers find

- Tycoons exchange views on building a cyberspace community of shared future

- China successfully launches its first dark matter satellite

- Report: Layoffs may loom next year

- China launches satellite to shed light on invisible dark matter

- China strongly opposes US arms sale to Taiwan

- Good international coordination a must to combat terrorism

- Chinese embassy: spy report 'sheer fiction'

- US, Cuba agree on restoring commercial flights

- Fed raises interest rates, first rate hike since 2006

- IAEA decides to close nuclear weapons probe of Iran

- Russia, US call for common ground over issues

Canadian college offers flying classes to legless girl

Canadian college offers flying classes to legless girl

Fashion buyer scours the world for trendy items

Fashion buyer scours the world for trendy items

Tycoons exchange views on building a cyberspace community of shared future

Tycoons exchange views on building a cyberspace community of shared future

Snow scenery of Taklimakan Desert in Xinjiang

Snow scenery of Taklimakan Desert in Xinjiang

East China province gets 1st subway line

East China province gets 1st subway line

President Xi delivers keynote speech at World Internet Conference

President Xi delivers keynote speech at World Internet Conference

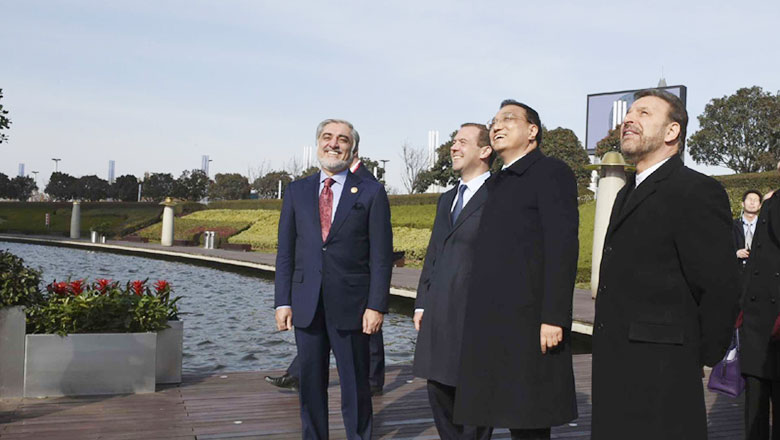

Chinese premier shows Zhengzhou's fast growth to SCO leaders

Chinese premier shows Zhengzhou's fast growth to SCO leaders

Two Chinese Antarctic expedition teams set off for Antarctic inland

Two Chinese Antarctic expedition teams set off for Antarctic inland

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|