Hard landing 'unlikely despite a bumpy road'

Updated: 2016-02-24 08:03

By Zheng Yangpeng(China Daily)

|

||||||||

China will stage its largest annual political event - the "two sessions" - in less than 10 days. China Daily takes a close look at a series of hot topics and catchphrases for the sessions.

Today's catchphrase - the New Normal: In the past few years, the Chinese government has pledged more economic reforms and a transition to a more sustainable economic model - often described as the New Normal. Under this model, economic growth will be moderately slower than the double-digit figures seen in the past three decades. Growth will be safer and more sustainable as it relies more on services and consumption, and less on commodity-intensive investment and manufacturing. However, the government has reiterated that GDP growth should be kept within a reasonable range to prevent a hard landing and should also offer room for reforms. Economists widely believe that the range should be between 6.5 and 7 percent.

The Chinese economy is on a bumpy road but stronger than-expected January data suggest that a hard landing is unlikely, according to analysts.

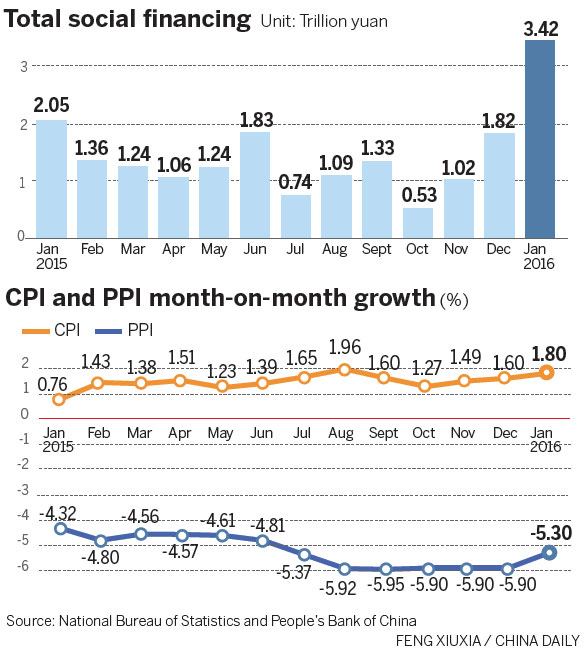

The data showed deflationary pressure had eased a little as the consumer price index rose by 1.8 percent last month from a year earlier, beating market expectations of 1.6 percent and up from a 1.6 percent increase in December.

The producer price index which measures wholesale inflation, fell by 5.3 percent in January from a year earlier slightly less than market expectations of a 5.4 percent decline and easing from a fall of 5.9 percent in December.

Social financing - data compiled by the government to gauge credit flowing to the real economy - stood at 3.42 trillion yuan ($522 billion) in January, up from $276 billion in December and beating expectations of $337 billion. Outstanding credit grew by 12.1 percent year-on-year.

Liu Wenqi, a researcher at China International Capital Corp, said in a research note that the unexpected "credit cascade" might even understate the pace of credit expansion, because the local government debt-for-bond swap had yet to start.

Tom Orlik, an economist at Bloomberg, said, "Although China has still to solve major problems, in some important respects policy is already moving in the right direction.

"The yuan has been repegged to the dollar. That's a step back on exchange-rate reform but should at least put a cork in capital outflows. Multiple rate cuts and expanded fiscal stimulus are underpinning growth. A 3.2 trillion yuan bailout for local governments has reduced one of the main sources of financial risk. Lower down payment requirements are boosting home sales."

He also said that Zhou Xiaochuan, governor of the People's Bank of China, would hold a news conference in Shanghai on Friday - an opportunity to explain exchange-rate policy.

On March 5, the National People's Congress annual session will include Premier Li Keqiang's Government Work Report for 2016. Plans for a larger fiscal deficit and expansion of the 3.2 trillion yuan bailout for local governments would underpin confidence in the 2016 growth outlook, Orlik said.

Song Yu, chief economist at Goldman Sachs Gao Hua Securities, said growth would slow to 6.7 percent in the first three months of this year as financial services contribute less to expansion than a year ago, and because policy measures to support growth have tapered off since the last quarter of 2015.

Even though he predicts that full-year growth will drop to 6.4 percent, he is not negative about China's economic prospects and dismisses predictions of a collapse.

Song also said that after a period of stabilization, policymakers will probably guide the yuan carefully down once again. He predicts that it will fall to 7 against the US dollar by the end of the year.

zhengyangpeng@chinadaily.com.cn

Seven-year-old village kid cares for her grandparents

Seven-year-old village kid cares for her grandparents

Future stars battle intense competition for stardom

Future stars battle intense competition for stardom

Matters of state

Matters of state

Students begin new term with lucky bags and red envelopes

Students begin new term with lucky bags and red envelopes

The life of a postpartum care worker

The life of a postpartum care worker

Top 10 most Internet-savvy banks in China

Top 10 most Internet-savvy banks in China

To eat or not to eat? Delicious and adorable art

To eat or not to eat? Delicious and adorable art

12 photos you don't want to miss about Chinese Lantern Festival

12 photos you don't want to miss about Chinese Lantern Festival

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

Accentuate the positive in Sino-US relations

Dangerous games on peninsula will have no winner

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

US Weekly

|

|