China rides biotech wave

Updated: 2016-07-01 10:06

By Lia Zhu(China Daily USA)

|

||||||||

|

A delegation of 37 biotech companies and more than 130 representatives from China attended the BIO International Convention last month in San Francisco. This year's delegation was the largest ever to the convention, according to the China Chamber of International Commerce, which led the delegation. Lia Zhu / China Daily |

The United States' biotech industry is the world's leader, but China is moving forward, pushed by the central overnment and increasing demands on healthcare for the population, LIA ZHU reports from San Francisco.

In an hour, four investors had stopped by Alex Zhang's booth to seek investment opportunities at the international biotech convention in San Francisco.

"It was unimaginable in the past that US investors should be interested in a Chinese biotech company," said Zhang, investment and financial director of Sinobioway Group, a major biotech company in China at the Biotechnology Innovation Organization (BIO)'s annual convention.

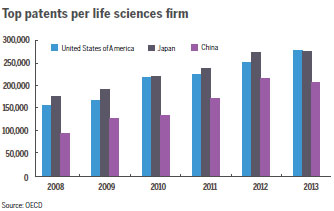

The United States is the world's leader in the biotech industry with the best technologies and the most intellectual patents, but China is moving forward at a very fast pace, said Lin Shunjie, director general of trade and investment at the China Council for the Promotion of International Trade (CCPIT), who led a delegation of more than 130 people and 37 companies at the BIO convention.

Despite that China lags behind the US by a big margin in the biotechnology sector, there is great potential for the two countries to collaborate with each other, not only in terms of investment but also broader areas, Lin said.

The growth of China's biotech development is fueled by the country's focused national policies and continuing investment in life science and technology, as well as the increasing pool of professionals with globally-trained backgrounds.

Biotechnology is one of the seven strategic emerging industries that the Chinese government designated in the 13th Five-Year Plan. "Made in China 2025", an initiative of the central government to upgrade industry, also designates biotechnology as a key industry to push economic development.

The bio-pharmaceutical market in China is expected to reach about $601 billion and the market for biotech manufacturing will be at about $150 billion by 2020.

China's market

"The growth of China's bio-pharmaceutical market is the result of the increasing demand on healthcare in the country," said Zhang. "Traditional Chinese medicine (TCM) and chemical drugs can't meet the need, especially in the treatment of cancer. China is undergoing an industrial transition from chemical drugs to bio-pharmaceuticals."

Any ambitious pharmaceutical company in China must "go out" to increase its competitiveness, said Lian Zuo, vice-president and chief science officer of Hainan Hualon Pharmaceutical Co, Ltd.

"We are not only interested in the US, but also many other countries to explore partnerships," said Zuo, who had several meetings with European counterparts at the convention to discuss possible collaborations.

"In recent years, China has implemented some policies to encourage Chinese pharmaceutical companies to be geared to international standards," said Zuo. "For instance, if a new drug is approved by FDA (Food and Drug Administration) or EU (European Union), its review process in China will be expedited."

At the same time, small and innovative R&D biotech companies in the US also have a strong desire to collaborate with big Chinese companies, according to Zuo. "We often receive such inquiries from overseas," she said.

Zhang agreed. He said collaboration with overseas companies means more than just marketing products. "Sinobioway aims to find the best technologies and best partners through direct investment," he said, adding that they expected to build their awareness in the US market and seek potential partners by attending the BIO convention.

"Some innovative companies in the US have very limited resources in capital, manufacturing and marketing. A partnership with Chinese companies like Sinobioway means they have access to China's huge market and production capacity," he said.

BioAtla LLC, a San Diego-based company focused on the development of Conditionally Active Biologic (CAB) antibody therapeutics, is working with Sinobioway to develop several CAB candidates for the Chinese market.

In May 2015, the two companies entered into a strategic collaboration for the development and commercialization of select CAB antibodies and other CAB-based therapeutics in China.

In January this year, they selected the first product programs for development. BioAtla also received $19 million in program payments and equity investment from Sinobioway as part of a total of more than $70 million in payments and investment from Sinobioway over the next 12 months. In return, Sinobioway has exclusive rights to develop and commercialize the selected CAB antibodies in China.

Last month, Sinobioway opened an office in San Diego to facilitate further investment and other potential partnerships.

Chinese direct investment in the US biotech and health sector has seen a dramatic increase recently. Last year, 23 deals were reached with a total value of $900 million, compared with only six deals worth $28 million in 2012, according to Rhodium Group China Investment Monitor.

"Chinese investors are becoming increasingly savvy about the investments they choose to diversify their portfolio. Quite frankly, the biotechnology market in the US is very healthy," said Greg Meiselbach, director of International Affairs with BIO.

Meiselbach said BIO has been leading missions to China almost every year to "play a facilitator's role for cross-border partnerships".

Development opportunities

China is at the forefront of significant growth within the biotech industry and Western biopharmaceutical leaders increasingly look to China for business development opportunities, said the organization in an article posted on its website.

BIO's member companies are exporting more products and technologies to China than ever and it has been working with China to encourage the country to remain open to foreign medical technology and to deliver the broadest possible range of products to its patients, the organization said.

"China has a growing educated class of researchers that can help develop new innovative therapies. It also has the largest spending market with the largest healthcare system to deliver the therapies to its patients," Meiselbach explained, adding that biopharmaceuticals are sometimes the best therapies to treat the leading diseases in China, like lung cancer and heart disease.

"But like every relationship, there's positive and negative," he said, referring to the challenges faced by the US biotech companies, especially the emerging ones.

"There are areas in the industry that China can improve on - to increase access of Chinese patients to the best leading therapies in the world. Those issues mostly fall into regulatory harmonization and speeding the drug approval, and strengthening intellectual property right for the developer of the medicine," he said.

Intellectual property laws are the driving force for innovation and biotech progress and the ability to enforce patents is critical, said BIO, which predicts that China will become a hub of innovation if it remains committed to putting into place an innovation-friendly ecosystem.

"Innovation is happening in China, but the reason why the US biotech economy is so strong is that we foster innovation through a variety of policies that really foster innovation and collaboration between companies and researchers and universities," said Meiselbach.

"This collaboration is called a bio-ecosystem, which incorporates strong corporate regulatory systems, strong IP and low barriers for investment into the companies in order for bio-economy to really flourish," he said.

According to BIO's data, the investment in life sciences in the US takes up 23 percent of the country's total investment in innovation, even higher than the IT investment, which accounts for 18 percent.

The US has many other resources for early stage biotech companies, which are, however, comparatively fewer in China, such as incubators that provide financial assistance and expertise to startups.

"It takes time for a market to appreciate and accept a new technology. We found the US is more sensitive to innovative technologies," said Yuling Luo, founder and CEO of Advanced Cell Diagnostics, Inc, a Bay Area-based biotech company focused on RNA-based cancer diagnostics.

He said his team had thought of starting their project in China 10 years ago, but they felt it was more difficult than in the US mostly because the investors and the authorities had difficulty fully understanding their concept.

With an initial fund of $250,000 from the US government, Luo said they secured a total of $40 million later and the company has made rapid growth. "All the top 10 pharmaceuticals in the US and universities like MIT and John Hopkins are our customers," he said.

Last year, Luo's company set up an office in China to access the lucrative market. He said some Chinese investors recently reached out to him and were interested in acquiring his company.

"I think it's a good trend to leverage the Chinese capital and the US cutting-edge technologies," Luo said. "The innovations here need financial support and the huge population in China - 1.4 billion people and 200 million to 300 million middle-class - can afford, more high-value technologies now than a decade ago."

Chinese students

Like Luo, who came to the US as an international student, more and more Chinese students with US training are attracted by the huge Chinese market and plan to start their companies in China.

According the China Chamber of International Commerce, up to half of overseas Chinese students majored in biotechnology and medicine before 2000, and they have formed a Chinese-American biotech community and play an important role in bridging the biotech exchanges and cooperation between the two countries.

Liu Fei, a postdoctoral fellow in nanomedicine at Stanford University School of Medicine, said his team - three scientists in Silicon Valley and two in China - was in talks with venture capitalists in China for their precision cancer early detection product.

"Now is an opportune time to start up a business in China with the availability of capital, the large consumer market and manufacturing capability," he said.

"The high energy consumption and low productivity industries still predominate in China, and the government has realized it and put a priority on innovation," said Liu. "Compared with the United States, it takes less time to get a product to market, which will help us in expanding our business globally."

Liu and his team also participated in the Chunhui Cup entrepreneurship competition organized by the Chinese government in order to get more exposure to potential investors.

"We hope to set up the company by the end of this year and realize the R&D in Silicon Valley, manufacturing in China and sales in the world," he said.

Contact the writer at liazhu@chinadailyusa.com

- Russian Eastern Spaceport shows mutual trust

- UK parties head for leadership battles amid Brexit fallout

- Special Syria envoy plans for July talks, August political transition

- Double suicide attacks kill at least 28 in Cameroon

- Turkey in mourning for 42 killed in deadly assault on Istanbul airport

- Brazil could dismiss Rousseff the day before Olympics ends

Tenth birthday of the world's highest altitude train line

Tenth birthday of the world's highest altitude train line

Crucial moments in the history of the CPC

Crucial moments in the history of the CPC

Chibi Maruko-chan 25th anniversary exhibition

Chibi Maruko-chan 25th anniversary exhibition

Turkey in mourning for 42 killed in assault on airport

Turkey in mourning for 42 killed in assault on airport

China's future film stars take graduation photos

China's future film stars take graduation photos

Russian Eastern Spaceport shows mutual trust

Russian Eastern Spaceport shows mutual trust

Chinese Olympic team's uniforms unveiled in Beijing

Chinese Olympic team's uniforms unveiled in Beijing

Paintings on paddy fields in Shenyang, NE China

Paintings on paddy fields in Shenyang, NE China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

US Weekly

|

|