Art market's growing pains

Updated: 2013-03-08 12:35

By Michael Barris (China Daily)

|

||||||||

|

Sotheby's Hong Kong first mid-season art sale which fetched, HK$680 million ($87.3 million), against a pre-sale estimate of HK$130 million. All the 25 masterpieces on offer were sold in just over an hour, and the top lot of the sale, Lotus and Mandarin Ducks sold for HK$191 million, setting the auction record for the artist, Zhang Daqian. Gao Yiping / For China Daily |

Battered by a downturn, the Chinese auction marketplace heads into its first spring sales. Will the feverish buying that transformed the country into the world's leader return? China Daily's Michael Barris reports from New York.

| ||||

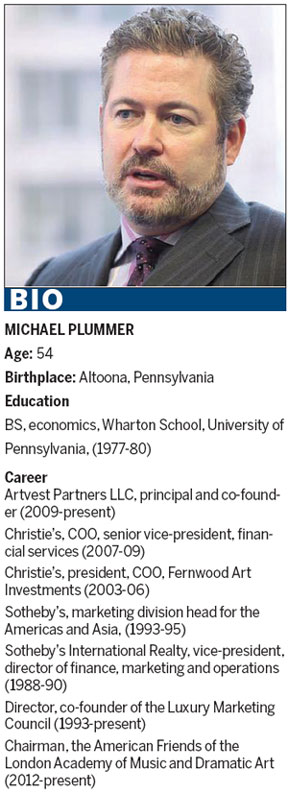

When China's prominence as a buyer in the world's art market slipped, Michael Plummer was watching from a front-row seat.

The co-founder of Artvest Partners, a New York art-market advisory firm, was at Sotheby's auction house in Hong Kong for last fall's first major art sale in China. On that October day, he saw a slowing market stumble badly after three years of feverish buying by Chinese collectors.

"The first auction sale (at Sotheby's) did well," Plummer said. "But then, that was followed by a sale where 50 percent of the lots didn't sell - something which hadn't happened since 2008. It was the first sign from Hong Kong that the market had changed."

Sales at the Chinese mainland's major auction houses - the hub for the vast majority of art sales in the country - plunged. By the end of 2012, full-year sales at Beijing Poly International Auction, the leading auction center, fell 49 percent from a year earlier, the Art Newspaper reported. At smaller rival China Guardian Auction, sales declined 54 percent, the paper said.

In Hong Kong, which fared better during the art-market downturn than the Chinese mainland, Sotheby's sales skidded 38 percent. Sales at Christie's fell 16 percent. New York-based Sotheby's and London-based Christie's aren't allowed to hold auctions in the mainland.

Whether China will make a comeback in the global art market may be determined by this spring's auctions at the Hong Kong offices of Sotheby's in April, and Christie's in May, Plummer said. "That would let us see if the market is changing," he said.

Until early 2012, the marketplace in China for art and antiques had been unusually exuberant. New buyers paid top prices for works from Ming vases to contemporary Chinese paintings, and led China in 2011 to end the United States' decades-long domination.

"The new collector base in China was buying recklessly, and I use that word intentionally - I mean recklessly," Plummer said. "They were buying things that had authenticity issues, that had damage. No serious collector would pay the money they were paying, but they were in this feverish acquisition mode. They were spending recklessly on all sorts of things - and not making careful judgments about quality and authenticity and provenance."

Market observers were concerned that the feverish buying "was a sign of an overheated marketplace, and would likely lead to a crash - possibly a catastrophic crash", Plummer said. Ultimately, the buying spree didn't produce a crash, but a correction that cooled an over-stimulated marketplace, he said.

The downturn created a "much more sober market", Plummer said. "A lot of observers think maybe the market has wised up. There's a maturity that's entering the marketplace."

Chinese buyers, Plummer said, "learn very quickly. They started to figure out themselves that in some way they are their own worst enemy, in their buying habits, in not being discerning enough and careful enough, and (in ) creating a false market".

Seeds of the plunge

China's new art buyers included car dealers, coal miners, manufacturers, and other people enriched by the country's transformation into the world's second-largest economy. A penchant for accumulating objects at a frantic clip highlighted a particular Chinese cultural trait: "Generally, in China, the extremely wealthy buy art more as a status thing than in the West, and to show off," said Eli Klein, owner of Eli Klein Fine Art, a New York gallery selling Chinese art. "It is more often in China a speculation and investment thing, and they are buying to flip it and make more money."

In her 2012 report for the European Fine Art Foundation that declared China the new global art-market king, art economist Clare McAndrew pointed out that newly wealthy Chinese see art as a safer, more lucrative investment than the turbulence-prone stock market or the government-restricted real-estate market.

Financial products in China, Plummer said, aren't as "evolved or trusted, and not as sophisticated as they are in the US. So, where the Chinese like to put their money is in real estate, art and in the businesses they own; also in jewelry and gems. There is an interest in tangible things. Objects - that's where you put your money."

As buyers in China acquired beautiful, expensive objects, the country's share of worldwide art sales rose to 30 percent in 2011 from 23 percent in 2010, according to McAndrew's report. China's growth pushed the US, at 29 percent, to second place. In 2011, the report said, China's surge lifted total worldwide sales of art and antiques 7 percent, a period characterized by a cautious buying climate in the rest of the world tied to the US financial and economic crisis.

According to art-market data firm Artprice, three of the world's 10 most expensive art works sold at auction in 2011 were by Chinese artists. The top seller was Eagle Standing on Pine Tree (1946) by Qi Baishi, which sold for 425.5 million yuan ($68.3 million) at China Guardian in May 2011.

At the boom's peak, the increasing number of wealthy collectors pouring millions into the art market fueled a rise in speculation, causing price swings and heavy trading volumes for artists of uncertain importance. Speculation ebbed after the downturn, Plummer said, as the projected value of works dropped.

"A lot of these speculators in China have found that when they go to sell things at auctions, the auction houses would tell them it's worth much less than what they paid for it," said Plummer, whose background includes developing an art fund as COO for Christie's Financial Services. "And once their collector base has that experience, they sober up pretty quickly - either stop buying, or buy more carefully in the future."

After the fall

As the marketplace digests the downturn, there is considerable interest in what the next phase will bring.

Francois Curiel, the head of Christie's in Asia, said in an e-mail to China Daily that "the market is now entering a period of consolidation, with strong but more sensible activity. The interests of Chinese collectors are also becoming more diverse". Noting that "Asian contemporary art is still going strong, but other more traditional areas, such as Chinese furniture or calligraphy, as well as ancient and modern Chinese pictures, are attracting a growing interest", Curiel finds "a new balance" among collectors that is "good news for the development of the market in the region".

Thomas Zhao, a New York-based overseas representative for auction house Beijing Poly, said he expects the art-auction market in China to remain resilient at least through 2015. That values have dropped less than volume reflects the strength that is still in the market, he said. In the months ahead, he said he expects to see new buyers go hard at the market, combining downturn-scarred veterans with neophytes who toyed with the idea of entering the fray before the correction. "In 2014 and 2015, those two kinds of people will combine to push the market up," Zhao said.

Charlotte Burns, art market and business editor covering Americas, for the Art Newspaper, says "growing pains" are part of the economic expansion underway in China. "So while the industry is expanding, there are questions about the reliability of the auction results, and speculative practices can hinder the growth of the market," she said. "These things happen in any emerging economy and especially in one that is so bullish and growing so quickly."

An issue that may affect auction prices is legislation that would allow artists to receive royalty payments when their work is resold at auction. The droit de suite (artists' resale right) clause is in the draft of a new copyright law to be submitted to China's State Council, the country's cabinet.

The resale right would apply to original works of fine art and photography, as well as literary and musical manuscripts, according to the draft.

While auctions highlight art's market value, some artists choose to remain on the sidelines during discussions about the market's prospects. A case in point is Wei Dong, a Chinese artist who often sells his work through Eli Klein Fine Art.

Wei studied art in Beijing and immigrated to the US in 2001; he lives and works in Manhattan and Beijing.

Asked what the changes in the Chinese art market mean to him, Wei said: "I do not really pay much attention to it. Or it does not really impact me much. I paint because I love it. Whether the trend is up or down has little influence on me."

Contact the writer at michaelbarris@chinadailyusa.com

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|