China is now No 1 in trade

Updated: 2014-01-13 11:18

By Li Jiabao in Beijing and Amy He in New York (China Daily USA)

|

||||||||

China overtook the United States last year to become the world's largest trading country in goods for the first time, according to figures released by China's customs administration on Friday.

Combined annual exports and imports in China amounted to $4.16 trillion, said Zheng Yuesheng, spokesperson for the General Administration of Customs.

China's imports last year stood at $1.95 trillion, an increase of 7.3 percent from the previous year, and exports reached $2.21 trillion, a rise of 7.9 percent. This left the country with a trade surplus of $259.75 billion, the customs administration said.

The country's trade with the European Union rose by 2.1 percent year-on-year to $559.06 billion, while trade with the US increased by 7.5 percent to $521 billion.

However, trade with Japan fell by 5.1 percent to $312.55 billion amid prolonged tensions between Beijing and Tokyo.

China missed its trade growth target for the second year, with year-on-year growth of 7.6 percent in 2013, lower than its annual target of 8 percent. In 2012, its trade growth was 6.2 percent, a marked contrast to the annual target of 10 percent.

From January to October last year, the value of China's trade in goods was $192 billion higher than the United States', with China's growth rate outpacing that of the US by 7 percentage points.

Judging by the fact that US trade growth was less than 1 percent from January to November, Zheng said China surely surpassed the US to be the leading world trading nation in 2013.

In a joint research paper, Yang Weixiao and Sheng Xu, two senior analysts from Lianxun Securities, said China stands a good chance of doing better in global trade this year thanks to the recovery in developed economies led by the US.

Qi Jingmei, a senior researcher at the State Information Center, said goods trade in 2013 "by and large" fulfilled the government's goal and didn't drag down China's overall economic growth.

Zheng said the leadership's pledge on reform and opening-up, its development plan for the Shanghai Free Trade Zone and its commitment to foreign investment will provide great impetus to the country's foreign trade in 2014.

"Global commodity prices are expected to remain restrained following the US tapering off of monetary stimulus. This will lower costs for Chinese importers and enhance their competitiveness," Zheng said.

But he said China's exporters face challenges from rising costs, including increased labor costs and appreciation of the yuan, as well as fierce competition from neighboring countries.

"China will continue with economic restructuring, especially on overcapacity, which will restrain fast growth in domestic demand," Zheng said.

Ann Lee, professor of economics and finance at New York University, said, "It doesn't surprise me given that that was China's orientation and the fact that China's economy has been growing so rapidly compared to the developed world. The US economy has largely been based on its service economy, so you don't really export services."

Lee said that trade in the coming year will most likely increase despite China's growth slowdown, which said is tied to developed countries' "prolonged lackluster economy."

In December, China's goods exports grew by only 4.3 percent from a year earlier, lower than the 12.7 percent in November, as the foreign exchange regulator stepped up scrutiny of trade financing to stop banks from financing companies with fabricated trade.

Overstating export invoices was viewed as a way to disguise the inflow of speculative funds, which inflated trade figures earlier last year and led to the regulatory crackdown in May.

Goods imports in December increased by 8.3 percent year-on-year, the strongest in five months, suggesting firm domestic demand despite weak industrial production.

Imports of crude oil, soybeans and natural rubber in December rose to a record volume in China, the world's leading buyer of the commodities, while iron ore imports last year also hit a record.

Contact the writers at lijiabao@chinadaily.com.cn and amyhe@chinadailyusa.com

(China Daily USA 01/13/2014 page1)

Cristiano Ronaldo wins FIFA best player award

Cristiano Ronaldo wins FIFA best player award

Xuelong carries on mission after breaking from floes

Xuelong carries on mission after breaking from floes

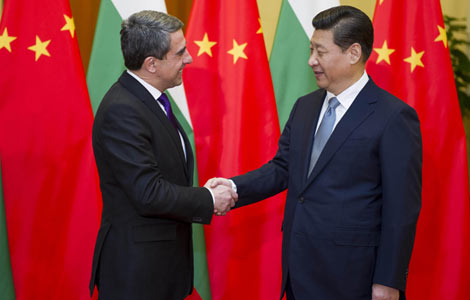

Beijing and Sofia vow new initiatives

Beijing and Sofia vow new initiatives

71st Golden Globe Awards

71st Golden Globe Awards

Bangkok unrest hurts major projects and tourism industry

Bangkok unrest hurts major projects and tourism industry

No pant for cold subway ride

No pant for cold subway ride

Tough army training turns boys into men

Tough army training turns boys into men

Blaze prompts concern for ancient buildings

Blaze prompts concern for ancient buildings

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Jackson's family bid for new trial denied

Newspapers must change or die

Abe’s brother to explain shrine visit to US

Protests cannot end Thai deadlock: observers

Mercy killing still a hot button issue

China builds army 'with peace in mind'

UN plea made on war victims

Li: China's tech innovation a priority

US Weekly

|

|