Panyu has its work cut out to maintain shine

Updated: 2014-11-27 06:47

By Xu Jingxi(China Daily USA)

|

||||||||

Diamond district in Guangdong reels from the impact of rising costs, reports Xu Jingxi in Guangzhou

Transformation and upgrading are the buzzwords in the jewelry industry in Guangzhou's Panyu district, a key center of China's diamond industry, as exports falter and costs rise.

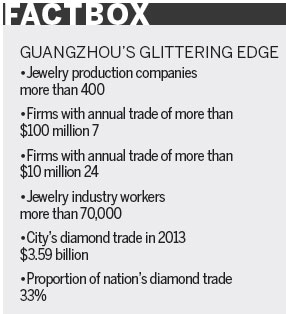

Panyu's jewelry exports surged from $2.53 billion in 2011 to $4.13 billion in 2013, according to customs data provided by the district's economic and trade promotion bureau - a growth rate of almost 28 percent a year.

|

Workers examine polished diamonds at Guangzhou Evergreen Diamond Co Ltd in Panyu, Guangdong province. Guangzhou recorded diamond trade transactions of $3.59 billion in 2013, one-third of the country's total. Chen Jimin / For China Daily |

But growth slowed to a crawl during the first three quarters of this year. Exports expanded just 5 percent to 19.8 billion yuan ($3.23 billion).

The diamond-cutting industry, a major business in Panyu, has seen orders slump. The outbreak of Ebola in some countries in western Africa, a big source of rough diamonds, forced governments there to tighten border controls or even close their borders. That choked off much of the rough diamond supply and drove up prices, which had been rising in recent years.

"Our orders this year are down 40 percent to 50 percent from the usual levels," said Yuan Zhonglin, a manager at Guangzhou Evergreen Diamond Co Ltd.

The Hong Kong-invested enterprise usually processes about 600,000 carats of raw diamonds a year, with an export value of $130 million, or one-third of the export value of Panyu's entire non-industrial diamond shipments.

"The price of rough diamonds keeps increasing but the price of polished diamonds does not, so our margins are being squeezed. And we also get fewer orders," Yuan said.

The company has nonetheless managed to maintain its output value by changing the kind of work it does, according to Li Minyi, secretary to president of Guangzhou Evergreen.

"We've gradually increased the share of big diamonds in our business because they provide higher added value than small diamonds. The share of big diamonds has risen from 40 to 50 percent to 60 to 70 percent.

"If we hadn't looked ahead and made that change, our output value this year would have been affected," she added.

Diamond-cutting companies in Qingdao, Shandong province, are struggling to survive because their orders have fallen by half and they have maintained their focus on small stones, Li said.

Guangdong, Shandong and Zhejiang provinces are China's major diamond-cutting centers. The nation is the world's second-largest diamond processor after India. Guangdong alone accounts for 70 percent of the country's diamond-processing activity.

Guangdong's diamond industry grew as companies relocated from neighboring Hong Kong starting in the late 1970s, when the reform and opening-up began. At least 95 percent of Hong Kong-based jewelry brands' products are made in Panyu.

Guangdong province now has a complete industry chain encompassing design, processing and logistics.

Guangzhou, the provincial capital, recorded diamond trade transactions of $3.59 billion in 2013, one-third of the country's total. Panyu, a district in the city, contributed 60 percent of that figure.

The province announced plans on Nov 11 to build the Guangzhou Diamond Trading Center. It will also seek approval from the central government to establish a diamond exchange, the country's second after the Shanghai Diamond Exchange, according to Guangzhou Mayor Chen Jianhua.

To address rising labor costs in the Pearl River Delta, Li's company has cut its workforce in half to 1,000 people through the use of advanced equipment. For example, it bought a diamond-cutting machine worth 6 million yuan in 2010.

Yuan said that workers can earn 4,000 yuan to 5,000 yuan a month but it is still difficult to recruit sufficient staff.

The statutory monthly minimum wage in Panyu surged from 770 yuan in 2008 to 1,550 yuan in 2013. But the fees clients pay to have diamond cut and processed "have remained almost the same in the past 10 years", said Li.

Diamond-cutting also demands workers with more education and technical training than many other industries. Yuan said that the company requires at least a high school degree, and it takes one year for a worker to become proficient.

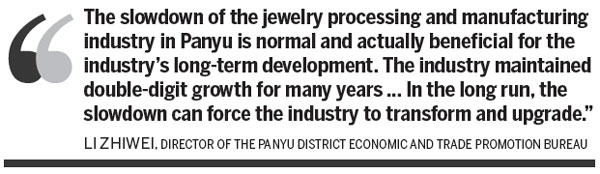

The slowdown of the jewelry processing and manufacturing industry in Panyu is "normal and actually beneficial for the industry's long-term development", said Li Zhiwei, director of the district's economic and trade promotion bureau.

"The industry maintained double-digit growth for many years. It's only normal that growth would slow," he said. "In the long run, the slowdown can force the industry to transform and upgrade."

Customization as opposed to mass production is the way to go, added Li Zhiwei, because more people are buying jewelry as an investment. And of course, there is e-commerce.

"E-commerce can reduce costs. We can ship products from factories directly to consumers, so our prices can be more competitive," he said. Some jewelry companies in Panyu have already opened stores on e-commerce platform Tmall, a B2C platform run by Alibaba Group Holding Ltd.

Shawan Jewelry Industrial Park in Panyu has launched Worldmart*E, an e-commerce platform that provides services including bonded warehouses, import and export customs clearance, logistics and insurance.

As China has become the world's third-largest jewelry consumer, after the United States and Japan, jewelry companies in Panyu will further expand into the domestic market, Li Zhiwei said.

The annual Guangzhou Panyu Jewelry Cultural Festival, which runs this year from Nov 29 to Dec 3, will be a great opportunity to "build Panyu as a jewelry brand featuring its workers' great skills and high quality" and make its products better-known among ordinary consumers.

Contact the writer at xujingxi@chinadaily.com.cn

(China Daily USA 11/27/2014 page13)

The plight of pregnant women in rural China

The plight of pregnant women in rural China

Rescue dogs show skills in NW China

Rescue dogs show skills in NW China

Top 10 largest hotel chains in China

Top 10 largest hotel chains in China

10 'mosts' about foreigners in China

10 'mosts' about foreigners in China

DreamWorks-themed ice sculpture festival kicks off in Macao

DreamWorks-themed ice sculpture festival kicks off in Macao

Folk art shines at East China fair

Folk art shines at East China fair

Goodbye, my brothers!

Goodbye, my brothers!

9 global hubs for renminbi trading

9 global hubs for renminbi trading

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Microsoft reported to be facing $137 million bill for back taxes

Partnership with private firms fuels China's growth

BMO Global Asset Management Launches ETFs in Hong Kong

BlueFocus aims to acquire Canadian company

Anti-corruption move gains traction

Maryland's new first lady thankful

Amazon answers China's 'Double 11' with Black Friday

Tencent-HBO deal can feed big appetite for content in China

US Weekly

|

|