A healthy bourse needed to drive long-term growth

Updated: 2016-06-15 14:08

By

Zhu Qiwen

(chinadaily.com.cn)

|

||||||||

|

|

A man checks share prices on his mobile phone while waiting for his coffee at a Starbucks branch in Beijing July 16, 2015.[Photo/Agencies] |

For Chinese investors who have been expecting introduction of more international institutional investors to boost the domestic stock market, it is disappointing that Morgan Stanley Capital International has again delayed adding Chinese shares to its benchmark emerging markets index.

One year after last summer's the stock crash, Chinese shares are still struggling to have a solid foothold. But the poor performance of the Chinese stock market should not be made an excuse to deny its long-term significance to both the Chinese economy and investors at home and abroad.

In retrospect, it seems wise for Morgan Stanley to have deferred inclusion of Chinese A-shares in one of its key indices last June just as the benchmark Shanghai Composite Index peaked at 5,178.19. With the Shanghai index still struggling below 3,000 nowadays, an early Morgan Stanley nod would have done little to China's integration into the global market by prematurely exposing global investors to the tumult of China's stock market.

Yet a move to make Chinese stocks a bigger part of the global portfolio is inevitable.

Morgan Stanley's decision to delay the inclusion of Chinese shares in a key index tracked by international institutional investors who may inject tens of billions of dollars into the world's second-largest stock market should therefore not be interpreted as a vote of no confidence. Instead, it should be deemed as an urgent call for greater efforts to repair and revive the Chinese stock market.

A well-functioning stock market is needed more than ever to help revitalize domestic private investment, a key growth engine for consumer-oriented innovation and service.

As growth of private investment in this country drastically slowed to 3.9 percent in the January-May period from an already weak 5.2 percent in the first four months, policymakers should reconsider developing a healthy stock market that can effectively raise funds for future innovators.

- $45.5b pension funds set to play stock market in Aug

- China's stock market value rises amid improving sentiment

- More fluctuation in the stock market expected

- China's pension fund to flow into stock market this year

- Stock market investors' risk appetite to grow

- Hopes rise high for stock market rally till April-end

- China has more than 100 million stock market investors

- Stabilizing stock market requires policy review

- Orlando massacre sparks gun-control bill

- Cambridge students celebrate end of exams with cardboard boat race

- Pensions for elderly threatened if Brexit wins, warns British PM

- Park calls for national unity on peninsula's denuclearization

- 232 Indian cadets take part in parade in Bhopal

- UK's Cameron warns health services, pensions could face cuts post-Brexit

Rio Olympics unveils medals

Rio Olympics unveils medals

New photos capture life in China

New photos capture life in China

Fair ladies at Royal Ascot

Fair ladies at Royal Ascot

Never too old to learn; Nepal's 68-year-old student

Never too old to learn; Nepal's 68-year-old student

Tourists visit beer museum in E China's Qingdao

Tourists visit beer museum in E China's Qingdao

Turning straw to gold: folk artist's straw pyrography

Turning straw to gold: folk artist's straw pyrography

People in shock after Florida nightclub shooting

People in shock after Florida nightclub shooting

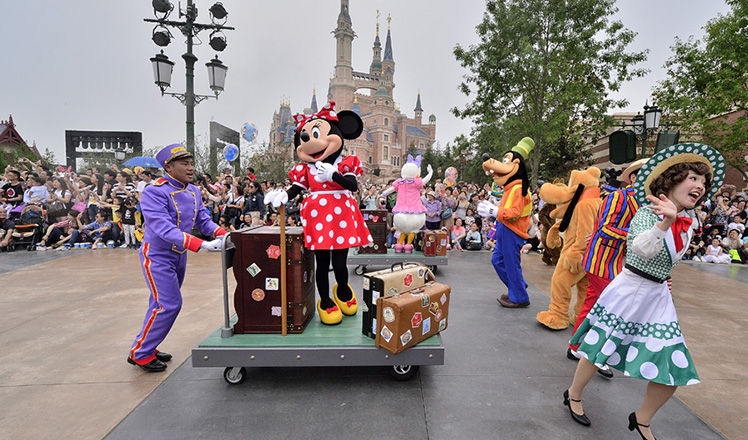

Shanghai Disneyland all set for official opening on Thursday

Shanghai Disneyland all set for official opening on Thursday

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

US Weekly

|

|