Bolder yuan seen for LatAm

Updated: 2016-10-11 11:26

By Mao Pengfei and Pau Ramirez in Mexico Cityfor China Daily(China Daily USA)

|

||||||||

Now that the yuan is included in a key currency grouping, its globalization can be a boon to Latin America by enabling expanded credit options for easier trade with China, according to Latin American analysts.

The inclusion of the Chinese yuan, or renminbi (RMB), in the International Monetary Fund's (IMF) Special Drawing Rights (SDR) currency basket as of Oct 1 is a crucial step for it to become a global currency.

The yuan has taken its place alongside the world's four other major reserve currencies: the dollar, euro, British pound and Japanese yen. The yuan is the only currency from a developing nation in the SDR.

Jorge Castro, president of the Institute of Strategic Planning (IPE) in Buenos Aires, said that the yuan's new place will help to create a more multipolar economic order.

"The permanent inclusion of the yuan in the IMF's basket of currencies is a step of extraordinary importance for the yuan's conversion into a global currency," he said. "This accelerates its process of internationalization, and all signs indicate it will become a global currency in the next five or six years," he explained.

"Trading in our times is headed up by China, which will accompany the growing use of the yuan in international trade, alongside other international currencies," continued Castro.

"In 1990, the US GDP was around 22 percent of the global total; this is now under 15 percent. China has become the second-largest global economy ... making the two crucial global currencies the US dollar on one side and the Chinese yuan on the other," said the expert.

Castro was keen to point out that the IMF's decision will impact Argentina as "China is Argentina's main foreign investor. Furthermore, China accounts for over two-thirds of the country's agricultural exports."

With the yuan now serving as a global currency accepted in international transactions, Latin America's trade ties with China can benefit from increased lines of financing, especially for developing countries with little access to international credit markets.

While Beijing considers the yuan's rise to reserve status as "recognition of China's economic development, reforms and opening up", for Latin America it stands to have a positive impact on trade.

The move bolsters Latin American central banks' beefing up their foreign reserves with yuan and transforms them into accessible sources of financing for companies that want to do business with China.

In September, the yuan was the world's fifth most used currency for global payments (after the dollar, euro, pound and yen), according to the global transaction service SWIFT.

Despite being a region with substantial trade flows with China, Latin America still carries out few transactions in yuan, though several regional countries have said they intend to de-emphasize the dollar,

including Brazil, a member of the BRICS bloc of emerging economies, along with Russia, India, China and South Africa.

"BRICS members want to step up trade in national currencies to cut back their reliance on the United States, and that can lower costs. If the yuan is available to Brazilian exporters, it would be an advantage," said Alexandre Contijo, an analyst at the Brazil-China Business Council.

In addition to the yuan's admission into the exclusive club of reserve currencies, China launched the Cross-border Inter-bank Payment System (CIPS) in October 2015, and the two measures together will likely increase the use of the yuan in Latin America's trade flows.

Brazilian analyst Larissa Wachholz, of consulting firm Vallya, said the CIPS, backed by the yuan's new reserve currency status, can serve to promote the use of the renminbi in investment financing.

"There is a movement in China to move things in that direction. Chinese banks have consolidated their presence in Latin America. Entities such as the ICBC (Industrial and Commercial Bank of China) or the China Development Bank have the capacity to finance Chinese investment in Latin America, and now, if they are interested, they can do it in yuan. Though it remains to be seen how these banks are going to implement that," Wachlolz said.

The new flow of yuan could have the "most immediate" impact on countries such as Venezuela, which are undergoing economic hardship but have little access to international credit markets, she said.

The South American country could benefit from Chinese financing in yuan, which it could then use to pay for imports from that country, said Wachholz.

On Tuesday, Venezuelan President Nicolas Maduro said talks with China to that effect were "advancing".

The effect of the yuan's new status in other areas remains uncertain, Wachholz said.

To promote the use of an "IMF money" system and boost the yuan in the process, China's government on Sept 1 issued an SDR-denominated bond in its interbank market.

SDR was created by the IMF in the 1960s as a "supplementary international reserve asset", whose value is today based on the five reserve currencies. SDR bonds have been tried before, in the 1980s, with little success.

World's top 10 most valuable unicorn companies

World's top 10 most valuable unicorn companies

Carver finds fame, money in wood sculptures

Carver finds fame, money in wood sculptures

Missile destroyer to become local military-themed park

Missile destroyer to become local military-themed park

The world in photos: Sept 26 - Oct 9

The world in photos: Sept 26 - Oct 9

Classic cars glitter at Berlin motor show

Classic cars glitter at Berlin motor show

Autumn colors in China

Autumn colors in China

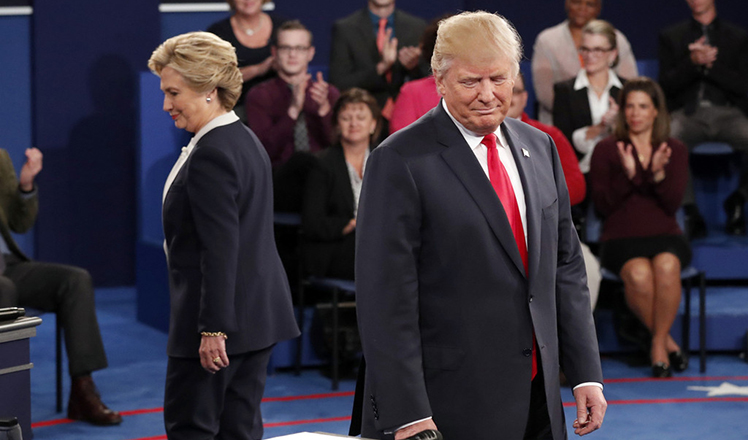

US second presidential debate begins

US second presidential debate begins

Egrets Seen in East China's Jiangsu

Egrets Seen in East China's Jiangsu

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|