Building lasting relationships

Updated: 2011-12-09 08:21

By Tuo Yannan (China Daily)

|

|||||||||

|

Gree employees work at the assembly line of a plant established in Brazil. Gree, in 1998, was among the first Chinese companies to enter Brazil. [Photo/Xinhua] |

Chinese companies, such as Gree Electric Appliances, make sizable inroads in Brazilian markets

Eric Zhang has a problem that most business people would give a limb for: he can't fill the orders fast enough.

Zhang is the general manager in Brazil for China's largest air conditioner maker, Gree Electric Appliances Inc of Zhuhai.

He says that despite the high price tag, the company's products are popular with Brazilians, especially the well-off. The soccer legend Pele is said to be among its customers.

Gree was among a clutch of Chinese companies that entered Brazil in 1998. What makes the country particularly compelling in a business plan for an air conditioning company is that when it is summer in Brazil it is winter in China and vice versa.

The company is ranked fourth in Brazil and sold 400,000 air conditioners there last year. The aim is to double the number even with stiff competition from other international brands such as LG Electronics of South Korea.

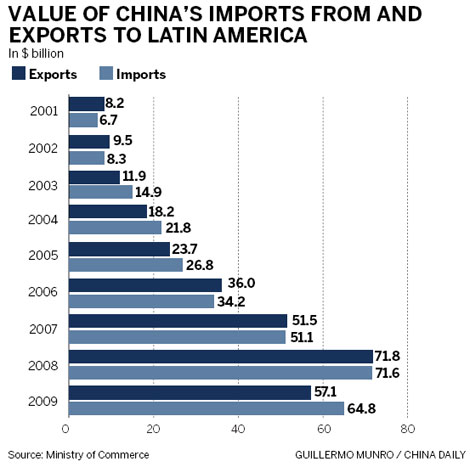

Gree's growth epitomizes how Chinese companies have made considerable inroads in Brazil and the overall growth in bilateral trade.

Brazil, the most distant country for China among other BRICS (Brazil, Russia, India, China and South Africa) nations, has emerged as the closest to China economically.

China has been Brazil's largest trade partner since 2009, a position previously held by the United States, as a result of huge exports in the energy and agricultural goods sectors. China's investment in Brazil was less than $300 million (220 million euros) in 2009, but increased to $17 billion last year, making it the largest foreign investor in Brazil.

As the two economies are complementary, growth in bilateral trade will continue to be in double digits, and the figure for this year is likely to be $70 billion, says Brazil's Ambassador to China, Clodoaldo Hugueney.

When Brazilian President Dilma Rousseff visited China in April, she said Brazil wanted to diversify trade and investment ties beyond raw materials to include more value-added goods.

Marcos Almeida, a partner at Ernst & Young Terco, says foreign direct investment in energy and mining will continue to rise because the Brazilian government is increasingly sensitive to foreign investors buying agricultural land.

Brazil's Ministry of Development, Industry and Foreign Trade says raw products, including ore, coffee beans and soybeans, accounted for 44 percent of the country's exports last year.

A deal between China Petrochemical Corporation (Sinopec Group) and the oil company Repsol SA was the biggest foreign direct investment deal in Brazil. The Chinese company bought 40 percent of the Brazilian business of the Spanish oil giant Repsol for $7.1 billion. Sinopec has also been in charge of a natural gas project named Gasene in Brazil since 2004.

Iron ore is another big investment target for Chinese companies. Vale SA, the Rio de Janeiro-based miner, is the world's biggest producer of iron ore and one of Brazil's largest companies. "If it were not for Vale's exports, the Latin American country would have run a trade deficit last year rather than its $20.3 billion surplus," according to a Financial Times report.

In the first quarter of this year, China accounted for about 29.7 percent of Vale's revenues - more than half of the company's revenue in Asia. In 2004, Vale signed a contract with Sinosteel Corp of China to supply 600,000 tons of iron ore pellets every year from 2005-2011 at $32.76 a ton.

However, Brazil is seeking to diversify the categories of imports and investment, Hugueney says.

He says China should diversify its imports from Brazil, by buying more high-tech goods, such as aircraft, automotive and mechanical equipment, high-end manufacturing goods such as luxury shoes, and agricultural products such as beef and pork, rather than merely the soybeans, iron ore and oil that have been the staple Chinese imports from Brazil.

The ambassador's remarks echo the words of China's Minister of Commerce Chen Deming during a visit to Brazil in May.

"China is willing to promote the diversification of Brazilian exports to China and to add more value to Brazilian exports," he says.

An estimated 84 percent of China's imports from Brazil are raw materials and agricultural goods, including iron ore and soybeans. The huge Chinese demand for the commodities drove an 18-fold increase in Brazil's exports to China from 2000-2009.

That is not to say there have not been problems. There has been an increase in the number of trade complaints Brazil has filed against China, and of the 144 anti-dumping investigations Brazil opened last year, nearly 50 were against China.

"Brazil is seeking more Chinese investment in the manufacturing sector to avoid trade conflicts between the two nations," Hugueney says.

More and more Chinese manufacturing companies are now setting up their offices in Brazil, many of them technology companies.

But in recent years, the Brazilian government has imposed stricter regulations on foreign investors buying agricultural land. It has called for joint ventures in this sector rather than foreign direct investment.

Alessandro Teixeira, deputy minister in Brazil's Ministry of Development, Industry and Foreign Trade, says some Chinese companies are cooperating with Brazilian partners with agricultural products such as soybean oil. "That's the kind of partnership that China and Brazil are looking for."

Brazil accounts for more than 40 percent of the Latin American economy. Teixeira predicted that the percentage will increase to 50 percent in the next 10 years, and Brazil's economic role in Latin America will be even more significant.

Chinese companies, such as the telecom equipment makers ZTE Corp and Huawei Technologies Co, have invested heavily in Brazil in recent years.

ZTE has set up an industrial park in Hortolandia, close to Sao Paulo. The company's Brazilian operations recorded $600 million in sales revenue last year, and the figure is expected to reach $1 billion this year. Products from the industrial park will be shipped to other Latin American countries.

"The Brazilian market accounts for about 9 percent of ZTE's overseas revenue. The country is crucial for our company's development in Latin America," says Yuan Lie, president of ZTE South America Region.