Who will get rich from Twitter's IPO?

Updated: 2013-11-08 10:03

(Agencies)

|

|||||||||

SAN FRANCISCO - Just about everyone in Silicon Valley has dreamed of striking it rich with a well-timed investment. Here is a list of the number and value, based on the closing price of $44.90, of the shares owned by some of the people and investment firms that have benefited the most from Twitter's initial public offering on Thursday. At the market close, Twitter's valuation was $24.47 billion.

Executive officers and directors:

Evan Williams - 56,909,847 shares, or 12 percent, worth $2.56 billion. Williams was Twitter's chief executive until 2010, when current CEO Dick Costolo took the helm. He is working on a publishing platform, Medium, which is dedicated to long-form content.

Benchmark - 31,568,740 shares, or 6.7 percent, worth $1.42 billion. Venture firm Benchmark started investing in Twitter in 2009 when it was valued in the $200 million-$250 million range. This stake includes shares owned by partner Peter Fenton, who led the firm's investment in consumer-Internet play Yelp, holds a board seat at Twitter.

Jack Dorsey - 23,453,017 shares, or 4.9 percent, worth $1.05 billion. Dorsey co-founded Twitter and still serves as its chairman. In 2009, he founded payments service Square and serves as its CEO.

Dick Costolo - 7,675,239 shares, or 1.6 percent, worth $344.6 million. A onetime improvisational comedian, Costolo took the helm of Twitter in 2010. He joined Twitter as chief operating officer the year before, after he and co-founders sold their Web feed management provider FeedBurner to Google Inc

Adam Bain - 1,785,818 shares, or less than 1 percent, worth $80.2 million. Bain is the president of global revenue at Twitter. He was formerly the president of audience network at News Corp's Fox Interactive Media.

David Rosenblatt - 291,666 shares, or less than 1 percent, worth $13.1 million. Rosenblatt is CEO of luxury online retailer 1stdibs.com and is a member of Twitter's board of directors.

The following groups own at least 5 percent:

Rizvi Traverse Management - 85,171,093 shares, or 17.9 percent, worth $3.82 billion. A closely held private-equity fund based in Michigan, Rizvi has made a name for itself by buying stakes in entertainment companies such as Playboy and movie producer Summit Entertainment. Last year, it led a $200 million funding round in Jack Dorsey's payments company, Square. This stake includes shares over which JP Morgan has dispositive power.

Spark Capital - 32,414,224 shares, or 6.8 percent, worth $1.46 billion. Venture firm Spark started investing in Twitter in 2008. For a time, Spark partner Bijan Sabet served on Twitter's board.

Union Square Ventures - 27,838,992 shares, or 5.9 percent, worth $1.25 billion. Venture firm Union Square started investing in Twitter in 2008. For a time, USV partner Fred Wilson served on Twitter's board.

DST Global - 23,744,745 shares, or 5 percent, worth $1.07 billion. The investment firm founded by Russian billionaire Yuri Milner led a $400 million investment in Twitter in 2011. At the time, Twitter was valued at around $8 billion.

Kerry to join Iran nuclear talks in bid to reach deal

Kerry to join Iran nuclear talks in bid to reach deal

Politicians court US-Asians amid anti-China sentiment

Politicians court US-Asians amid anti-China sentiment

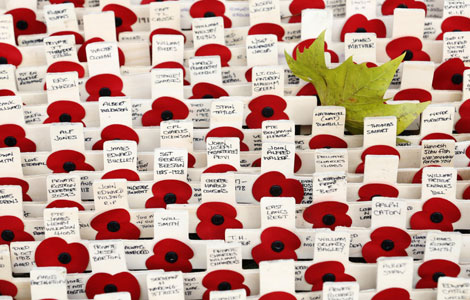

Britain remembers war dead

Britain remembers war dead

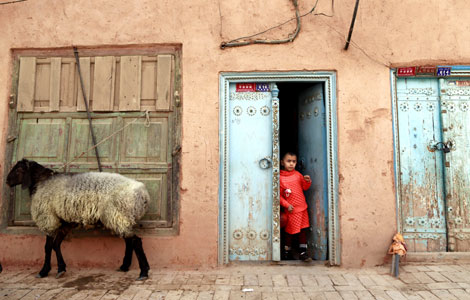

Stolen newborn returned to family

Stolen newborn returned to family

TCM firms should 'learn rules of West'

TCM firms should 'learn rules of West'

Artists see big picture in CBD's art zone

Artists see big picture in CBD's art zone

Twitter shares soar 92% in frenzied NYSE debut

Twitter shares soar 92% in frenzied NYSE debut

Fly with the Jetman

Fly with the Jetman

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China should allow for higher inflation: economist

CIA paying AT&T to provide call records - NYT

Li vows growth, reform balance

Sister cities step up business

Bank exec describes meeting with Li Keqiang

Russian meteor studied for clues to next one

Twitter soar 92% in NYSE debut

Overseas Chinese chase opportunities at home

US Weekly

|

|