High stakes for US families losing jobless benefit

Updated: 2013-12-29 02:18

(Agencies)

|

||||||||

The end of unemployment checks for more than a million people on Saturday is driving out-of-work Americans to consider selling cars, moving and taking minimum wage work after already slashing household budgets and pawning personal possessions to make ends meet.

Related StoriesGreg and Barbara Chastain of Huntington Beach, Calif., put their two teenagers on the school lunch program and cut back on dining out after losing their T-shirt company in June following a dispute with an investor. They've exhausted their state unemployment benefits and now that the federal extensions are gone, unless they find jobs the couple plans take their children out of their high school in January and relocate 50 miles east where a relative owns property so they can save on rent

"We could let one of our cars go, but then you can't get to work — it's a never-ending cycle," 43-year-old Greg Chastain said while accompanying his wife to an Orange County employment center. He said they eventually may try their luck in a less expensive state like Arizona or Texas if he can land a manufacturing job there.

The end to the five-year program that extended benefits for the long-term jobless affected 1.3 million people immediately and will affect hundreds of thousands more who remain jobless in the months ahead. Under the program, the federal government provided an average monthly stipend of $1,166.

While the Obama administration and Democrats in Congress want to continue the program, the extensions were dropped from a budget deal struck earlier this month and Republican lawmakers have balked at its $26 billion annual cost.

The end of the program may prompt a drop in the nation's unemployment rate, but not necessarily for a good reason. People out of work are required to look for work to receive unemployment benefits. As benefits disappear, some jobless will stop looking for work out of frustration and will no longer be counted as unemployed.

The trend has already emerged in North Carolina, which started cutting off extended benefits in July. The state's unemployment rate went down — from 8.8 percent in June to 7.4 percent in November— even though the number of North Carolinians who said they had jobs rose only slightly in that time.

The North Carolina evidence is consistent with the theory that ending benefits will cause some unemployed to drop out of the workforce, said Michael Feroli, an economist at JP Morgan Chase.

That's what Fed chairman Ben Bernanke meant when he said this month that the end of extended benefits "will bring the unemployment rate down, but for ... the wrong reason."

Some unemployed people said the loss of benefits might drive them to take minimum wage jobs to get by until they can find work at their skill level and in their field.

Richard Mattos, 59, of Salem, Ore., has been out of work since March, when he was laid off as a case manager at a social services organization. Without the unemployment income, Mattos said he and his wife will have enough money for one month's worth of bills. Almost every day, he visits employment centers run by the state of Oregon or Goodwill Industries International.

"I don't know what we're going to do," he said. "We could end up homeless because of this."

Since 2008, the federal program paid out benefits to the unemployed after their 26 weeks of state benefits ran out. At its peak, the program offered up to 73 weeks of federal benefits — which are typically offered during periods of high unemployment — to the long-term jobless.

James Sherk, a labor policy analyst at the conservative Heritage Foundation, said ending the extensions could induce workers to take jobs they might have overlooked initially. Extended unemployment benefits can give workers "a false sense of how much time they have before they have to start broadening their net to less than ideal positions," he said, adding that the labor market, while not ideal, is stronger and continues to improve.

In November, the country's unemployment rate fell to a five-year low of 7 percent, but is still above the 5 percent to 6 percent rate that would signal a normal job market. And long-term unemployment remains a problem for the economy as nearly 4.1 million Americans have been out of work for six months or more.

Deborah Barrett, a 57-year-old resident of Newport, R.I., is one of them. She was laid off from her management job in accounting in February and has sent out hundreds of resumes since. She said doesn't know how she'll get by without the federal assistance.

"It's petrifying," she said. "Unfortunately, I don't believe my story is very unique."

Laura Garay, 57, pawned her jewelry, withdrew retirement funds and relied on support from friends after losing her paralegal job in May, the same month she was diagnosed with lymphoma.

Her monthly $1,700 in unemployment covers her house payment in Westminster and the cost of maintaining her health insurance to cover a barrage of exams and radiation therapy.

Garay said her illness set back her job search, but as long as she's healthy, she'll work at just about anything to get back on her feet and avoid being jobless for too long.

"You don't find a job in two weeks, you don't find a job in three weeks," she said. "You find a job after months of searching."

F1 legend Schumacher in coma after ski accident

F1 legend Schumacher in coma after ski accident

Net result

Net result

Fire on express train in India kills at least 26

Fire on express train in India kills at least 26

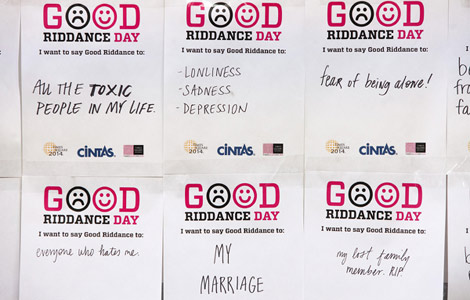

Times Square visitors purge bad memories

Times Square visitors purge bad memories

Ice storm leaves many without power in US, Canada

Ice storm leaves many without power in US, Canada

'Chunyun' train tickets up for sale

'Chunyun' train tickets up for sale

Abe's war shrine visit sparks protest

Abe's war shrine visit sparks protest

LeBron James is AP's Male Athlete of the Year

LeBron James is AP's Male Athlete of the Year

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

German magazine reveals NSA hacking tactics

Auto industry rolls through ’13 for China, US

Outrage still festers over Abe shrine visit

Suicide bomber kills 16 at Russian train station

Li says economy stable in 2014

Bigger role considered in the Arctic

3rd high-level official probed

Abe stepping up military agenda

US Weekly

|

|