BRICS' good story continues

Updated: 2014-07-14 07:05

By Zhang Jun (China Daily Latin America)

|

||||||||

The five countries of Brazil, Russia, India, China and South Africa were named "BRICS" by Jim O'Neil, the former chief economist at Goldman Sachs as an investment concept to optimize portfolios toward a group of fast-growing emerging economies. At the time, few imagined that this simple combination of five letters would have had such influence over the global economic conversation of the past decade. The BRICS countries not only rewarded investors with strong profits, but also symbolized the new force driving global economic growth, particularly during the darkest period of the international financial crisis.

Recently, however, the luster has faded with BRICS countries experiencing large capital outflows, excessively volatile exchange rates, the pressure of spiking inflation, and increasing social instability. International institutions such as the IMF and OECD, through their models, indicators, numbers and figures, have changed their tone and begun to paint a gloomy picture of BRICS for the months and years to come. Because of that, the BRICS phenomenon today is perceived by many investors as a page that needs to be turned.

If we only take these indicators into account, there is no reason to believe that the BRICS' amazingly successful story will continue. However, if we take a step back and look at the bigger picture, we may see something different.

First, there is no doubt that the BRICS countries are experiencing some challenges, but most of them have become apparent only very recently. If we look at the BRICS economic footprint over a longer period and with a dynamic view, we find that the general growth trajectory has not been reversed. According to the latest data from the IMF, during the past two decades, the BRICS countries' collective share of the global economy has increased from 5.6 percent to 21.3 percent, and this number has kept growing even during the current tough times. Some experts also point out that over the past 20 years private consumption, investment and trade in BRICS countries has nearly doubled. Therefore, it is hasty and misleading to declare the demise of BRICS using the data of the past several months rather than looking at performance over the past two decades. Investors who fled the BRICS markets are those who only seek short-term returns. Those who see greater rewards over the longer term have largely stayed in the game.

Second, the success of BRICS is not an accident of demographics or history. In fact, Goldman Sachs' O'Neil summarized the elements of BRICS success: rising productivity, relatively low labor costs, huge domestic and overseas demand, country-specific preferential policies that encourage foreign investment and technical aid, and better practices in macro-economic and social management.

While it is true that some of these elements are gradually losing their cutting edge, most of them remain largely unchanged. The fundamentals of BRICS comparative advantages remain strong.

Third, the greatest potential for future growth is concentrated in BRICS countries.

Last but most important, BRICS are in command of their own destinies. The greatest difference between the BRICS when the term was first invented and the BRICS of today is that it has developed from an investment concept into an ongoing full-fledged mechanism of inter-governmental cooperation. The five BRICS countries are not passively waiting for economic forces to decide their fate. Despite the recent unfavorable external conditions, BRICS have been taking actions to ward off shocks and have stabilized their own situations. While carrying out structural reforms tailored to their own national circumstances, BRICS countries are also developing a common agenda to strengthen their collective growth and resilience. This is best exemplified by the ongoing process of establishing a BRICS New Development Bank (NDR) and the Contingent Reserve Arrangements (CRA), two initiatives designed to facilitate infrastructure investment and prevent external shocks, respectively.

Only concerted and unremitting efforts by BRICS will translate hope into reality. With commencement of the second cycle of cooperation marked by the sixth BRICS summit to be held this week in Brazil, the five countries countries are gearing up for more progress in the following key areas:

Being more responsive to domestic challenges and achieving more inclusive and sustainable economic growth and social development.

Stimulating greater potential for BRICS cooperation with a much closer economic, financial and people-to-people linkage.

Improving global economic governance by increasing the voice and representation of BRICS as well as other Emerging Market and Developing Counties (EMDCs).

Taking advantage of positive spillovers of BRICS cooperation with increasing FDIs and business to other EMDCs.

BRICS, has gone from a concept that once was widely regarded as identifying the hottest spots for investment to a question mark that has been raised repeatedly in recent years. But BRICS, like anything else, inevitably face ups and downs in the course of development. Nonetheless, when all the facts are considered, we have every reason to believe that the BRICS countries' good story will continue and that the page is yet to turn.

The author is China's Sous-Sherpa for BRICS affairs, director general of the Department of International Economic Affairs of the Ministry of Foreign Affairs.

Brazil launches China desk to handle economic ties with China

Brazil launches China desk to handle economic ties with China

NY Wheel reels in Chinese EB-5 investors

NY Wheel reels in Chinese EB-5 investors

The Penguins of Madagascar to enter China

The Penguins of Madagascar to enter China

Panda cub Bao Bao turns one

Panda cub Bao Bao turns one

HK kid's symphony returns to NY

HK kid's symphony returns to NY

China, US reach agreement

China, US reach agreement

40 bodies from jet returned to Dutch soil

40 bodies from jet returned to Dutch soil

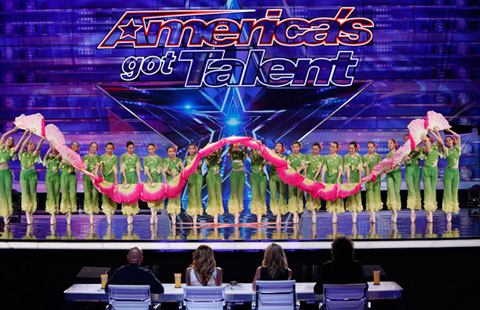

Dance troupe's fusion performance wins over judges

Dance troupe's fusion performance wins over judges

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Manufacturing hits an 18-month high

Transformers producers hit with breach of contract suit

US chipmaker to be deemed monopoly

Chinese still seek Beckel termination

One dead in shooting in Philadelphia

France: Air Algerie plane 'probably' crashed

TransAsia crash while landing in Taiwan

China, UC-Davis set up food safety center

US Weekly

|

|