View

Yuan focus must shift from dollar

By Huang Yiping (China Daily)

Updated: 2010-08-10 12:03

|

Large Medium Small |

International anxiety over China's currency exchange rate policy appears to be gathering momentum again, given that the yuan has risen only slightly since June 19 when the People's Bank of China (PBOC) made it more flexible.

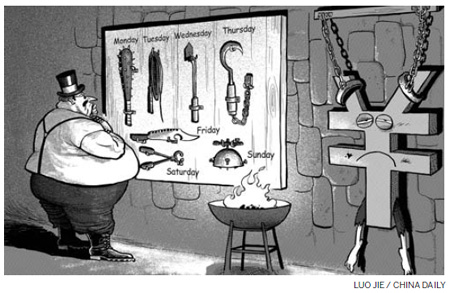

Though the recent global economic uncertainty warrants some caution, it is vital that the yuan rises more steadily over time in order to address economic imbalances and international reactions both. China's exchange rate policy should, however, focus more on a basket of currencies, de-emphasizing the bilateral exchange rate against the US dollar.

To start with, expectations of a sharp rise in the yuan by international investors and foreign policymakers were unrealistic. Although the central government is determined to make the exchange rate more flexible, it has never given the impression of a drastic revaluation of the yuan.

In fact, the policy statements of PBOC, the country's central bank, during the past few years have repeatedly emphasized the need "to improve the exchange rate formation mechanism" and "keep the exchange rate at the rational and balanced level basically stable".

The government's conservative stance on the yuan's revaluation is best understood by its concern over GDP growth and job creation. Traditionally, China's policymakers have been reluctant to implement any policy with negative short-term growth implications. But this is changing gradually. There is increasing agreement among the policymakers that overemphasis on short-term growth may result in serious structural problems such as large current account surplus which, in turn, could damage long-term growth potential.

Like any other country, however, China's exchange rate policy is also subject to domestic politics. A large number of exporters and foreign direct investment entities strongly oppose the revaluation of the yuan, often citing potential job losses as the main fallout. For instance, one government department conducted a stress test a few months ago, which showed that a 3 percent rise in the value of the yuan was the maximum change that the export sector could possibly cope with. The "test" was certainly flawed, because the yuan rose more than 5 percent a year between 2005 and 2008 when the export sector and the job market both were at their strongest.

But recent developments in the world economy have probably made the policymakers more cautious. The deteriorating sovereign debt crisis in the European Union increased the risk of a "double dip" recession in the world economy. China's economic growth slowed down too, though modestly, in the second quarter and the trend is likely to continue next year.

More importantly, the current account surplus has shrunk sharply - from the peak of 10.8 percent of GDP in 2007 to 3.5 percent during the first quarter of this year. This has certainly weakened foreign politicians' argument that the revaluation of the yuan is key to adjusting external imbalances.

Most Chinese policymakers agree that the yuan should rise in the long run, because of structural imbalances and rapid productivity growth. PBOC officials, too, have complained about losing the monetary policy independence because of a very rigid exchange rate policy.

An undervalued currency has already resulted in huge amounts of foreign exchange reserves. It has also contributed to excessive liquidity in the markets, evident in rapid growth of asset bubbles and sharp increases in prices of certain products, such as garlic and cotton.

But many criticisms levelled by international leaders against China's exchange rate policy are unfair and often driven by the economic and political problems plaguing their own countries. One such example is American politicians' tendency to blame China's currency policy for the high unemployment rate in and large current account deficits of their country.

China, however, is a huge country with a huge population and the world's second largest economy. It is thus natural for its policy decisions to evoke strong reactions. So, we cannot rule out the possibility of the US resorting to trade protectionism against China, at least for now. Were this to happen, it would be detrimental to China's economic future. Therefore, it is in China's own economic interest to respond rationally to international criticisms.

China started its managed float exchange rate regime aimed at a basket of currencies in 1994. This has remained the general policy framework despite disruptions during the Asian and global financial crises. Therefore, the critical issue is not the policy regime but the level of exchange rate.

Developments over the past two decades show there exists a wide gap between China's policy preference for gradual change and the international community's expectation of rapid revaluation of the yuan. Thus, striking a compromise between these two factors has become crucial for China's economic future and its future role in the world economy.

There are many ways that China could improve its exchange rate policy. It is important to recognize that rigid exchange rate is no longer compatible with China's large and dynamic economy. A steady revaluation of the yuan is needed by China's own changing economic conditions, and not simply forced upon it by some other country.

For instance, a stronger currency is consistent with China's policy objective of shifting the economy away from exports and investment toward consumption. It would facilitate industries' shift from producing low value-added goods to high value-added products and, therefore, support sustainable economic growth. Although the policy objective should induce two-way exchange rate fluctuations, it seems reasonable to expect an average rise in the yuan of about 5 percent a year against a basket of currencies.

On a more practical level, PBOC should think of de-emphasizing the importance of the bilateral exchange rate against the US dollar. Despite the announcement of the basket regime, PBOC continues to quote the yuan's rate against the greenback as the most important reference. This is misleading, and at times provides excuses for global criticism. It is probably better for PBOC to focus more on an index against a basket of currencies. After all, China's policy objective is to maintain exchange rate stability against a basket of currencies, not the dollar.

Economics textbooks tell us that real exchange rate adjustment can occur either through nominal exchange rate or inflation. China's average consumer price index (CPI) has averaged only 1 percent during the past decade. But it is now entering a new phase of development with steady increase in the costs of labor, land, capital and resources. These imply greater inflation pressure going forward. It might be helpful if the central bank could tolerate a somewhat higher inflation rate in the coming years.

When they were at a development stage similar to what China is in today, Japan (in the 1960s) and South Korea (in the 1980s) experienced close to 6 percent average CPI. Tolerance of a somewhat higher inflation rate in China is not only necessary for overall price adjustment, but also useful for reducing pressure on nominal appreciation.

The author is professor of economics at Peking University's China Center for Economic Research.