US

High trade surplus stirs pressure on currency

By Ding Qingfen and Tan Yingzi (China Daily)

Updated: 2010-08-11 14:41

|

Large Medium Small |

US critics set to renew criticism on yuan ahead of mid-term poll

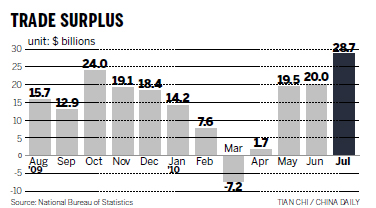

BEIJING / Washington - The wrangling on the Chinese currency between China and the US is expected to heat up, as one US senator has already renewed his criticism on the yuan, after China's trade surplus reached 18-month high in July.

Exports shot up 38.1 percent from the same period last year, bringing trade surplus to a 18-month high of $28.7 billion and beating common forecasts, figures from the General Administration of Customs showed on Tuesday. But imports grew only 22.7 percent year-on-year, at a much slower pace than expected.

In July, exports grew to $145.5 billion and imports increased to $116.8 billion.

"These numbers show just how little motive China has to end its currency manipulation unless it is pushed to do so," AFP quoted Democratic Senator Chuck Schumer of New York, a frequent critic of Beijing's handling of the yuan, as saying on Tuesday.

A US researcher said China's widening trade surplus, coupled with mid-term elections in US, will prompt more US criticism on the Chinese currency - which some US lawmakers and businesses believed should be appreciated by as much as 40 percent.

"The July trade surplus will be cited in the US as more evidence that China is a trade predator. With an election looming in November, the US Congress is going to criticize Chinese trade policy, no matter what happens to China's trade surplus," said Derek Scissors, a research fellow at The Heritage Foundation.

"The temporary effect from stimulus is now fading worldwide and China's export growth is likely to weaken in the winter. That may be too late, though, to avoid American trade action," he said.

Chinese analysts said China must also be prepared for a fresh round of international pressure led by the US to raise the value of the yuan, as the US and EU will possibly "launch more trade remedy cases against China" in the second half of the year.

"Anti-dumping and anti-subsidy cases against China, especially from the US, will grow in the second half," said He Weiwen, deputy director of the China Institute for Open Economy of the University of International Business and Economics in Beijing.

The country's high trade surplus will likely remain for the rest of the year as domestic demand continues to shrink from government attempts to curb the property bubble, Chinese analysts have said.

As government policies on curbing real estate speculation continue and commodity prices are expected to stay low, the country's imports of "most industrial materials" will continue to shrink, said Yan Jinny, an economist from Standard Chartered Shanghai.

Trade surplus will stand at above $20 billion in the coming months, she said.

Li Jian, a senior researcher of the Academy of International Trade and Economic Cooperation affiliated to the Ministry of Commerce, agreed.

"In the rest of the year, the trade surplus is very likely to range from $20 billion to $25 billion," Li said.

For the rest of the year, slowdown in export growth will continue but it will be moderate, as China's exporters are shifting more focus onto Asian and emerging markets from the US and EU, Yan said.

Exports to South Korea and Singapore accelerated to 40.3 percent and 11.2 percent in July, from 37.4 percent and 8.4 percent in June, Customs figures showed.

Over the weekend, the US said in its preliminary ruling that it will impose anti-dumping duties as high as 429 percent on imports of drill pipe used for oil wells from China.

Yan from Standard Chartered said "a sizable trade surplus means that the Chinese government has less justification to interrupt the appreciation of its currency".

A number of trade experts have called on the Chinese government to launch more policies to stimulate imports, especially high-tech and valued-added products, to balance the foreign trade and to fend off the criticisms.

Last weekend, the Ministry of Finance, together with four other ministries, released a policy on remitting import value-added tax and import tax on selected hi-tech products, which analysts said is a sign that China is taking imports seriously.

CHINA DAILY