View

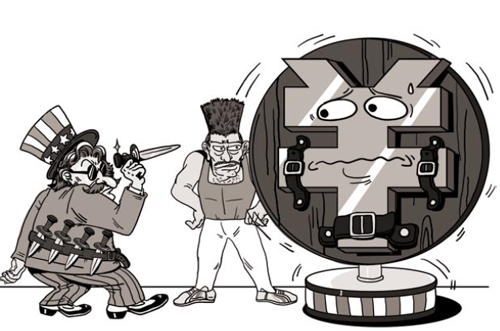

Pushing and pulling on the yuan

By Yu Yongding and Fu Yu (China Daily)

Updated: 2010-08-27 16:35

|

Large Medium Small |

China's trade surplus climbed in July to its highest level in 18 months, raising new questions about whether the country's currency remains undervalued despite government efforts to introduce a more flexible exchange rate. Chinese officials claim the pace of reform and appreciation is gradual and controllable, but nonetheless the United States Congress has pushed to pass measures penalizing Chinese exporters, especially as the November midterm elections approach. Yu Yongding, an academician of the Chinese Academy of Social Sciences and former member of the Monetary Policy Committee of the People's Bank of China, recently spoke on currency reform and the trade balance between China and the US in an interview with China Daily reporter Fu Yu.

Q: Is the re-introduction of a flexible exchange rate partly a response to foreign pressure?

A: To allow the renminbi to appreciate when there is an excess supply of US dollars is in China's own interests. It is not a matter of yielding to foreign pressure. In fact, early this year when the Chinese economy had achieved a strong V-shaped rebound, a plan to return to a more flexible exchange rate was already in the works. Rumblings from US politicians delayed rather than prompted the yuan's depegging.

China knows well that, despite its tremendous progress, its economic development is unbalanced and unstable, and hence it must speed up the paradigm shift in how it develops. To allow the yuan exchange rate to reflect supply and demand on the foreign exchange rate market is an indispensable element of China's paradigm shift.

China has been running the so-called twin surpluses (current account surplus and capital account surplus) for two decades. This irrational pattern of international balance of payments represents a gross misallocation of resources. When a country with an inflexible exchange rate is running twin surpluses, the country has to pile up foreign exchange reserves. The accumulation of the borrowed reserves means that China has failed to translate capitals it attracted with high costs into imports of capital goods, technology and managerial skills. Instead, it lends the capitals back to the US with very low returns.

Besides the fact that persistent twin surpluses and the resultant accumulation of foreign exchange reserves represent a massive wealth transfer from China to the US, securities from the US government are not as safe as we used to believe, due to the steady increase in the US' net foreign debt and the rapid deterioration of its fiscal outlook.

Q: Will the reform inevitably lead to the appreciation of the yuan?

A: According to the People's Bank of China, the yuan exchange rate will be based on market supply and demand, and determined with reference to a basket of currencies.

If the yuan exchange rate is entirely decided by demand and supply in the foreign exchange market, it may appreciate significantly because of the excess of the US dollar vis--vis the yuan in the foreign exchange market.

However, if the yuan pegs to a basket of currencies, it may appreciate or depreciate depending on changes to the exchange rates of the US dollar against other major currencies in China's chosen basket of currencies regardless of an excess of US dollars.

Q: Will the stronger yuan reduce the trade surplus significantly?

A: The exchange rate is just one of many factors that decide trade balance. Beside the exchange rate, China's trade balance is also influenced by growth in the global economy as well as the domestic economy.

Generally speaking, other things being equal, the yuan appreciation will reduce China's trade surplus by reducing exports and increasing imports. China's terms of trade will be improved, its non-tradable sector will be boosted, and its outbound foreign direct investment will increase.

The appreciation will lead to the bankruptcy of certain export enterprises and trading companies, which in turn will lead to an increase in unemployment in certain sectors and regions.

However, while acknowledging the effect of currency appreciation on trade balance, its effectiveness should not be exaggerated either because China's trade pattern is characterized by the domination of processing trade.

The yuan appreciation will cause some troubles for some exporting firms, but overall the benefits will outweigh the costs. As long as the Chinese government can strike a fine balance between growth and structural adjustment, most exporters will survive and prosper. With a more balanced economy, China will be well placed for growth for another decade.

Q: Paul Krugman stated that in his back-of-the-envelope calculations, he found that for the next couple of years, Chinese mercantilism might end up reducing US employment by around 1.4 million jobs. What's your view?

A: China's economic structure is vastly different from that of the US. China's exports to the US rarely compete directly with US-made goods. According to a former minister of commerce of China, the country would have to sell 800 million shirts to afford one Airbus. This is a very good illustration of the trade pattern between China and developed countries, including the US.

As pointed out by the former Assistant Secretary of Treasury Philip Swagel, China's trade surplus does cost jobs, "but they were lost in Malaysia, Honduras, and the other low-cost countries from which US clothing and toys will be sourced as Chinese exports slow." To cut current account deficits, the US must reduce its investment-savings gap. Otherwise, the appreciation of the renminbi vis--vis the dollar will not lead to an improvement to the US trade account.

Q: Will a trade protectionist policy solve the current Sino-American trade dispute?

A: The policy dilemma for the US government is how to reconcile two contradicting objectives. On the one hand, the US government must use fiscal deficits to lift the economy out of recession. On the other hand, the US government should reduce its current account deficit.

Promoting exports in order to reduce its current account deficit is no doubt the right policy for the US. This policy will achieve two objectives at the same time: growth and a reduction in the current account balance.

To achieve the reduction by artificially suppressing imports with a trade protectionist policy is counterproductive. Trade protectionism will drag the growth of the global economy down that boomerang will come back and nip US exports in the bud. Instead of resorting to protectionism, the solution for the US government lies in an increase in exports, which in turn depends on the American people's hard work, innovation, and creativity. Confrontation will solve nothing.

Q: Also according to Krugman, China's policy of keeping the yuan undervalued has become a significant drag on the global economic recovery. What do you think?

A: This overlooks the fact that the growth rate of China's trade surplus fell significantly in 2008 and turned negative in 2009. In real terms the growth rate of China's exports compared with the rest of the world and that of its imports were negative 10.5 percent and 1.7 percent in 2009, respectively. This is an outcome that is in no small part because imports have held up quite well due to the Chinese government's massive stimulus package.

Moreover, as taught in every introductory macroeconomics course, when calculating the contribution of the trade balance to overall economic growth, it is the change in trade balance - not the absolute size - that matters.

Because China sucked in imports at a greater pace than it pushed out exports in 2009, it made a positive contribution to the global recovery. As pointed out by Pieter Bottelier, a former head of the World Bank's office in Beijing, "China did more than any other country to pull the world out of the recession".