Business

Tapping into the mobile market

By Eric Jou (China Daily)

Updated: 2011-01-03 10:48

|

Large Medium Small |

|

Employees of Ubisoft Shanghai try the company's newly developed games. The industry has grown with foreign companies such as Ubisoft investing in the Chinese market and training developers. Gao Erqiang / China Daily |

Chinese companies are expected to drive the future of the games industry

BEIJING - The Chinese video game industry is growing up and changing the face of the gaming world.

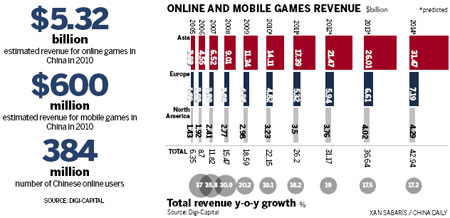

"The Asia-Pacific region and Europe should end up taking 90 percent of online and mobile revenue," said Tim Merel, co-founder of the London-based digital media investment firm Digi-Capital. "If you aren't in China, you aren't anywhere."

The Chinese online and mobile gaming industry is expected to earn more than 28 billion euros in revenue by 2014

and China will account for half of that pie, figures from Digi-Capital show.

China is expected to drive the future of the industry

and figures from China game industry analyst Nico Partners also see the market growing by 20 percent a year for the next four years.

Similarly, China's online and mobile gaming market promises an estimated revenue stream of $6 billion this year and projected revenues of $18 billion by 2014, compared to the

$2 billion and projected $3 billion for the United States.

Lured by the huge potential, more European game makers are looking to set up their bases in China.

One of them is European game publishing and developing giant Ubisoft.

The France-based Ubisoft is one of the largest game developers and publishers in the world and is best known for the hit Tom Clancy games, Assassins Creed, and Rayman: Raving Rabbids.

Ubisoft set up shop in Shanghai in 1996 and Ubisoft Shanghai has been cranking out game after game for its parent company.

Ubisoft established its Shanghai studio to globalize its workforce, said Corrine Leroy, managing director of Ubisoft Shanghai.

"We came to China for two things. One was to publish our games in Chinese," Leroy said. "Two, we were developing part of the game and some games for the whole market."

Leroy recalls how hard it was for her and Ubisoft to recruit talent during the initial establishment of their Shanghai studio.

"The people were less trained. At that time when we were recruiting artists, we had to train them to use 3d max (an auto desk software). But now when we recruit, even if they are junior, they have already used this kind of software," Leroy said.

"It went from extremely basic because those guys had nowhere to find us, they had no way to get trained in tools in university. But this lasted only two years, and after that, when we recruited people, they were already using the tools that we use in the industry."

The industry has grown on the back of foreign companies such as Ubisoft investing in the Chinese market and training developers. Starting with outsourcing and development for hire, Chinese game developers have begun building their own gaming brands.

But the industry only really took off around the year 2000, amid the South Korean online gaming boom, Leroy said.

Console and offline games also never really boomed in China because of the high prices of consoles were sold, and online games grew through that opening.

"There wasn't really a market to create games for Asia, it grew only because South Korea's government, a little over a decade ago, decided to invest a lot in online gaming," said Richard Tsao, managing director of Ubisoft's Chengdu business.

"Online gaming became very popular in South Korea and then Chinese operators started to see the value of licensing games from South Korea to operate in China, so the online gaming industry in China took off."

Still, the Chinese market faced other barriers. Gaming consoles subsequently became illegal and the only channel to distribute video games was through online operators, which take a huge chunk of the profits.

Foreign developers also have to cooperate with local companies to publish their games and this union usually happens with local Internet giants such as Tencent.

"We have no choice," Tsao said. "If we want to operate games in China, we have to work with Chinese operators."

According to figures from Digi-Capital, Internet penetration within China will be a key factor in the development of the gaming market and many foreign companies are eyeing a piece of the action. Internet penetration in China is currently 29 percent - or 384 million users - and is expected to reach 56 percent or 754 million users by 2014. That includes mobile Internet users. The pie will generate up to $18 billion by 2014, figures from Digi-Capital show.

The Chinese market's emphasis on online gaming is also changing the face of the industry, with piracy less of a major issue, analysts say.

Evolving from just mirroring South Korean online games to producing their own, Chinese companies have helped spur the growth of free-to-play models or f2p, in which game transactions known as micro transactions provide the income to game makers. These micro transactions earn revenue in place of offering a game for free.

"There are a lot of games in the market now that don't care about the piracy, halfway through the game micro transactions offer you opportunities to advance in the game faster or game goods by paying for these with real-world money," said Zhang Ming, deputy secretary general of the Shanghai Information Services Association and vice-president of UBM China, which is under the Ireland-based United Business Media (UBM).

"Game makers can say, 'Go ahead, pirate our games, you are just giving us free publicity, we'll make our money through people playing our free game and purchasing game goods.

"What is happening now is that the government, particularly the Shanghai municipal government, is making it easier for companies to register intellectual property."

Micro transactions, prominently featured in social network software games such as Farmville and Happy Farm, are symbols of how far ahead China is compared to the West in online gaming, analysts say.

"China is evolving the online gaming market better than any other country in the world," Tsao said. "The West is slowly catching up to the concept of online gaming in general. China has close to a decade or more of experience."

Another technological improvement that is growing the video gaming industry is the advent of the Apple App Store and the proliferation of smart phones, analysts say.

The mobile phone gaming market is expected to generate half a billion euros this year and by 2014, will rake in more than 900 million euros that year. China is also becoming the home of hundreds of independent game developers working for the mobile market.

Even Rovio, the makers of the runaway hit Angry Birds, has set its sights on the Chinese market. Peter Vesterbacka, who is in charge of business development at Rovio, said it is hard not to see someone playing Angry Birds on the subway in Shanghai.

According to Vesterbacka, Angry Birds is only available in China officially via iTunes and Rovio is in talks with operators on bringing the game officially to the Chinese mainland.

This kind of mobile Internet distribution system bypasses the problem of the online operators in China and is proving to be a new form of distribution, resulting in an increase in the number of smaller foreign companies coming to China to create games.

Smaller developers and companies that may not possess the investment capital of big companies also head into China making games with cheap talent and using the new distribution channel created by the iPhone to sell their games back to the West.

Happy Latte is one of such company that operates in China but focuses and sells its products in the West.

"Honestly, we don't even target China as a market, our games were not even available at the beginning in China," said Bjorn Stabell, managing director of Happy Latte.

"We were doing something for RenRen (Chinese social networking service) but we found it not as open as Facebook and the Apple App store."

Despite the seemingly closed market, it all comes down to the possibilities that the Chinese market and industry hold.

Patrik Wilkens, vice-president of sales of Shouji Mobile, a British-owned business based in Beijing that deals in localization for foreign companies, sees a bright future for the game industry in China, particularly in the mobile market. He cited the prospective plans of companies like Rovio, PopCap and Electronic Arts.

"First of all, the Chinese market is so big, it's very difficult to ignore it. On the mobile side, it's harder to access the Chinese market than to enter the European market," Wilkens said.

"But I think the Chinese market, especially with the Android technology on the smart phone side, will grow even bigger. Android is getting cheaper and more affordable and with the whole market shifting right now to smart phones, I'm sure that companies like the big ones are coming here. Rovio mobile is coming into the market, Popcap is already in the market and EA is setting up its own studios in the market."

The increase in the number of Chinese and overseas developers making games in the country also presented opportunities for UBM, which operates the Game Developers Conference (GDC), to set up GDC Shanghai for game makers to get together and trade stories, techniques and lessons on how to make great games.

"What we're hoping for is that everything that UBM can offer regarding game making can be made available for the Chinese market," Zhang Ming from UBM China said.