Investment

BMW gets nod for auto financing arm

By Han Tianyang (China Daily)

Updated: 2010-09-20 07:46

|

Large Medium Small |

|

Executives from BMW and its joint venture announce the auto financing company that will start operation in November. Photos Provided to China Daily |

Just 10% of customers in China now borrow to buy

BEIJING - Luxury auto icon BMW Group announced last week that it has government approval to set up an automotive finance company in China that plans to start business in the fourth quarter of this year.

BMW will have a 58 percent share in BMW Automotive Finance (China) Co Ltd, with the remaining 42 percent owned by BMW Brilliance Automotive Ltd, the joint venture between BMW and domestic carmaker Brilliance Auto.

With registered capital of 500 million yuan, the Beijing-based auto finance company is expected to start operation in November providing wholesale and retail financing as well as leasing services to BMW dealers and customers.

The German automaker launched its first auto financing operation in the 1970s, initially for its home market, and later in more than 50 markets globally.

It began auto financing services in China three years ago in cooperation with Shenzhen Development Bank.

On average about 5 to 10 percent of BMW buyers in China now pay in installments, said Kirk Cordill, managing director and CEO of BMW Automotive Finance (China) Co Ltd, compared to 49 percent of BMW customers worldwide that use BMW financing.

"We expect to increase retail penetration (in China) considerably after 2011," said Friedrich Eichiner, member of the board of management of BMW, who added that more Chinese consumers, especially the younger generation, consider financing a viable way of owning a vehicle.

Market data shows only 10 percent of car buyers in China finance their purchase, compared to over 80 percent in the US, due to the lack of a sound credit check system in China as well as the local consumer preference to pay cash.

The gap means huge potential in the lucrative business.

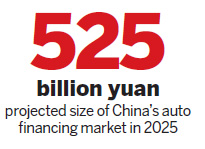

According to the estimates by the China Association of Automobile Manufacturers, the country's auto financing market may hit 525 billion yuan by 2025.

Several foreign automakers now have auto financing units in China, including GM, Volkswagen, Ford, Toyota, Daimler, Nissan, Fiat, PSA Peugeot Citroen and Volvo.

The first auto finance company in China was established in 2004 by General Motors Acceptance Corp and Shanghai Automotive Group Finance Corp, as an extension of the partnership between GM and SAIC.

The GMAC-SAIC Automotive Finance Co Ltd recently announced that it signed contracts on 109,000 car loans in the first eight months this year, exceeding the full-year figure in 2009.

Domestic carmakers have also now forayed into the market. Chery Automobile Co set up an auto financing joint venture with Huishang Bank last year, followed by BYD Co and Guangzhou Automobile Group Co, both forming loan ventures with foreign-funded commercial banks.

Carmakers are attracted to the large profit margin in the auto financing business, much higher than the gains from just selling cars, said analysts.

Of BMW Group's 413 million euros ($541 million) in pre-tax profit last year, 365 million euros ($478 million) came from its financing business.

Another important purpose for carmakers to have their own financing in China is to provide loans for dealers that play such a significant role in driving sales growth, analysts said.

China Daily

(China Daily 09/20/2010 page18)