View

A fair climate for competition

By Yao Zhizhong (China Daily)

Updated: 2010-12-10 11:19

|

Large Medium Small |

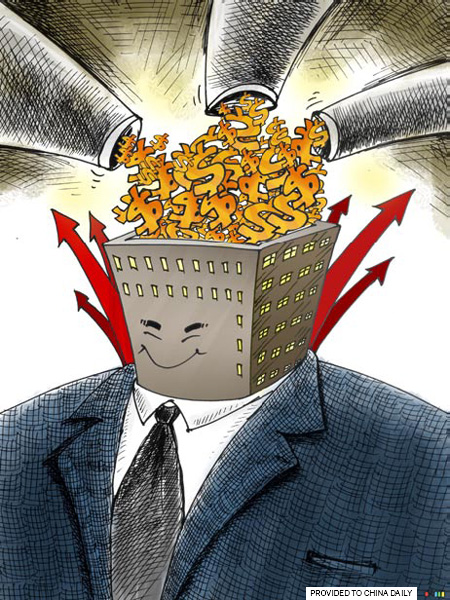

The investment landscape in China is improving with the biggest changes to policy coming in the cancellation of preferential policies to foreign-funded companies.

The preferential policies include issues on taxes, land and resource prices as well as market access. With increasing costs on labor, land, environmental protection and resources as well as growing awareness of employment protection and a withdrawal of tax incentives, foreign-funded companies have to compete with domestic companies at a higher cost.

I believe they have to adjust to the realities of China's economy.

The cancellation of preferential policies is not a discriminatory act against foreign-funded companies but a move by China to give domestic companies a fighting chance. China is trying to squeeze inefficient companies out of the market and create a fair competitive environment.

Too many incentives for foreign-invested firms may make it hard for China to produce advanced technologies and management ideas. If foreign-funded firms bring advanced technologies, labor productivity of these foreign-funded companies will be higher than their domestic competitors.

But the figure showed that in 2007, before income tax was unified, among the companies with more than 5 million yuan ($750,469) annual income in primary business, the labor productivity of foreign-funded companies was 137,000 yuan a person, which is still lower than their domestic competitors, at 154,000 yuan a person.

Although some multinational companies did bring China advanced technology and efficient modes of production, the 2007 figures states that not all of the foreign direct investments are efficient in high technology.

A foreign-funded company has to bear comparatively higher costs than its domestic competitors due to efforts in overcoming language barriers, differences in culture and getting familiar with the local manufacturing and sales environment.

To overcome the extra costs, foreign-funded companies have to be very efficient in their modes of production.

Therefore, as long as the foreign-funded companies have higher costs in production and sales than domestic companies, their productivity will be higher. And if foreign-funded companies continue to do business even though their productivity is lower than domestic companies, foreign direct investment for inefficient companies will continue to come to China.

The cancellation of preferential policies for foreign-funded companies is a good sign for efficient and high-tech foreign-funded capital. The preferential policies, which are to the advantage of inefficient foreign-funded companies, might create a low level of market competition. And this situation is not good for efficient multinational companies.

Changes to China's investment environment do not mean China doesn't have a need for foreign-funded companies. They can still help China participate in manufacturing and distribution. They can prod domestic companies to become better through competition. They can also transfer technology and human resources to domestic companies. But these foreign-funded companies need to be efficient.

As the cheap labor advantage in China began to disappear, new opportunities to attract foreign-invested companies can be seen in the areas of rapidly growing quality of human resources, high productivity and a large growing consumer market brought by the improved living standards. China has also improved its legislative environment and government regulations. Increased costs of the resources and energy will bring more advanced economic structure and mode of production. In fact, in the first three quarters of this year, China's foreign direct investment had increased 17 percent year-on-year.

The author is a researcher at the Chinese Academy of Social Sciences.

(China Daily 12/10/2010 page12)