Foreign retailers bank hopes on China

Updated: 2012-09-28 10:30

By Diao Ying (China Daily)

|

||||||||

|

A Wal-Mart supermarket in Chongqing. Many Western retailers have already opened stores in China. Zhou Hui / for China Daily |

Companies look ahead with cautious optimism in a consolidating market

It is common enough, even traditional, for a mother in London to dish up Weetabix cereal for her children's breakfast. If a mother from Chongqing in Southwest China does the same, it would be regarded as Western, possibly as something cool and exotic.

What they are unlikely to realize is that Weetabix is now a Chinese product, the 80-year-old British brand having been recently bought by Bright Food, based in Shanghai.

The change of ownership indicates both the economic muscle of some Chinese companies and the appetite of Chinese consumers for Western brands.

According to the Global Retail Index, a survey carried out among 200 retailers worldwide, China and India are seen as the top growth markets. Multinational operators said they expect sales to increase in both countries, while those operating elsewhere remain cautious about future growth, according to the report released at the World Retail Congress in London in early September.

Modern retail outlets, such as supermarkets and hypermarkets, are common in the West and in big cities in China, but not in underdeveloped areas. Urbanization happened in London in the 19th century. In Chong-qing, only 6.5 million of its 28 million residents live in urban areas.

The Chinese government aims to transform the economy by letting more of the population move into cities, where they will spend more as their lifestyle changes. In the countryside, a household eats whatever is grown in the fields; in cities, they have to go to supermarkets.

For retailers in the West, that means good opportunities. Many are facing difficulties with governments and consumers cutting spending in many European countries. Looking beyond their borders for business has become even more important.

The global retail survey says that the companies polled appreciate that China's economy is slowing down, but is far from being in recession. Lim Beng Chee, chief executive of CapitaMalls Asia, a leading retail real estate developer, says he considers China's 7 to 8 percent economic growth "still very good".

He says this increase is remarkable when compared with European countries, which will see hardly any growth, and is good even when compared to places such as Singapore, currently looking at a 2-3 percent annual growth rate.

Many Western retailers have already opened stores in China. Tesco, the largest supermarket chain in Britain, has opened more than 100. Marc Bolland, CEO of British retail giant Marks & Spencer, says the company is looking to Asia and Europe to provide its best growth prospects, and that it aims to open 100 international stores annually.

As well as general retailers, some specialized retailers are also expanding in China. Alliance Boots, Europe's largest pharmacy chain, recently signed a strategic agreement with Nanjing Pharmaceutical, China's fifth-largest pharmaceutical wholesaler with a good retail network.

The retail market in China is consolidating, says Stefano Pessina, executive chairman of Alliance Boots, "and we would like to act as a market catalyst in China with regards to the consolidation process".

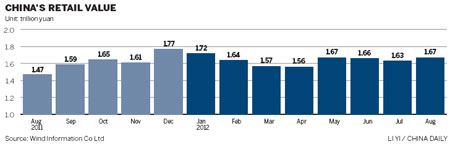

According to Pessina, the Chinese retail market has seen double-digit growth for many years, and with around 10,000 wholesalers now, the government seems to favor a consolidation process that will involve international companies and give birth to a limited number of reliable players.

"But obviously, the key reason why we decided to prioritize China is because we believe we cannot become global without having a strong presence there," he adds.

Increasing urbanization in China also offers huge potential for retailers. Large-scale urbanization will happen in the next 10 years, says Lim of CapitaMalls Asia, and more people will change their lifestyle and start shopping at supermarkets.

"Each year around 30 million people move to China's cities from rural areas, and that means the country's retail industry is developing rapidly," he says.

Therefore, many of the international retailers have started to look beyond the mega-cities of Beijing, Shanghai and Guangzhou. For instance, Wal-Mart, Carrefour, and Metro Group have established businesses in Chongqing and announced future plans to expand around this region, according to a report on the retail industry by Deloitte.

Despite the potential, however, establishing a retail business in China is harder than it used to be. About five years ago, a foreign retailer had a chance of success as long as it had a presence in China, due to strong demand and less competition, according Frank Wei, managing director of Warburg Pincus Asia LLC, the private equity firm that has invested in Gome, China's second-largest home appliances chain. Nowadays, foreign players need to be more creative and innovative to succeed in China, he says.

"The market has become much more competitive, with places like Beijing and Shanghai close to saturation."

He adds more companies are looking at opportunities in second and third-tier cities, as well as having to provide specialized retail offers. Warburg recently invested in a retailer in Nanjing in Jiangsu province, specializing in childcare.

But Wei says that despite the overall economic slowdown, some of the companies his firm has equity in are still seeing annual sales increases of about 30 to 40 percent.

In the third-tier cities now being targeted, it is all about building a strong infrastructure and having a strong local presence, he says.

CapitaMalls' Lim says that international retailers also need patience to learn about the market. CapitaMalls, from Singapore, came to China in 1995 and failed to make a profit in the first six years. And as Alessandro Benetton, chairman of the Benetton Group, the Italian fashion brand, said in a recent interview: "When it comes to China, there are as many people queuing in as people queuing out."

Another new trend is online stores. In China, as elsewhere in the world, more people are shopping online.

E-commerce is developing at breathtaking speed in the country - valued at about $100 million (77.7 million euros) in 2011, with an annual growth of 30 percent - but, according to Wei, people are still learning how to profit from it.

"There are opportunities for making money. The problem is how, " he says.

diaoying@chinadaily.com.cn

(China Daily 09/28/2012 page3)