Beauty, personal care market to keep growing

Updated: 2012-10-03 10:25

By Wang Zhuoqiong (China Daily)

|

||||||||

Sector gets boost from healthy retail environment, higher incomes

China's beauty and personal care sector will continue to see robust growth in the next four years, according to an industry report.

Consumers are likely to increase expenditure on beauty products, thanks to promotions by key industry players and a healthy national economy, a report by Euromonitor International said.

An anticipated baby boom this year is expected to drive the growth of baby and child-specific products, while older age groups will continue to drive sales of anti-aging skin products, the report said.

|

|

Premium beauty and personal care products accounted for the majority of the industry's sales growth in 2011, according to a report by Euromonitor International. Premium skin care, makeup and fragrances witnessed strong growth last year, with consumers trading up from mass brands, the report said. [Photo by Liang Zhijie / For China Daily] |

Men's grooming is likely to see ongoing growth due to increasing demand from younger Chinese men, it added.

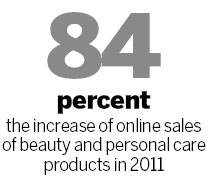

One of the notable trends is that fast-growing e-commerce has resulted in declining sales through traditional retail channels in 2011, the report found.

Department stores and superstores are considered two major channels for beauty and personal care products in China, with department stores mainly providing middle-to-high-end goods and superstores focused on low-to-middle-end goods.

Online retail has grown rapidly, thanks to increasing Internet access and use of e-commerce websites such as Alibaba Group's business-to-consumer platform Tmall.com. E-commerce appeals to many Chinese consumers due to its accessibility, attractive prices and convenient delivery services.

|

Online retailers' target consumers of beauty and personal care products are middle- and high-income female consumers.

E-commerce advertising has also increased and can be regularly seen on TV channels, such as CCTV, as well as outdoors in public transportation stations, the report said.

By the end of 2011, a large number of leading international and domestic companies in the beauty and personal care market - including Procter & Gamble (Guangzhou) Ltd, L'Oreal China, Unilever China Ltd and Shanghai Jahwa United Co Ltd - have set up stores on Tmall.com because of its popularity.

Shiseido China Co Ltd began to use Tmall.com in February 2012, according to the report.

Several leading companies in the beauty and personal care market have been working to build up official online platforms targeted at Chinese consumers.

One notable example in this respect was Shiseido's efforts.

In 2011, the company launched its official website, through which consumers can directly purchase its Pure & Mild branded products. Shiseido also plans to add five more beauty and personal care brands, such as Za and Tsubaki, to its official online store in the near future, the report said.

Individual sellers on Taobao.com, China's largest consumer-to-consumer website, have also contributed to growing online sales of overseas beauty and personal care products.

Recently, a former Chinese flight attendant was sentenced to 11 years in jail for smuggling overseas cosmetics, which are subject to import duties. She sold the products through her online store on Taobao.com.

The Ruder Finn/Ipsos China Luxury Forecast 2012 reveals that there has been a huge spike in online shopping. About 10 percent of luxury goods and about 17 percent of luxury cosmetics were purchased online.

Another finding of the Euromonitor report was that premium beauty and personal care products accounted for the majority of the industry's sales growth in 2011.

Premium skin care, makeup and fragrances witnessed strong growth last year, with consumers trading up from mass brands, the report said.

The trend is attributed to rising disposable income combined with product innovation. As a result, an increasing number of high-income consumers have turned to department stores to purchase premium cosmetics products, said the report.

Meanwhile, many low-income consumers continue to struggle with rising inflation, which has pushed up the prices of many mass-market products.

However, demand for mass-market cosmetics still increased, although at a slower rate compared with premium cosmetics in 2011, the report said.

wangzhuoqiong@chinadaily.com.cn