Rays of hope for manufacturing

Updated: 2012-10-25 09:11

By Chen Jia (China Daily)

|

||||||||

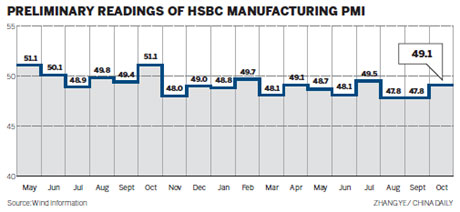

Gradual uptick in new orders drives leading index to three-month high

China's manufacturing sector may start to see light at the end of the tunnel in October, thanks to a gradual uptick in new orders, strengthening market expectations of accelerated growth in the fourth quarter, HSBC said on Wednesday.

|

|

|

Workers on an assembly line in an electrical appliances plant in Hangzhou, Zhejiang province. An increase in orders has helped drive the China manufacturing purchasing managers' index to its highest point in three months, according to a preliminary HSBC report. [Photo/China Daily] |

The HSBC preliminary manufacturing purchasing managers' index climbed to 49.1 in October, the highest level in three months, from a final reading of 47.9 September, the latest signal that economic growth may have started to rebound.

The leading economic indicator is considered a barometer of operational activities in the manufacturing industry. A reading of less than 50 means contraction, while more than 50 suggests expansion.

The Otober growth of HSBC's PMI was the fastest in two years, partly driven by a rapid rebound in new orders, with this sub-index reaching a six-month high, according to Qu Hongbin, HSBC's chief economist in China.

Another sub-index indicating output increased to a three-month high of 48.4 this month, from 47.3 in September. While this is still a contraction, it was at a slower pace, said HSBC.

Qu added: "This is helped by the filtering through of the earlier easing measures," confirming he considered the positive changes were the result of the government's stimulus measures, including injection of liquidity, acceleration of infrastructure construction and an expansion of fiscal expenditure.

"There are signals to show a recovery of domestic demand and business confidence," he added.

HSBC's survey was based on data compiled from monthly replies to questionnaires from more than 420 manufacturing companies. The preliminary reading is published a week before its final PMI data is released.

Qu added that in order to ensure that economic growth rebounds effectively, policies stressing fiscal spending and monetary easing should remain the order of the day.

Zheng Xinli, vice-chairman of the China Center for International Economic Exchanges, a top government think tank, said: "China's economic growth may speed up to 7.5 percent in the fourth quarter, which will lift the whole year's growth to 7.6 percent.

"A modest rebound in China's expansion is likely to continue next year," said Zheng, who is also a guest economist for China Daily.

"If we can take effective measures to fight against the slowdown risk, the process of getting economic growth back on track will be shortened."

Zheng called on the government to further boost infrastructure spending in sectors including railways, subways and public utilities.

A Ministry of Finance official told Xinhua News Agency on Tuesday that the government's proactive fiscal policy will continue to stabilize growth, based on the implementation of existing support measures.

The official added that the government would continue to increase spending on education, healthcare, social security, employment and affordable housing.

The growth of fiscal spending has played an important role in the government's efforts to stabilize economic growth since May.

In the first nine months, the central government's investment budget for infrastructure construction reached 390.5 billion yuan ($62 billion), accounting for 97 percent of the whole year's budget, which was 8 percentage points higher than the investment during the same period last year, according to the ministry.

The ministry official added that the central government's spending on affordable housing reached 233 billion yuan, 61.7 billion yuan more than its total investment in this field in 2011. This part of spending increased 34.1 percent year-on-year in the first nine months.

China's benchmark Shanghai Composite Index climbed to 2115.99 points at the close on Wednesday, a rise of 0.07 percent on the previous day's close.

This tracker of the country's biggest companies has dropped 3.79 percent so far this year amid the sluggish economic environment.

Liu Kegu, former vice-president of China Development Bank, said the speed at which China's economic growth rebounds is also influenced by the global economic situation.

As Europe and the United States may continue to have difficulties in boosting their economic growth, the recovery in China's economic growth is likely to remain modest, Liu said.

chenjia1@chinadaily.com.cn