New listings set to cheer bourses

Updated: 2014-06-26 07:03

By Xie Yu in Shanghai (China Daily USA)

|

||||||||

Low valuations, anticipated high returns to lift investor sentiment

New share listings are expected to lift investor sentiment on Chinese bourses, with the current low valuations providing enough room for higher future returns, market analysts said on Wednesday

Trading in the shares of the newly listed Wuxi Xuelang Environmental Technology Co, Shandong Longda Meat Foodstuff Co, and Feitian Technologies Co, is expected to start in Shenzhen on Thursday, the Shenzhen Stock Exchange said in an announcement on Tuesday night. The initial public offerings of the three companies marked the resumption of IPOs on Chinese bourses after a long hiatus.

Ten companies planning IPOs had already announced their offer prices by Monday, the China Securities Regulatory Commission said in a statement on Tuesday, adding that the average price-earnings ratio of these is 17.76, or about 39 percent lower than the average of the 48 IPOs at the start of this year.

"The regulators have managed to keep the valuations at relatively low levels. This will prevent liquidity drains and sharp price declines on the secondary market," said Zito Ji, an analyst with a Shanghai-based mutual fund.

"With the IPO prices of the new entrants at levels that are lower than their peers, there is more than enough room for price appreciation after trading starts on the secondary market," he said.

New issues have already attracted considerable interest from investors during the offer period. Six companies that completed the IPO process on Monday collectively raised 563.9 billion yuan ($91 billion), which is more than two times the volume attracted by the first seven companies which conducted IPOs in January.

The average lot-winning rates for online and offline biddings are 0.79 percent and 0.24 percent respectively, according to the CSRC.

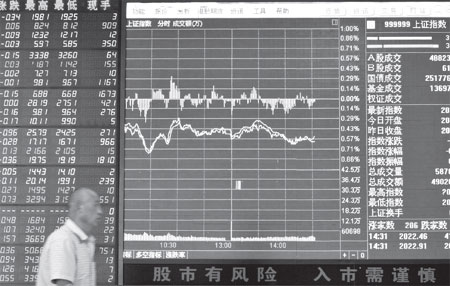

The benchmark Shanghai Composite Index dropped 0.41 percent to 2,025.50 at close on Wednesday, and turnover shrank to 56 billion yuan from 61.7 billion yuan on Tuesday.

The Shanghai Composite Index has dropped 4.3 percent year-to-date on concerns that the new issues would drain market liquidity further, the biggest fall among 46 emerging and developed countries, according to Bloomberg. On the other hand, Chinese IPOs have jumped an average 43 percent in their trading debuts this year, the most worldwide.

"The extremely low winning-rates may guide most of the locked-up capital back to the secondary market, which benefits liquidity and will boost the stock market performance temporarily. However, as long as investors remain interested in new offerings, the stock market is likely to remain depressed," said Zhu Junchun, an analyst with Great Wall Securities.

More than 600 companies have submitted IPO applications and more than 400 have published their draft prospectuses, the CSRC said in a statement in May.

The CSRC plans to allow about 100 IPOs from June to the end of the year and the stock sales will be evenly spread over time, CSRC Chairman Xiao Gang said in a statement recently.

xieyu@chinadaily.com.cn

|

The benchmark Shanghai Composite Index drops 0.41 percent to 2,025.50 on Wednesday, and turnover shrinks to 56 billion yuan from 61.7 billion yuan on Tuesday, on eve of the trading of new shares. Lu Qijian / For China Daily |

(China Daily USA 06/26/2014 page15)

Germany, US sail into knockout stages in Recife rain

Germany, US sail into knockout stages in Recife rain

PLA ships arrive in Hawaii for naval exercise

PLA ships arrive in Hawaii for naval exercise

Baucus: Investment pact opens a new chapter

Baucus: Investment pact opens a new chapter

2014 Smithsonian Folklife Festival kicks off in DC

2014 Smithsonian Folklife Festival kicks off in DC

Germany vs USA - The battle of two masterminds

Germany vs USA - The battle of two masterminds

Apple to launch bigger iPhones to reignite sales

Apple to launch bigger iPhones to reignite sales

Xunlei IPO on Nasdaq raises $88m

Xunlei IPO on Nasdaq raises $88m

Beijing, Boston are just 13 hours apart

Beijing, Boston are just 13 hours apart

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Envoy rejects a 'zero-sum' strategic race

Chen Guangbiao's charity event provides lunch, no cash

Google unveils new products

Overseas services boosted by Alipay

Opinion: Fine twist in Sino-US military ties

Bigger Apple iPhones said to start mass output soon

Chinese investors discovering lure of Motor City

Pilots' 'mismanagement' causes Asiana crash

US Weekly

|

|