Has China's banking sector entered a crunch time?

Updated: 2013-07-02 11:19

(bjreview.com.cn)

|

||||||||

This time, the PBOC wants to rein in excess bank lending, especially in the sector of shadow banking—all non-bank loans that involve banks and trust companies, underground finance, micro-credit companies, private financing, private-equity investment, hedge funds and off-balance sheet lending transactions. China's shadow banking system has lent far too much and too recklessly over the past several years. Excessive amounts of debt have been accumulated by speculators, property developers and local governments. The PBOC wants to push money instead into the real economy as it seeks to shore up growth.

Experts warn that without thorough reform of the country's banks, the entire financial system could face its biggest crisis yet.

The real reason

June is a traditional season for a liquidity crunch, but this year's situation was worse. A source from the PBOC told Xinhua News Agency that several specific factors contributed to the tightness. "First, bank loans rocketed in the past several months, causing liquidity pressure on commercial banks. Second, the end of May is the traditional peak season for corporate tax payments. Third, a recent regulation on the foreign exchange market to clamp down on capital inflows has made China suffer from a drop in foreign exchange inflows in recent weeks and months.

But do banks really lack cash? The answer is no.

As of June 21, financial institutions had total provisions of 1.5 trillion yuan ($242 billion). Usually, provisions of 600 billion to 700 billion yuan ($97.62 billion to $113.89 billion) could meet the needs of daily banking transactions, according to a PBOC statement on its website.

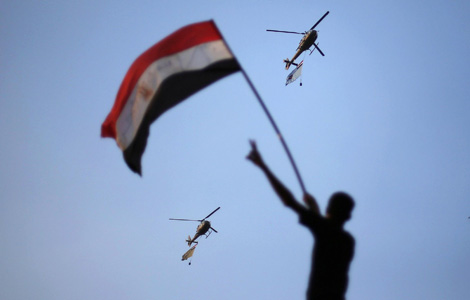

Egypt army gives Mursi 48 hours to share power

Egypt army gives Mursi 48 hours to share power

No quick end in sight for Beijing smog

No quick end in sight for Beijing smog

New filial law sparks debate

New filial law sparks debate

Bakelants claims Tour de France second stage

Bakelants claims Tour de France second stage

2013 BET Awards in Los Angeles

2013 BET Awards in Los Angeles

Gay pride parade around the world

Gay pride parade around the world

Four dead in Egypt clashes, scores wounded

Four dead in Egypt clashes, scores wounded

New NSA spying allegations rile European allies

New NSA spying allegations rile European allies

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

19 firefighters killed in Arizona fire

Book reveals islands' true history

Tokyo warned not to resort to 'empty talk'

Snowden applies for Russian asylum

No quick end in sight for Beijing smog

New home prices defy curbs

Mandela 'still critical but stable'

Shanghai to open first Sino-foreign high school

US Weekly

|

|