Logistics, construction and port stocks get a lift

Updated: 2013-07-05 07:21

By Wang Ying in Shanghai (China Daily)

|

||||||||

The State Council's approval of the Shanghai free trade zone has spawned a new class of concept stocks in trading, logistics, construction and port facilities.

Boosted by the approval of the FTZ plan, shares of Shanghai Material Trading Co Ltd, Shanghai Wanye Enterprises Co Ltd and CTS International Logistics Corp Ltd all soared by the daily limit of 10 percent in Shanghai.

Shanghai Material shares traded at 4.69 yuan (76 US cents) before being suspended. Shanghai Wanye reached 3.41 yuan and CTS soared to 5.62 yuan.

Locally based companies, including Y.U.D Yangtze River Investment Industry, Shanghai Jinqiao Export Processing Zone and Shanghai International Port (Group), also outperformed the broad market, rising by 5.34 percent, 2.55 percent and 6.25 percent, respectively.

The Shanghai Composite Index opened lower on Thursday but then recovered in the morning session. The benchmark index ended Thursday 0.59 percent higher at 2006.10.

Li Zheming, an analyst with Datong Securities Brokerage Co Ltd, said the FTZ plan, which will boost production and manufacturing, facilitate the development of the service sector and spur financial innovation, was well received among related shares, whose prices saw big gains.

"With the outline of the FTZ plan becoming clearer and firmer, related industries and companies will get a further boost in their stock prices," Li said.

The State Council on Wednesday approved Shanghai's proposal to build the country's first free trade zone that follows international norms.

The zone, covering 28 square kilometers, will be built over 10 years, using as a basis three existing comprehensive bonded zones: the Waigaoqiao Free Trade Zone, the Yangshan Free Trade Port Area and the Pudong Airport Comprehensive Free Trade Zone.

Without a detailed plan, analysts said it is hard to predict what changes the FTZ will bring in comparison with the existing zones.

Instead, they anticipate more favorable policies, with the real estate, logistics, high-technology and manufacturing sectors to benefit.

"Logistics will be one of the first industries to see an improvement from fewer trade restrictions, including upgraded facilities for storage, transportation and shipping.

"Manufacturers will also benefit with less taxation, lower logistics and storage costs, simplified procedure for trading and so on," said Wang Jianhui, chief economist with Southwest Securities Co Ltd.

"The establishment of the free trade zone in Shanghai will help reduce trading costs, promote trade, attract foreign investment and help the industrial development of port, shipping, airport, logistics, storage" and other facilities, according to a previous report from Haitong Securities Co Ltd.

That report suggested that increased trade within the zone will also mean more opportunities for financing and yuan settlements for cross-border trade.

"There are numerous special zones across the nation, but it's hard to name one that has a significant influence toward the nation's economic transformation.

"The Hong Kong model can be a good reference, but that will require less administrative-level restriction on privately owned companies, which can be counted on to take a lead and play a big role in the free trade zone," said Wang.

The nation's first bonded area was set up in Waigaoqiao in 1990. There are now 103 similar free trade zones or areas in China.

Their total trade value reached $468.5 billion in 2011, accounting for 12.9 percent of the nation's total imports and exports, according to Haitong Securities.

- Shanghai to develop bonded areas into FTZ

- Looking to China's logistics market

- Major logistics industrial park planned

- China's logistics sector reports slower growth

- Ningbo Port, Maersk to set up joint venture

- Panjin Port increases throughput by 40m metric tons

- Shanghai Port's container flow rises in March

Muscle Beach Independence Day

Muscle Beach Independence Day

Tough workout for Li Na in war of words

Tough workout for Li Na in war of words

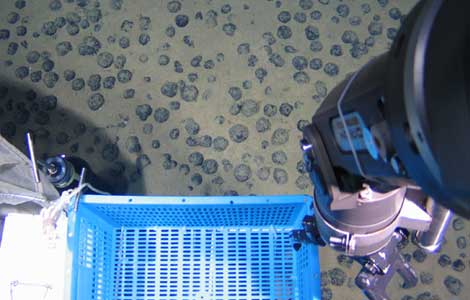

Submersible taps mineral deposits in S China Sea

Submersible taps mineral deposits in S China Sea

Ecuador finds spy mic for Assange meeting

Ecuador finds spy mic for Assange meeting

US martial artists arrive at Shaolin Temple

US martial artists arrive at Shaolin Temple

July 4 in Prescott: Balance of grief, patriotism

July 4 in Prescott: Balance of grief, patriotism

Jubilant crowds celebrate after Mursi overthrown

Jubilant crowds celebrate after Mursi overthrown

Growth slowing for services

Growth slowing for services

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Figures show shifts in US, China economies

Egypt's prosecution imposes travel ban on Morsi

Russia more impatient over Snowden's stay

Mandela still 'critical but stable'

Figures show shifts in US, China economies

Chinese electrician killed in Cambodia

EU and US set for free trade talks

China and Canada to form pact

US Weekly

|

|