Internet giants enter online pay market

Updated: 2013-07-11 07:31

By Shen Jingting (China Daily)

|

||||||||

Chinese Internet giants Baidu Inc and Sina Corp received third party payment licenses from the People's Bank of China, the central bank, to conduct related online payment services within the country.

According to the bank, the two Internet companies received official approval on July 6. Both companies were granted a five-year permission to conduct Internet payment businesses. Sina, which operates the twitter-like micro-blogging service Weibo, also got the nod to run a mobile phone payment business.

It means all major Chinese Internet companies, including Alibaba Group Holding Ltd and Tencent Holdings Ltd, have obtained third party payment licenses. Alipay, the online payment arm of Alibaba, together with Tencent's Tenpay, were among the first companies to receive licenses from the People's Bank of China - in May 2011.

The reasons why Baidu and Sina are latecomers in the online payment industry, even lagging far behind some Chinese telecom companies, is because their online payment branches are weak and didn't receive much attention from their management, said Zhang Meng, an analyst with Beijing-based research firm Analysys International.

"Baidu's and Sina's application for online payment licenses have more strategic significance than immediate practical meaning for the two," Zhang said.

Sina started to explore the Internet payment business in 2011. It launched the online payment tool SinaPay that year and upgraded the service into WeiboPay (micro-blogging wallet) in 2012. Every Weibo user automatically has a WeiboPay account. Sina said it hopes to provide a more convenient way for micro-blogging users to conduct transactions online and developers to charge users for products and services.

Sina Weibo introduced Alibaba as a stakeholder in May to act as a bridge for Sina to make use of the Alipay service. Analysts said it's safer for Sina to have its own payment tool as it's important to keep transaction data in Sina's own realm.

"An online payment service will prompt Sina Weibo's commercialization process," Zhang said. Previously, Sina had made some attempts to generate money from its Weibo platform. It cooperated with mobile phone manufacturer Xiaomi Corp to sell Xiaomi smartphones through WeiboPay last year. However, some shoppers complained after WeiboPay was paralyzed for a while through excessive use.

Baidu started investigating an online payment service as early as 2008 but the company's enthusiasm for it cooled alongside the fall of its e-commerce business Baidu Youa.

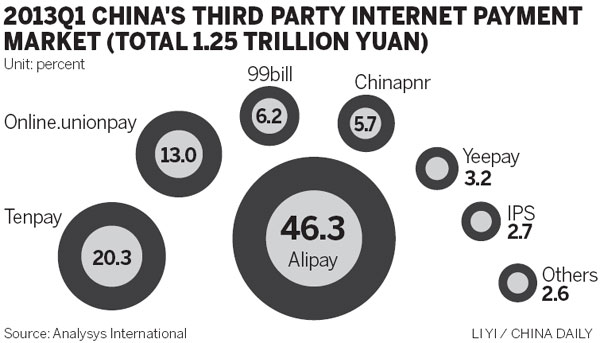

Alibaba's Alipay still dominates the Chinese Internet payment market. According to a report issued by Analysys International, Alipay had a 46.3 percent share of the online payment market in the first quarter of 2013, followed by Tencent's Tenpay, with 20.3 percent.

Alipay had a total of 800 million registered accounts by the end of April. Tenpay said it had 200 million registered users by the end of last year.

China investigates GSK executives for bribery

China investigates GSK executives for bribery

China, Russia complete 3-day joint naval drill

China, Russia complete 3-day joint naval drill

US drone completes 1st carrier landing

US drone completes 1st carrier landing

Sino-US talks 'help build trust'

Sino-US talks 'help build trust'

Boston Marathon bombing suspect pleads not guilty

Boston Marathon bombing suspect pleads not guilty

Caution urged in seeking experts from abroad

Caution urged in seeking experts from abroad

Shanghai struggles with growth

Shanghai struggles with growth

Trade town turns to tourism

Trade town turns to tourism

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Senators skeptical about Smithfield deal

Beijing has world's most delayed airport

Caution urged in seeking experts from abroad

Snowden is likely Venezuela bound

Talks 'help build trust' between China, US

Obama pushes House Republicans on immigration

Chinese researcher pleads guilty in US drug case

US Navy completes 1st unmanned carrier landing

US Weekly

|

|