FDI surges despite slowdown

Updated: 2013-07-18 05:44

By Li Jiabao (China Daily)

|

||||||||

China's GDP expanded 7.5 percent year-on-year in the second quarter, compared with the 7.7 percent growth in the first quarter and the 7.9 percent increase in the fourth quarter of last year.

Premier Li Keqiang on Tuesday pledged to keep restructuring the economy as long as growth and employment levels stay above acceptable limits, though the second-quarter slowdown raised the risk of missing the 7.5 percent growth goal for this year.

Finance Minister Lou Jiwei said on July 11 that the government will not roll out "large-scale fiscal stimulus" measures this year, after the 4 trillion yuan ($652 billion) stimulus package in the wake of the 2008 financial crisis.

Huo added that in view of June's FDI surge, it is possible that foreign investment flowed into the financing sector disguised as project spending and that the monitoring of liquidity risks "is crucial".

"FDI flowing into the services sector was higher than that for manufacturing, which highlights China's use of foreign spending and is in accordance with the government's economic restructuring," Wang said.

In the first half of the year, FDI into China's service sector rose 12.43 percent year-on-year to $30.6 billion, accounting for 49 percent of the country's total FDI, while FDI in the manufacturing sector dropped 2.14 percent year-on-year to $26.4 billion, accounting for 42 percent of the total in the same period, according to the ministry.

The ministry data also showed that FDI from the US rose 12.29 percent year-on-year to $1.83 billion in the first half while investment from the European Union increased 14.68 percent year-on-year to $4.04 billion. FDI from Japan went up 14.37 percent year-on-year in the first half to $4.69 billion.

Regarding the recent probes launched by the government into foreign companies including the pharmaceutical giant GlaxoSmithKline Plc and infant formula brands owned by Nestle SA's Wyeth, Mead Johnson Nutrition Co, Abbott Laboratories and Royal FrieslandCampina NV, Shen said that the move was not targeted at foreign investors but aimed to optimize the investment environment by creating fair and equal opportunities.

Meanwhile, China's non-financial outbound direct investment surged 29 percent year-on-year to $45.6 billion in the first half, according to the ministry. In the same period, spending in the US soared 290 percent year-on-year, that in Australia rose 93 percent year-on-year and that in the EU increased 50 percent year-on-year. But investment in Japan declined 9.1 percent year-on-year.

"China's non-financial outbound direct investment will maintain its fast growth in the second half of this year," Shen said. "China's encouraging policies and the improvement of the investment environment in host countries are the major drivers for the country's fast ODI growth in recent years. Meanwhile, Chinese companies began to get remarkable gains from outbound investments, which further strengthened their confidence in overseas investments," he added.

Detroit files biggest ever US municipal bankruptcy

Detroit files biggest ever US municipal bankruptcy

Plane crash victims' parents seek answers

Plane crash victims' parents seek answers

'Improving' Mandela marks 95th birthday

'Improving' Mandela marks 95th birthday

Qingdao eatery finds use for pesky seaweed

Qingdao eatery finds use for pesky seaweed

From university campus to boot camp

From university campus to boot camp

FIFA head: World Cup in Brazil could be mistake

FIFA head: World Cup in Brazil could be mistake

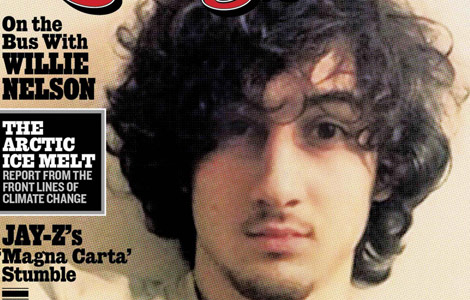

Bomber as rock star? Rolling Stone cover outrage

Bomber as rock star? Rolling Stone cover outrage

German band performs with 3D stage set

German band performs with 3D stage set

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama weighs canceling Moscow talks with Putin

Pentagon to field 4,000-person cyber squad

NSA implements new security measures

Detroit files biggest ever US municipal bankruptcy

China's Sansha city dock begins operating

Yuan: Collateral types to expand

Autopsy ordered for Hunan fruit seller

Plane crash victims' parents seek answers

US Weekly

|

|