Yuan influence on the rise worldwide

Updated: 2013-07-22 08:19

By Wang Xiaotian in Beijing and Singapore, and Li Xiang in Paris (China Daily)

|

||||||||

Asian advantage

An index compiled by Standard Chartered that tracks the progress of the yuan business breached 1,000 points for the first time in May.

The index, which started on Dec 31, 2010, at 100 points, tracks yuan activity in Hong Kong, Singapore and London.

The lender, however, indicated that overseas activities of the Chinese currency might soften in the second half, because yuan current account inflows into offshore markets ease because of the pauses in onshore yuan appreciation.

According to a survey conducted by BOC in June, nearly 80 percent of its 3,000 clients said they use the yuan because they have trade relations with the Chinese mainland and would like to settle transactions in the currency, while most of the overseas clients ranked stability of the yuan exchange rate as the top factor in choosing to use the Chinese currency.

"Hong Kong and Singapore have yuan clearing banks and are key centers for fostering yuan-based trade settlement and investment services," says Chin of York University.

Taiwan is also catching up fast. In February, Taipei became the fourth-largest offshore center for yuan settlement, behind Hong Kong, London and Singapore, up from seventh place in August 2012.

Yuan payments also accounted for 12 percent of Taiwan's bilateral trade with the Chinese mainland in March 2013.

"Taiwan's offshore market is developing quickly. Deposits are already at 66 billion yuan and we expect them to rise to 100 to 150 billion yuan by year-end," says the Standard Chartered Bank report.

There are, however, limits to how far the yuan can be internationalized through offshore channels, or via limited offshore-onshore options, Chin says. "China should not be hasty in appointing clearing banks in offshore sites."

The BOC survey also showed that 90 percent of the total yuan settlements were related to companies located on the mainland, or firms with a mainland background.

"That means only 10 percent of the yuan settlements happen between the overseas third parties, among which most are companies from Hong Kong and Macao," says Cheng Jun, general manager of the Corporate Banking Unit at BOC.

Mark Boleat, policy chairman of the City of London Corp, which oversees the running of London's business district, says that opening up the capital account and making the yuan fully convertible is a must for a prosperous offshore market. He says the quotas for the yuan qualified foreign institutional investor program (RQFII) need to be further extended to promote offshore-onshore circulation of the currency.

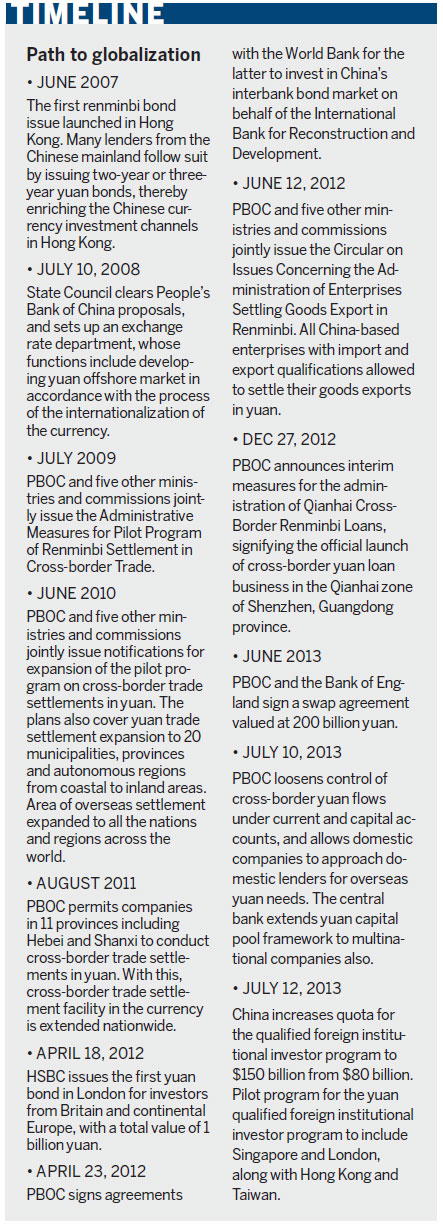

China on July 12 announced an expansion in the quota for QFIIs to $150 billion from $80 billion. It said the pilot program for RQFII will now include Singapore and London, with Hong Kong and Taipei already having joined the plan. The RQFII quota was set at 270 billion yuan in November last year.

The PBOC also announced on July 10 a set of measures to loosen controls on cross-border yuan flows under both the current and capital accounts. According to the new rules, domestic firms can apply to domestic banks to disburse the yuan overseas, while multinational companies can utilize a yuan capital pool framework to do the same.

Zhang Weiwu, general manager of the Industrial and Commercial Bank of China's Singapore branch, says the fact that the yuan is not yet fully convertible determines that apart from the naturally breeding market demand, banks' product innovation and guidance to the clients will play a substantial role in promoting wider acceptance of the currency. Foreign banks also have an edge as they have a strong local customer base in offshore markets, rich trading expertise and experience.

"In addition, they can contribute more to the innovation of the yuan-investment products," says Fang Wenjian, CEO of Bank of China (UK) Ltd.

The role of Chinese banks and that of international financial institutions will be more complementary than competitive, Fang says.

Zhang Chunyan in London and Zhang Yuwei in New York contributed to this story.

Contact the writers through wangxiaotian@chinadaily.com.cn

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Quake in NW China kills 89, injures 700

US blacks, whites split on Zimmerman verdict: poll

Kissinger and Jiang see bright future for relations

China sees no major forex withdrawal: regulator

Business holds up for Minmetals arm

Beijing knife attack leaves one dead

Kate gives birth to a baby boy

ROK-DPRK industrial park talks end

US Weekly

|

|