How strong is China Inc?

Updated: 2013-07-22 10:05

(bjreview.com.cn)

|

||||||||

|

|

|

ENERGY MOGUL: Beijing-headquartered Sinopec Group is ranked fourth on this year's Fortune Global 500 List, the highest among Chinese companies [Photo/bjreview.com.cn] |

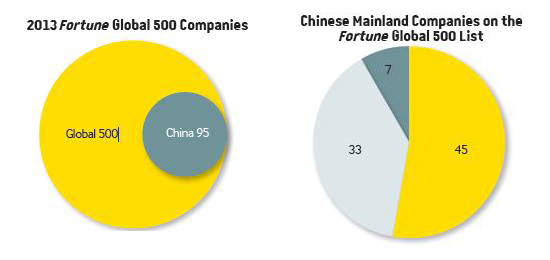

Fortune compiles its annual list based on a company's gross revenues, not profits. Chinese companies now account for nearly 20 percent of all companies on the list, roughly the same proportion of its population against the global population. But a closer look at the companies reveals that the problems plaguing the world's second largest economy are the same ones that could keep China Inc from truly going global.

China is making its mark on one of the world's most prestigious lists. A total of 95 Chinese companies made it on this year's Fortune Global 500 List, which was compiled by Fortune magazine. Those 95 companies include 85 from the Chinese mainland, six from Taiwan and four from Hong Kong.

On the rise

Netherlands-based Royal Dutch Shell topped the list with revenues over $481.7 billion in 2012, followed by Wal-Mart and Exxon Mobil, both US companies. China now has the second most companies on the annual ranking behind the United States, which boasts 132 companies. China added an additional 16 and overall exceeds the number of Japanese companies at 62.

Chinese companies account for 17 percent, or $5.2 trillion, of the gross revenues by the top 500, compared with the 28 percent, or $8.6 trillion, by US companies.

Three Chinese companies made it to this year's top 10. With gross revenues of $428.17 billion in 2012, China Petrochemical Corp (Sinopec Group) was ranked fourth overall. China National Petroleum Corp (the parent company of PetroChina), with gross revenue of $408.63 billion in 2012, ranked fifth. Both companies edged up by one spot from last year. The State Grid, with a gross revenue of $298.45 billion in 2012, was ranked seventh, the same as last year.

Concerns

Numbers, of course, don't mean everything. Chinese companies on the Fortune list are indeed big enough, but experts say the presence of many Chinese companies on the renowned list could be nothing more than a mirage.

Concerns include low profit margins and a lack of international operating skills. Among the mainland companies on the list, 10 of them logged losses in 2012 and six of them are even on Fortune magazine's ranking of top 50 companies (selected from its Global 500) with the biggest losses, while 33 saw declining profits.

In sharp contrast with the losses, China's financial industry players on the list raked in exorbitant profits in 2012. A total of 13 financial institutions from the Chinese mainland are on the list, including nine commercial banks and four insurance companies. Their profits account for a whopping 56.5 percent of the total. In comparison, 27 US financial institutions are on the list, including eight commercial banks, four diversified financial companies and 15 insurance companies. Their profits account for only 25.9 percent of the total.

Experts say those profits are worrisome.

"Financial excess is a phenomenon that the Chinese Government should be highly alert against," said Zhou Zhanhong, Assistant Executive Editor in Chief of the Chinese version of Fortune magazine.

The growing presence of Chinese State-owned enterprises (SOEs) in the rankings has rung some alarm bells for reform. Among the 85 Chinese mainland companies, over 90 percent are SOEs, meaning the country's private sector has largely missed out. Only seven of them made it onto the list. Two more private companies were added this year: the Shenzhen-based Amer International Group and Beijing-headquartered China Minsheng Banking Corp.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Guangdong to probe airport bomber's allegations

Police meets GSK representative after scandal

US protests demand 'justice for Trayvon'

6.6-magnitude quake hits NW China

Minister rules out stimulus package

Top Chinese admiral to visit US this year

Victory improves Abe's hand

Yuan influence on the rise worldwide

US Weekly

|

|