Provinces see slower growth

Updated: 2013-07-23 07:19

By Zheng Yangpeng (China Daily)

|

||||||||

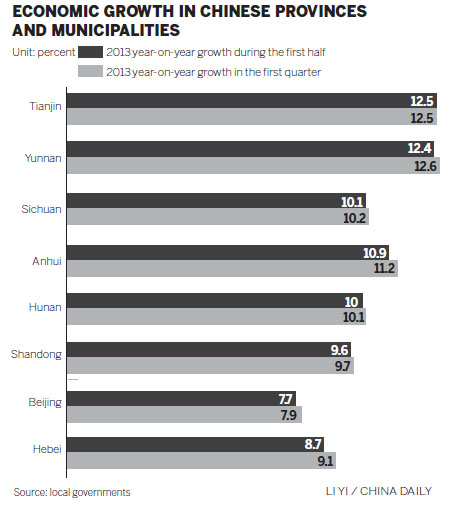

China's regional economies generally posted slower gross domestic product growth in the second quarter, in line with the slowdown in the national economy.

Analysts said hinterland regions should particularly boost their competitiveness as fixed-asset investment, a traditional engine for these regions, is unlikely to accelerate significantly in the second half of this year.

Of the 14 municipalities and provinces across China that have published their GDP figures in the first half of the year, 10 provincial regions' growth rates dropped compared with the first quarter. Three regions maintained the same growth rate, while one rose.

Provincial governments in China do not release individual figures for the second quarter, and the national GDP figure does not necessarily equal the aggregate of each region's figures.

China's GDP grew 7.5 percent year-on-year in the second quarter, down from 7.7 percent in the first quarter.

Hebei province saw the largest growth drop in the first half among provinces that have released their data so far. Its 8.7 year-on-year GDP growth in the first half was 0.4 percentage point lower than that in the first quarter.

Regional economy experts said Hebei's decline was largely due to the gloomy steel industry, which has been mired in chronic overcapacity. Hebei produces a quarter of China's steel.

Yao Huiqin, deputy director of the Center for Studies of China's Western Economic Development at Northeast University, said: "Hebei is not alone. Other provinces in central and western regions also face greater downside pressures from sluggish pillar sectors, such as mining, steel and metals."

A report published last week on the western region's economic prospects, said the area's greatest weakness is that it still lacks an internal growth engine. The region's industrial revenue growth was not due to technological upgrading or improved competitiveness, but resource exploitation and price rises.

Experts said that provinces with a greater reliance on fixed-asset investment would see their GDP growth come under greater pressure in the second half of this year, as there was little prospect of the central government rolling out a large-scale investment program.

Liang Hong, managing director of China International Capital Corp, said the desired outcome could not be realized if China continued to rely on government-led investment to spur growth.

On the contrary, the leverage level, which is already high, would be pushed higher and resource misallocation would intensify.

In a half-year macroeconomic report, Bank of Communications predicted that though fixed-asset investment may pick up a bit in the second half, it is unlikely to rally, dragged by sluggish manufacturing demand. The bank forecast that fixed-asset investment growth in 2013 would be 20.4 percent, slightly higher than 20.1 percent growth in the first half.

Bank of Communications Chief Economist Lian Ping cautioned that slower household income growth might affect the consumption sector, another important part of the economy. In the first half of this year, urban household disposable income grew just 6.5 percent, 3.2 percentage points lower than a year ago.

Alaistair Chan, a Sydney-based economist with Moody's Analytics, noted that investment contributed 5.9 percentage points to second quarter growth, more than double the 2.5 percentage point contribution from consumption.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US diplomat says China ties a priority

Nation falling short on IT security

Weiner not dropping out of NYC mayoral race

Death toll from H1N1 in Argentina reaches 38

DPRK halt on rocket facility confirmed

Celebrations erupt after word of regal delivery

Office to close due to protest in Manila

Multinationals' dependence on China grows

US Weekly

|

|