New tax cuts nurture small business growth

Updated: 2013-08-02 09:28

(Xinhua)

|

||||||||

TIANJIN -- Guan Guifeng paid 700 yuan ($114) in taxes on her Tianjin-based communications equipment business in July, but starting Aug 1, that burden will be a thing of the past.

Guan's business is among some 6 million small firms whose tax burdens will be significantly eased since the State Council, China's cabinet, announced in late July a move to suspend value-added tax (VAT) and turnover tax for businesses with monthly revenues below 20,000 yuan, starting from Aug 1.

The monthly revenue of Guan's Tianjin Yingtai Communication Equipment Sale Co Ltd, stands at around 15,000 yuan. Prior to the tax cuts, given tax rates ranging from 5 to 7 percent, Guan paid about 1,000 yuan, a quarter of her profits, in VAT and turnover taxes.

The tax cuts were rolled out in an effort to bolster slowing economic growth, and China's Ministry of Finance estimates that the cuts will save businesses 30 billion yuan this year.

While analysts believe the policy will have more of a symbolic significance than a material impact as the 20,000 yuan revenue threshold only applies to a limited number of companies, the move will surely send ripples through a part of the economy that employs tens of millions of people.

According to statistics from the Ministry of Industry and Information Technology, 99 percent of companies registered in China are small and medium enterprises (SMEs) and they produce up to 80 percent of urban jobs.

These companies also make up 60 percent of China's economic output. Easing their tax burden is part of what many call a "micro stimulus" plan that is more targeted and efficient than the massive liquidity injection unleashed in the wake of the global financial crisis in 2008.

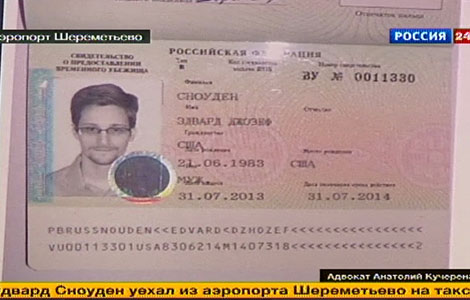

Snowden granted 1 year's temporary asylum in Russia

Snowden granted 1 year's temporary asylum in Russia

China sails through 'first island chain'

China sails through 'first island chain'

City's visa-free offer gets first takers

City's visa-free offer gets first takers

Property prices rise again

Property prices rise again

One-stop service offers new hope

One-stop service offers new hope

Private museums increasingly under spotlight

Private museums increasingly under spotlight

Apple CEO met China Mobile head, talked co-op

Apple CEO met China Mobile head, talked co-op

Kerry in Pakistan on unannounced visit

Kerry in Pakistan on unannounced visit

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Snowden granted one-year asylum in Russia

China sails through 'first island chain'

US rethinking Putin summit

Property prices rise again

China 'to add more to global growth'

Nation 'confident' on trade

Snowden has entered Russia: lawyer

China opposes US resolution

US Weekly

|

|