China's top banking regulator diagnoses the system

Updated: 2013-08-05 10:33

(cntv.cn)

|

||||||||

China's banking sector suffered a credit squeeze, late June, borrowing costs surged to record highs. Not surprisingly, both banks and borrowers have showed serious concerns about the stability of the system. CCTV talks with Shang Fulin, chairman of the China Banking Regulatory Commission, about those concerns.

China's key banks ranked high in Fortune's list this year. But most interbank borrowing operators won't forget tight liquidity conditions at the end of June. Under these circumstances, a question is rising: how is China's banking sector now?

"On the whole, I think the banking system is healthy. Several key indicators, such as lending and deposit growth, capital ratio and bad asset ratio, are almost the same from a year ago. Some are even performing better. Compared with the top 1000 banks in the world, our indicators are higher, which means better." Shang Fulin said.

Official data backed the comments. In the first half of 2013, Chinese banks' net profit was about 753 billion yuan, or $123 billion, which increased nearly 14 percent year on year. Meanwhile, the bad asset ratio was less then one percent, much lower than the global average level.

But the CBRC also notes the risks, especially in the local financing and property loans.

"Generally, the risks are under control. The local financing is better than general ones. It has long duration and lower bad loan ratio. Besides, most of our local financing are invested in manufacturing projects. The growth rate of property loan is lower than general loan's. Individual loans count around 60 percent of the total, which basically is safe." Shang Fulin said.

Shang also mentioned the risk of the so-called "shadow banks" in China. He said the "shadow-bank" products will bring some risks to the system, but the impact won't be big because the products' proportion is small.

Shang said that China will boost loans through innovation and guide banking loans, running to crucial sectors and industries, as well as to micro-and-small firms.

Fly for adventure at US air show

Fly for adventure at US air show

Kobe Byrant meets fans in Shenzhen

Kobe Byrant meets fans in Shenzhen

New Zealand milk stokes fears

New Zealand milk stokes fears

Yemen enhances security over embassies

Yemen enhances security over embassies

Chinese heavy ground combat vehicles join drill

Chinese heavy ground combat vehicles join drill

Police find kidnapped baby alive in Henan

Police find kidnapped baby alive in Henan

Privacy 'needed' for young offenders

Privacy 'needed' for young offenders

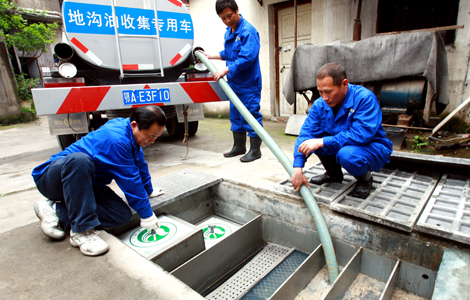

GPS devices to tackle food waste problem

GPS devices to tackle food waste problem

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Overseas investors welcome to bid in Beijing

US extends closure of embassies

New Zealand milk stokes fears

Riding the clean energy boom today

Magnetic attraction for EU SMEs

Mugabe wins Zimbabwe presidential election

EU solar deal hailed as blueprint

Shanghai probes sex claims against officials

US Weekly

|

|