Slowing economy takes toll

Updated: 2013-08-15 09:24

By Wang Xiaotian (China Daily)

|

||||||||

Beijing-based Hua Xia Bank Co Ltd also experienced declining asset quality. Its NPLs went up by 726 million yuan in the first half.

Its NPL ratio rose 0.03 of a percentage point to 0.91 percent. In East China, the ratio reached 1.46 percent, it said.

Soured loans of Industrial Bank Co increased 2.3 billion yuan to 7.6 billion yuan in the first half. Overdue loans, an indicator of future NPLs, surged by 4.5 billion yuan to 7.7 billion yuan.

Its NPL ratio rose 0.14 percentage point to 0.57 percent.

Guo Tianyong, director of the Research Center of the Chinese Banking Industry at the Central University of Finance and Economics in Beijing, said the rise in NPLs was a natural result of the economic slowdown.

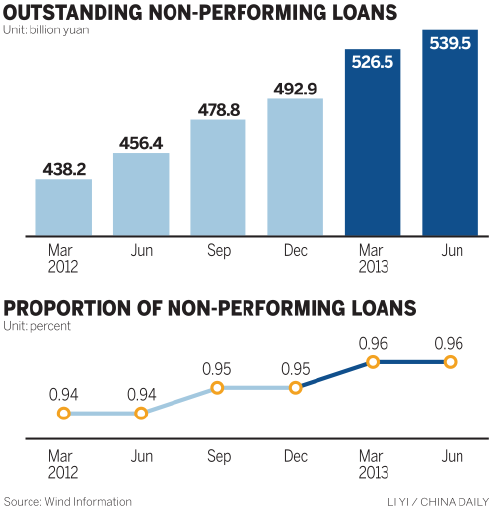

The China Business News on Wednesday reported that as of June 30, outstanding bad loans in the eastern provinces of Zhejiang, Jiangsu and Shandong totaled 247.1 billion yuan, accounting for 45 percent of bad loans nationwide.

Jimmy Leung, PricewaterhouseCoopers' banking and capital markets leader for China, said earlier that banks should now write off more bad loans using their profits.

But bank profitability had declined because of the domestic economic slowdown and government moves to liberalize interest rates and curb credit expansion.

The China Banking Association previously forecast that domestic banks' net-profit growth rate would drop by about 8 percentage points this year from last year's 18.9 percent.

Industrial Bank's interim results showed its profit growth of 27 percent was far below the 40 percent average pace during the same period of the past three years.

The half-year profit growth rate of Hua Xia Bank was 20 percent, compared with 42 percent in the first half of 2012.

Two killed in fiery crash of UPS cargo jet

Two killed in fiery crash of UPS cargo jet

Special bus seat for breast-feeding mothers

Special bus seat for breast-feeding mothers

Northern exposure

Northern exposure

Re-enacting ancestors' journey to the west

Re-enacting ancestors' journey to the west

Yao dreams of sports for fun with towering charity

Yao dreams of sports for fun with towering charity

Protests arise in Taiwan over 'comfort women'

Protests arise in Taiwan over 'comfort women'

Huawei unveil Ascend P6 smartphone in Vienna

Huawei unveil Ascend P6 smartphone in Vienna

When small is beautiful in hotel industry

When small is beautiful in hotel industry

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Abe rules out visit to Yasukuni shrine

Snowden case not to affect US-Russia talks

Over 200 dead after Egypt forces crush protesters

Manning 'sorry' for US secrets breach

China to probe foreign automakers

2 killed in crash of UPS cargo jet

Watchdog to protect rights of consumers

Sizzling summer tops the record list

US Weekly

|

|