More refiners allowed to import oil

Updated: 2013-08-17 08:28

By Du Juan (China Daily)

|

||||||||

The State Council, China's cabinet, will grant crude oil import quotas to "qualified" refineries, which experts say is a step forward in trimming large State-owned refiners' import monopoly.

The No 83 Document from the cabinet, issued on July 27, mainly focuses on promoting imports and exports.

The document said the central government may grant oil import rights to more refineries beyond the dominant companies, taking into account standards for environmental protection, security and energy consumption during the refining process.

In China, five State-owned companies have crude import rights, including two energy giants - China National Petroleum Corp and China Petrochemical Corp.

In the past year, China National Chemical Corp (ChemChina), which is focused on petrochemical downstream businesses, got a quota of 10 million metric tons for imported crude, which was seen as a major step in breaking the monopolized oil import market in China.

However, Li Li, a senior manager at ICIS C1 Energy, a Shanghai-based energy information consultancy, said ChemChina's new status is significant, but it won't be easy for other private refineries to emulate.

"China's crude oil refining industry has been asking for years for the opening up of the crude import market," said Li. "Some positive policies have emerged gradually, but they don't make the new policy a 'milestone'."

The international oil majors would like to see China further open up its import market, which will mean huge benefits for them since the country is about to become the world's largest crude oil importer, she said.

According to a report by the United States Energy Information Administration, China's net oil imports will exceed those of the US on an annual basis within about two months.

"It is the trend that China's crude import market will be more market-oriented and less monopolized, but it is still uncertain how long it will take to fully realize (the change)," Li said.

"The State Council is the top policymaker and it usually takes a long time from the top down, which is similar to the process of economic reform as it involves many parties' interests."

China's crude oil consumption last year was 475 million tons, up 4.7 percent year-on-year, according to CNPC.

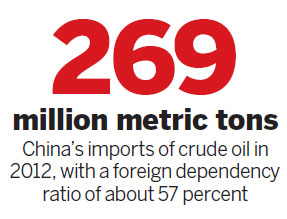

China imported 269 million tons of crude in 2012, with a foreign dependency ratio of about 57 percent.

According to the CNPC Economic and Technology Research Institute, China will import about 289 million tons of crude oil this year, which means that about 59 percent of the nation's crude oil demand will depend on imports in 2013.

As the country's oil consumption increases, its dependency on imports will continue to rise.

When China joined the World Trade Organization in 2001, it promised that the crude import quota of non-State trading organizations would grow 15 percent annually from 2006 to 2010.

So far, dozens of private companies have been granted crude oil and petroleum import certifications by the Ministry of Commerce.

However, up to 90 percent of the crude imports is still controlled by the two giants of the industry.

As for crude pipeline construction and oil storage facilities, the government is encouraging the participation of private capital.

According to an industry source, Tyloo Energy Co and Zhongji Chemical Co in Zhoushan, Zhejiang province, acquired crude storage licenses from the Ministry of Commerce during the first half of the year.

The two companies are subsidiaries of Tyloo Investment Group, which is said to be planning an expansion of its involvement in international crude oil trading.

dujuan@chinadaily.com.cn

(China Daily 08/17/2013 page9)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Dozens die in Egyptian bloodbath

Watchdog won't block Abe's military changes

Xi vows medical support to Africa

China trims US Treasury holdings in June

US urged to share with China

Defense chief kicks off US visit

Error puts Shanghai bourse in a spin

Japanese leaders claim neutrality

US Weekly

|

|