Undue taxes suggest local fiscal pressure

Updated: 2013-08-19 10:24

(Xinhua)

|

||||||||

A recent audit from eastern coastal province of Shandong showed that 40 enterprises from 11 counties had been overcharged 573 million yuan ($92 millon) land utilization and value added taxes by the end of 2012.

Six other enterprises had been prematurely levied taxes worth 144 million yuan.

Companies in northern Hebei province and southern Guangdong complained that they had been levied taxes that they should not have paid or were supposed to be paid in the next fiscal year.

Statistics from the China Iron and Steel Association showed that 80 of its members were supposed to pay 89 billion yuan taxes in 2012, but actually paid 98.4 billion yuan.

A number of reasons lie behind these malpractices by tax authorities: Local government pursuit of higher revenues is a major cause, according to Liu Shangxi, deputy director of the Research Institute for Fiscal Science, at the Ministry of Finance.

"Many local governments have aggressively pursued fiscal revenues and demanded increments in tax income, so the tax authorities have done whatever they could (to levy taxes)," Liu said.

China's economy has shown signs of slowdown since last year, bringing local governments under pressure to reduce their expenses.

Figures released by the Ministry of Finance show China's tax revenue totalled 6.94 trillion yuan in the first seven months this year, up 8.5 percent year-on-year. However, the growth is 0.5 percentage point lower from the same period last year.

In such circumstances, local government debt has become a grave concern in China.

An audit conducted in 2011 by the National Audit Office (NAO) found that local government debt totaled 10.7 trillion yuan at the end of 2010, more than 26 percent of gross domestic product.

In early June this year, the NAO said a follow-up audit found total debt of 3.85 trillion yuan owned by 36 local governments by the end of 2012, up 12.9 percent from 2010.

Illegitimate taxes can temporarily increase fiscal revenues of local governments but, in the long term, they harm enterprises and inhibit the establishment of a healthy tax system.

Liu believes local governments should better manage their expenses rather than charge these taxes to deal with their fiscal burdens.

Nadal beats Isner to win first Cincinnati crown

Nadal beats Isner to win first Cincinnati crown

Wild Africa: The new attraction to Chinese tourists

Wild Africa: The new attraction to Chinese tourists

Azarenka beat Williams for Cincinnati title

Azarenka beat Williams for Cincinnati title

500th eruption of Sakurajima Volcano in 2013

500th eruption of Sakurajima Volcano in 2013

A cocktail that's a treat for the eyes

A cocktail that's a treat for the eyes

Private sector to care for the elderly

Private sector to care for the elderly

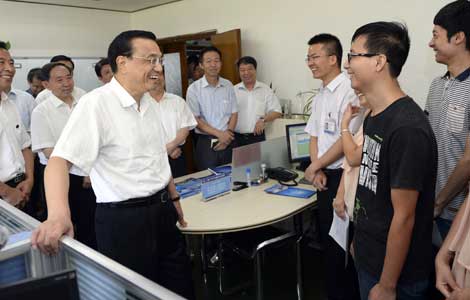

Be innovative, Li tells graduates

Be innovative, Li tells graduates

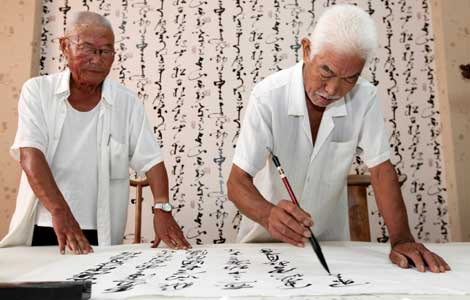

Go online to reap the harvest

Go online to reap the harvest

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Iran signals willingness to resume nuclear talks

Baby formula sales to be shifted to pharmacies

CIA document release acknowledges Area 51

36 killed in Egypt's prison truck escape attempt

Be innovative, Premier Li tells graduates

Onus on US to improve military ties

Trustee council may be answer for reforming

40 killed as floods ravage NE China

US Weekly

|

|