High hopes after CCC's Nasdaq listing

Updated: 2013-08-20 07:49

By Yu Ran in Shanghai (China Daily)

|

||||||||

Despite the tepid performance of China Commercial Credit Inc's shares after the company's debut on Nasdaq, fans and customers in the company's native city in Jiangsu province are hoping that the listing will indirectly benefit the many cash-starved small companies in the region.

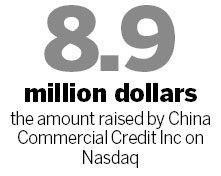

The company, founded by Qin Huichun, a former executive of the central bank's local branch, is the first Chinese lender to raise capital in a foreign market. The $8.9 million it raised on Nasdaq is a modest sum. But that doesn't seem to have dampened the enthusiasm of the company's supporters in Wujiang, which was incorporated as a district of Suzhou in 2012.

Wujiang, which used to be one of the fastest-growing townships in the region, is well known as the home of many small and medium-sized textile and garment companies that are struggling to move up the value-added chain by upgrading their products and developing their own designs and branding. As such, most of them are looking to their local lending companies for funding.

The company's stock exchange filings showed that its outstanding loans to a total of 248 borrowers, including businesses and rural farmers, amounted to $85.8 million at the end of 2012. In addition, it also acted as guarantor for loans worth $84.4 million for 116 companies.

Qin said that he needed to raise new capital to finance his plans to expand the company's lending business beyond Wujiang, the Wall Street Journal reported.

For now, his clients are expecting that he uses the new capital to help them fund their own expansion plans.

"We'll be delighted if the company offers a large amount of loans with reasonable interest rates after the US listing," said Zhang Guorong, the owner of Suzhou Meihaoting Clothes Co Ltd, a medium-sized manufacturer and exporter in Wujiang district.

Zhang added that the current annual interest rate of loans by small-lending firms is still quite high at nearly 20 percent, and such loans are only used as a short-term solution for cash flow problems.

In addition, the sluggish global economy has brought more challenges to local companies. Due to the lackluster economic situation in the US and Europe, nearly 70 percent of micro workshops that made linings for clothes were shut down in Wujiang due to lack of funds to pay back their debts.

"Hopefully, the listed small-loan company will soon ease the severe cash flow problems of the micro enterprises in the region," said Zhang.

In 2008, when the company was set up, the central government issued rules to allow lenders to get the money flowing and support SMEs with financial problems.

At the end of June, there were 7,086 small-loan companies in China, with the balance of loans exceeding 704 billion yuan ($115 billion). The amount of new loans for the first half was 112.1 billion yuan, according to the half-year report on small-loan companies released by the central bank at the end of July.

Getting loans from State-owned banks to solve their financial problems has proven very challenging for SMEs in China. The banks prefer to lend to State-owned enterprises with lower credit risks.

Therefore, most SMEs have to rely on small-loan companies and even private lenders to solve their cash flow problems.

"Most property developers like us have to borrow short-term money with high interest rates from trust companies, underwriting companies and private-money lenders for about a week every three months if we're launching new projects," said Peng Shangyue, the chairman of Jiangsu Jucheng Real Estate Co Ltd.

Meanwhile, small-loan companies are not allowed to collect deposits so they only can borrow money from financial institutions by pledging their registered capital. They then lend on to borrowers that failed to get loans from banks.

"I think that getting listed in the US as a small-loan company is a brave step to explore new financing platforms, which should be encouraged as it will definitely make more money available for lending," said Fu Jiarong, manager of Wenzhou Jiexin Small-Sum Loan Co.

However, experts said that not every small-loan company will be able to get listed to expand its financing channels.

"Getting listed could be a solution for qualified small-loan companies to raise more funds for loans, but the scale of most small-loan companies in China is too small for listings," said Liu Shengjun, the executive deputy director of the CEIBS Lujiazui Institute of International Finance.

Liu added that allowing private investors to enter the financial system by launching privately owned banks could be a better solution to make sure that SMEs have ample access to loans.

Merkel makes historic visit to Nazis' Dachau camp

Merkel makes historic visit to Nazis' Dachau camp

Chinese fleet sets sail for joint drills

Chinese fleet sets sail for joint drills

President Xi meets WHO director-general

President Xi meets WHO director-general

Everyman movie star

Everyman movie star

Rural boarding schools need dorm managers

Rural boarding schools need dorm managers

Center of hope and support

Center of hope and support

Chinese characters under threat in digital age

Chinese characters under threat in digital age

US, China to expand military exchanges

US, China to expand military exchanges

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Dispute slows positive trend on Korean Peninsula

Expanded Sino-US exchanges to stabilize ties

Chinese fleet sets sail for joint drills

Premier Li stresses need for reform

Children with HIV live in fear

Kidney trafficking operation smashed

Food safety tops public's concerns

Monkeys at park given contraceptives

US Weekly

|

|