Better times for insurers as profit surge

Updated: 2013-08-31 08:17

By Gao Changxin in Hong Kong (China Daily)

|

||||||||

Ping An Insurance (Group) Co of China Ltd, the nation's second-largest insurer, reported a 28.3 percent rise in first-half profit to 17.9 billion yuan ($2.9 billion) on Friday - part of a string of encouraging results for the sector.

Insurers benefited from the performance of the nation's equity market, which significantly increased their investment returns in the first half.

The benchmark Shanghai Composite Index had a short bull run early in 2013, and it jumped about 20 percent by the end of January from a December low.

That positive period for stocks was enough to boost insurers' performances.

Ping An, which also has operations in banking and wealth management, joined its peers to achieve surging investment returns. First-half investment income almost doubled to 26.44 billion yuan.

Net investment income, mainly comprised of interest and dividends, increased 24 percent to 25.97 billion yuan.

Impairment losses from investments shrank 73 percent to 1.05 billion yuan, following a doubling last year. That translates into a yield of 4.9 percent, up 1.2 percentage points from 3.7 percent in the first half of last year.

In the same period, China Life Insurance (Group) Co, China's biggest insurer, saw its investment yield increase 2.13 percentage points to 4.96 percent.

Yields at China Pacific Insurance (Group) Co Ltd and New China Life Insurance Co Ltd increased 0.9 and 0.8 percentage point to 4.8 and 4.3 percent, respectively

The higher investment yields also reflected new rules that were in effect since the end of last year, which gave insurers more freedom in choosing asset classes when investing client money.

Chief Investment Officer Timothy Chan said Ping An looks for low-priced blue-chips that pay "decent" dividends. Some smaller companies, he said, aren't favorable in terms of valuation at the moment.

A total of 9.4 percent of Ping An's 1.15 trillion yuan in insurance funds is invested in equities, with 83.6 percent in fixed-income products, he said.

Chan said that the investment structure will remain stable for the rest of the year.

The Shenzhen-based company said in a statement to the Shanghai Stock Exchange on Friday that its new business value, a gauge for the profitability of new life policies sold, rose 14.2 percent.

China Life saw its profit jump 68 percent from a year earlier in the first six months on higher investment income and lower impairment losses.

China Pacific Insurance's net income more than doubled to 5.46 billion yuan.

Ping An stock rose 0.93 percent to HK$54.35 ($7) in Hong Kong on Friday, trimming this year's decline to 16 percent.

Li revenges on Robson to reach last 16

Li revenges on Robson to reach last 16

Xi urges military to expand training

Xi urges military to expand training

'Brother Watch' pleads guilty to corruption

'Brother Watch' pleads guilty to corruption

Flight team performs first show abroad

Flight team performs first show abroad

Theater to be built at Terracotta Warriors site

Theater to be built at Terracotta Warriors site

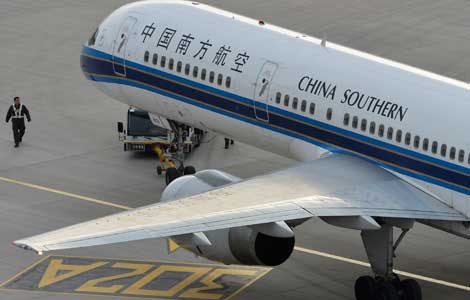

Economic slowdown, railways hold back airlines

Economic slowdown, railways hold back airlines

Sinopec takes stake in Egyptian oil

Sinopec takes stake in Egyptian oil

Lost for words

Lost for words

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

5.9-magnitude quake jolts SW China

UK asked NY Times to destroy Snowden material

US says 1,429 killed in Aug. 21 chemical attack

US boosts troops in Philippines amid tension

Xi urges military to expand training

IMF warns on capital account

Error costs Everbright millions

Economic slowdown, railways hold back airlines

US Weekly

|

|