Service-sector expansion slows

Updated: 2013-10-08 23:32

By Chen Jia (China Daily)

|

||||||||

HSBC's services PMI stands at 52.4 in September from August's 52.8

|

|

|

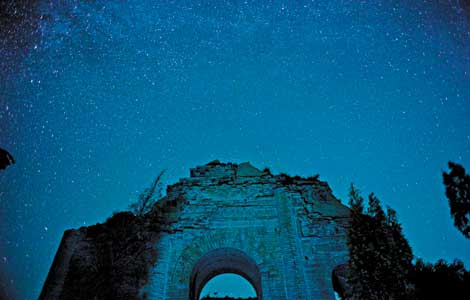

Waitresses set the table for guests at a themed restaurant in Taiyuan, Shanxi province. HSBC Holdings Plc said that growth in service-sector activity “remained substantially below-trend” in September. Fan Minda / Xinhua |

China's service sector expanded at a moderate pace in September, indicated by a 52.4 reading for the HSBC Services Purchasing Managers' Index, down from 52.8 in August, the bank said on Tuesday.

A report from HSBC Holdings Plc suggested that growth in service-sector activity "remained substantially below-trend".

One indicator of slack conditions was work backlogs, which declined at service providers in September. "But the rate of reduction was only marginal," it said.

A PMI reading above 50 means expansion, while one below 50 shows contraction.

Service managers expect higher activity levels in the next 12 months.

However, some of them remain worried about relatively weak demand that may restrict business growth, according to HSBC.

Qu Hongbin, chief economist in China at HSBC, said: "China's services activity growth appears to be stabilizing at a faster pace than in the second quarter. This led to a renewed expansion of employment, against a contraction in August.

"Combined with the gradual improvement of the manufacturing PMI, the Chinese economy is still on the way to a modest recovery. But a more consolidated and sustainable recovery requires structural reforms," he added.

Last Thursday, a separate survey from the National Bureau of Statistics and the China Federation of Logistics and Purchasing reported a non-manufacturing PMI of 55.4 in September, up from 53.9 in August — the highest level since March.

The official non-manufacturing PMI survey also covers the construction industry, in addition to the service sector.

Increased consumption in preparation for the "Golden Week" National Day holidays, which ended on Oct 7, boosted consumer services in September, and the government's aim of rebalancing the nation's industrial structure has increased demand in non-manufacturing sectors, said Cai Jin, CFLP vice-chairman.

In September, production activity in the manufacturing industry, as indicated by the official figure, edged up to 51.1 from 51 in August, though it was still below expectations.

Meanwhile, the final HSBC manufacturing PMI came in at 50.2 in September compared with August's 50.1.

Stronger expansion of industrial output and the service business since July may indicate faster GDP growth in the third quarter. Economists estimate the July-September growth figure could be 7.6 percent, after expansion slowed to 7.5 percent in the second quarter.

Complete third-quarter economic indicators are due for release by the NBS on Oct 18.

Chang Jian, a senior economist in China with Barclays Capital, said that the strong acceleration in industrial activity in July and August may not be sustained, as it reflected restocking and a temporary acceleration in infrastructure investment.

A slowdown is likely in GDP growth in the fourth quarter, and the rate for 2014 may retreat to 7.1 percent. That's below the consensus forecast.

That is because "the China economy faces various fundamental challenges, including industry overcapacity, financial and fiscal risks, a latent property bubble and a falling potential growth rate", Chang said.

"We expect the government to shift its policy focus from 'stabilizing growth' now to 'adjusting the economy's structure and promoting reforms' in 2014," she said.

China "will likely cut its 2014 GDP growth forecast to 7 percent from 7.5 percent next March", Chang added.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

ZTE, NBA's Houston Rockets shooting for global markets

Back to 1942, entered for the 86th Oscars

Obama says he'll negotiate once 'threats' end

Unprotected sex brings sharp rise in HIV/AIDS

Japan-US military drill raises tension

Xinjiang bid to curb terrorist attacks

No Xmas in July for vendors at Yiwu's market

Yellen to be nominated for Fed chair

US Weekly

|

|