No hard landing expected: UBS

Updated: 2013-10-16 07:05

By Xie Yu in Shanghai (China Daily)

|

||||||||

China's economy is unlikely to stage a strong rebound, as many investors have been hoping. But there won't be a hard landing, as many pessimists have predicted.

That's the verdict of UBS Securities' chief China strategist Gao Ting. He said that economic growth has reached a plateau and the government is trying to steer the economy to a safe middle course, fighting an unpredictable undercurrent.

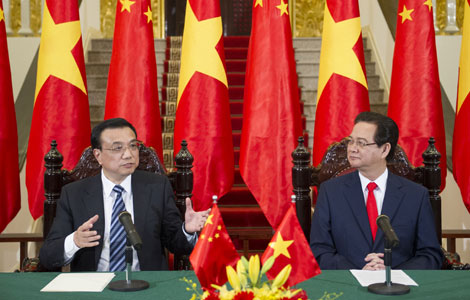

"Premier Li [Keqiang] said on several occasions that China will take a holistic approach in pursuing economic growth and carrying out reforms. In fact, we see that a middle road is being taken," said Gao, who is head of wealth management research at UBS Securities.

A strong recovery is not desirable, because it would almost certainly be driven by a sharp increase in credit, with all the nasty side effects, Gao said. But the government is trying to avoid a hard landing by judiciously introducing the least disruptive stimulus measures, following disappointing economic growth in the second quarter, he added.

"We should not expect robust economic growth and a rebound in the next quarter, or the next year," Gao said. UBS Securities has forecast third-quarter GDP growth of 7.7 percent, slowing to 7.5 percent in the following quarter.

Statistics show that the economy actually picked up from July to August, but at a modest rate and against a relatively small base, Gao said. Economic activity has remained solid, although the momentum may have softened.

As for specifics on the stock market's likely performance, Gao said that generally, positive expectations were already reflected in the most recent rally, which began in late June. Almost all industries benefited from the rally.

"When there is no strong policy backing short-term economic growth, the only market driver comes from expectations for companies' profit growth and China's reforms," he said.

Wang Tao, head of China economics research at UBS, agreed and said in the absence of major shocks, the key market driver in the next two or three quarters is likely to shift from cyclical performance and liquidity conditions to the announcement and follow-through of reform measures.

The monetary policy stance was fine-tuned toward loosening after the liquidity squeeze in June because of concerns over a potential economic hard landing. Most analysts believe the central government will maintain a neutral to tight monetary stance in the near future, and they do not expect loose liquidity.

"M2 growth rebounded and total social financing rose sharply in August. Now that growth is on track to achieve the 7.5-percent target for this year, we expect the policy stance to be tightened after the Communist Party meeting in November," Nomura's chief China economist Zhang Zhiwei wrote in a recent note.

He expects growth to peak in the third quarter at 7.8 percent, slowing to 7.5 percent in the fourth quarter and 6.9 percent in 2014.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Mexico demands US response over spying scandal

Breast cancer on the rise

Hong Kong, AmEx host culinary feast

Yao, NBA to open training school for teens

IMAX: China exceeds CEO's expectations

Last-ditch effort on debt ceiling

China-UK cooperation projects inked

Alcoa CEO to be feted by US-China Committee

US Weekly

|

|