Wumart bags Lotus outlets

Updated: 2013-10-16 07:05

By Sophie He and Oswald Chan in Hong Kong, and Wang Zhuoqiong in Beijing (China Daily)

|

||||||||

|

A Wumart Stores Inc hypermarket in Shanghai. Provided to China Daily |

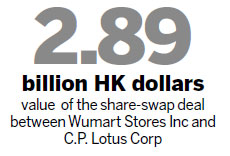

Wumart Stores Inc, a Chinese supermarket operator, announced on Tuesday that it is proposing to purchase outlets from retailer C.P. Lotus Corp through a share-swap deal valued at HK$2.89 billion ($372.7 million).

Wumart said that it has signed a framework agreement with Lotus, the flagship retail company in China controlled by the Charoen Pokphand Group of Thailand.

It also said that it will subscribe to shares and convertible preference shares from C.P. Lotus for HK$547.9 million.

It will pay HK$2.34 billion to take over 36 stores from C.P. Lotus in Beijing, Shanghai and elsewhere, excluding outlets in Guangdong and Hunan provinces.

C.P. Lotus agreed to pay HK$2.89 billion for 206.6 million of Wumart's H shares. After the proposed transaction, C.P. Lotus will own a 13.77 percent interest in Wumart, while Wumart will hold a 9.99 percent interest in C.P. Lotus, making each company the other's second-largest shareholder.

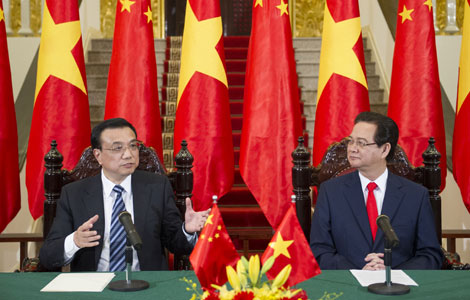

Xu Ying, president of Wumart Stores, told a news conference in Hong Kong on Tuesday that the transaction will mark the latest implementation of Wumart's expansion and growth strategy.

"It (the transaction) will significantly enhance our presence in the Greater Shanghai region and further strengthen our market leadership in Northern China, which is also consistent with the company's 'go national, but region-focused' strategy," she said.

Xu said after the transaction, Wumart's sales will increase by 46.5 percent (counted as of the 2012 fiscal year) and the number of its stores will increase to 577 from 541 (as of June 30, 2013).

Ed Chan, vice-chairman of C.P. Lotus, told the news conference that the deal will enable the company to focus on its highest growth areas in Guangdong and Hunan, as well as neighboring provinces that it may enter later. He said that C.P. Lotus owns 19 stores in Guangdong and Hunan, and that will increase to 22 by the end of this year.

The deal is expected to bring revenue and cost synergies to both companies, Chan added.

In the first half, C.P. Lotus recorded a net loss of 46.7 million yuan.

Xu and Chan declined to disclose the first-half net loss of the 36 stores acquired by Wumart. They stressed that Wumart will spare no effort in turning around those outlets.

Xu also said that Wumart will bring in a new investor - private equity firm Ascendent Capital LLC, which will subscribe to 16.6 million of Wumart's new H shares.

The acquisition shows how some local retailers have overtaken foreign rivals, said Hermann Ng, chief executive officer of Retail Nation, a consultancy in Shanghai. The move is also a signal of consolidation in the supermarket industry, he added.

Through the deal, Wumart, which has most of its stores in Northern China, is expected to expand to Eastern regions where C.P. Lotus has a larger presence, Ng said.

Rachel Li, business group director of Kantar Worldpanel China, said the customers of the two retailers are complementary and the merger of the companies' resources will enhance their efficiency.

Some financial analysts in Hong Kong said that the deal doesn't reflect a bearish outlook by C.P. Lotus toward the Chinese grocery retail market.

"C.P. Lotus is a small grocery retailer in the country. With such a small business network, it is difficult to compete and earn a substantial profit from the supermarket business," Tengard Fund Management Investment Manager Patrick Shum said. "As the profit potential is small, it is natural for C.P. Lotus to divest the grocery retail business in the country."

China has overtaken the United States as the world's biggest grocery retail market. The market's value is forecast to reach $1.6 trillion in 2016, according to retail market analyst IGD.

The Chinese grocery market has witnessed soaring demand for new products, brands and retail concepts. The sector's growth is being propelled by rapid economic expansion, population changes and rising food inflation.

But global grocery retailers are finding it a challenging market. For example, the Chinese logistics system is weak, so grocery retailers face higher transportation costs.

The nation's grocery market is also highly fragmented, so that market participants must devote more marketing resources to gain a major share. And amid a slowing economy, the grocery retail market is seeing a wave of consolidation.

Still, both international and domestic grocery retailers are expanding quickly in China, using diverse formats and entering new regions.

Contact the writers at sophiehe@chinadailhyhk.com, oswald@chinadailyhk.com and wangzhuoqiong@chinadaily.com.cn

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Mexico demands US response over spying scandal

Breast cancer on the rise

Hong Kong, AmEx host culinary feast

Yao, NBA to open training school for teens

IMAX: China exceeds CEO's expectations

Last-ditch effort on debt ceiling

China-UK cooperation projects inked

Alcoa CEO to be feted by US-China Committee

US Weekly

|

|